CT DRS CT-EITC SEQ 2011 free printable template

Show details

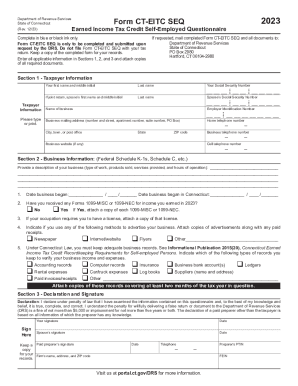

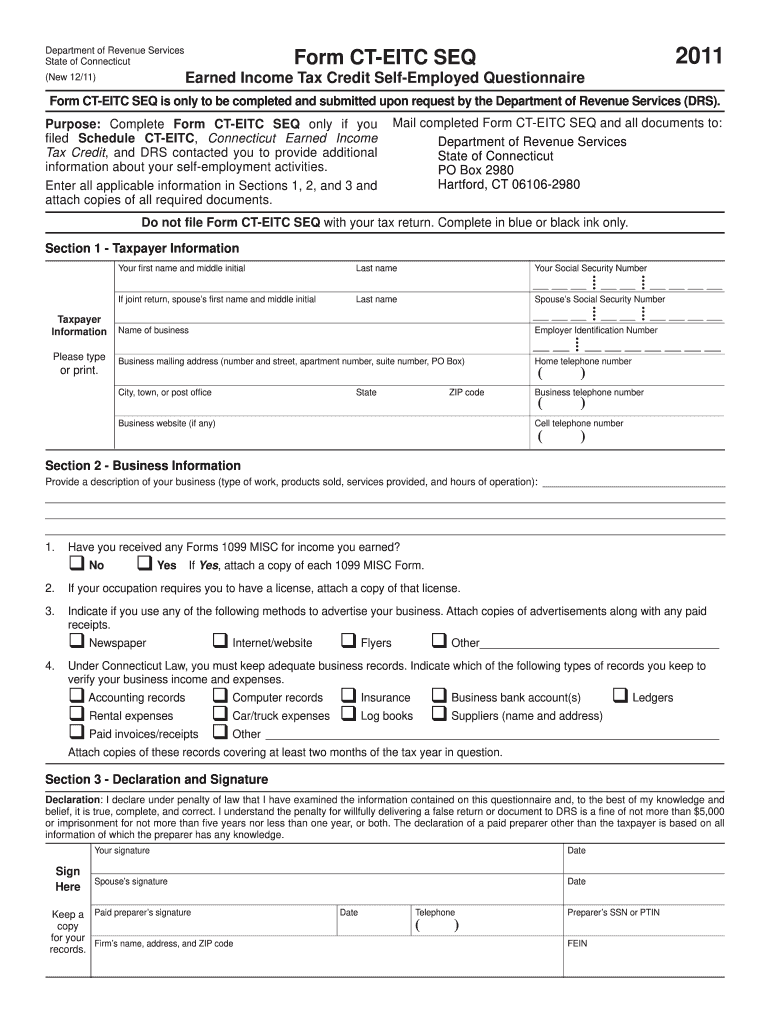

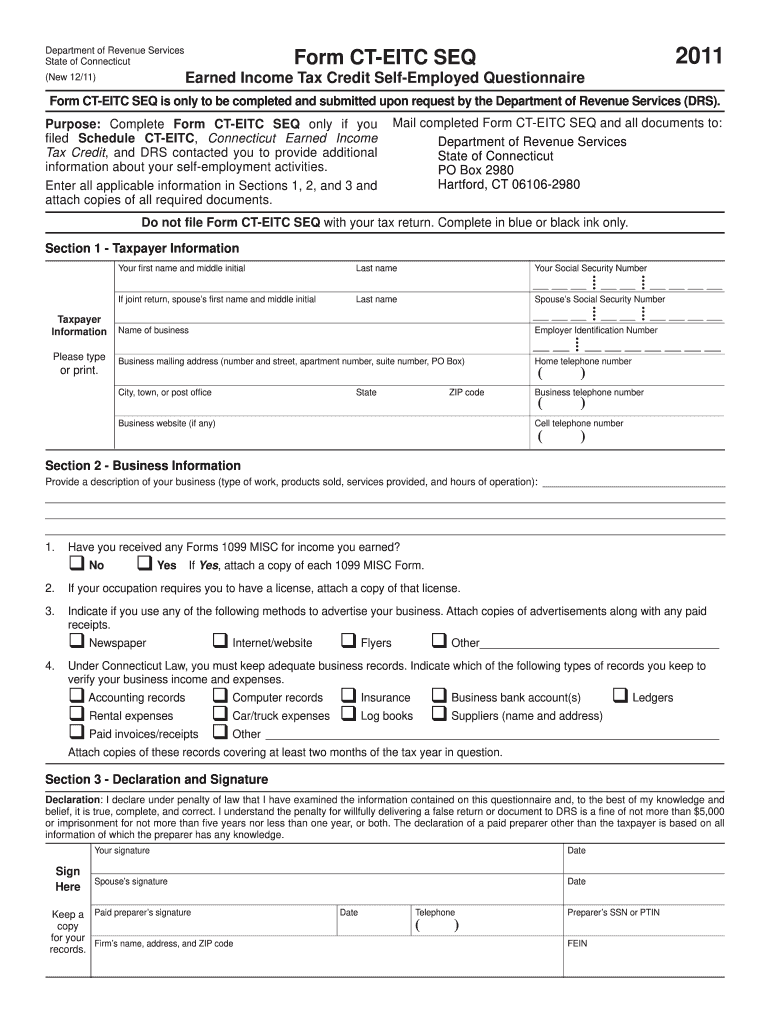

Mail completed Form CT-EITC SEQ and all documents to PO Box 2980 Hartford CT 06106-2980 Do not le Form CT-EITC SEQ with your tax return. Complete in blue or black ink only. Department of Revenue Services State of Connecticut Form CT-EITC SEQ Earned Income Tax Credit Self-Employed Questionnaire New 12/11 Purpose Complete Form CT-EITC SEQ only if you led Schedule CT-EITC Connecticut Earned Income Tax Credit and DRS contacted you to provide addition...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your eitc forms 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eitc forms 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eitc forms 2011 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit eitc forms 2011. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

CT DRS CT-EITC SEQ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out eitc forms 2011

How to fill out eitc forms 2011?

01

Gather all necessary information and documents such as your social security number, tax forms, and income records.

02

Read the instructions carefully to ensure you understand the form and any eligibility requirements.

03

Fill in your personal information accurately, including your full name, address, and filing status.

04

Provide information about your earned income and any additional income you may have.

05

Determine if you qualify for any tax credits or deductions and include them on the form.

06

Calculate your Earned Income Tax Credit (EITC) using the provided worksheets or by using tax software.

07

Double-check all entries and calculations to ensure accuracy.

08

Sign and date the form before submitting it either electronically or by mail to the appropriate tax agency.

Who needs eitc forms 2011?

01

Individuals or families who have earned income throughout the tax year may need to fill out EITC forms.

02

EITC forms are specifically designed for those who meet certain income and eligibility requirements to claim the Earned Income Tax Credit.

03

This credit aims to assist low to moderate-income earners in reducing their tax liability and potentially receiving a refund.

Fill form : Try Risk Free

People Also Ask about eitc forms 2011

How do I find my EIC from previous years?

What is Form 886 EIC?

Where can I find the EIC on my tax return?

Can I claim earned income credit from previous years?

What is EIC Form 15112?

Is there a form for EITC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eitc forms?

EITC forms refer to the required tax forms used by individuals to claim the Earned Income Tax Credit (EITC).

Who is required to file eitc forms?

Individuals who meet the eligibility criteria for the Earned Income Tax Credit (EITC) are required to file EITC forms.

How to fill out eitc forms?

To fill out EITC forms, individuals need to provide specific information about their income, expenses, and qualifying dependents. This information is used to determine their eligibility for the Earned Income Tax Credit.

What is the purpose of eitc forms?

The purpose of EITC forms is to calculate and claim the Earned Income Tax Credit, which is a refundable tax credit designed to assist low to moderate-income individuals and families.

What information must be reported on eitc forms?

EITC forms require individuals to report their income, filing status, eligible dependents, and other qualifying criteria to determine their eligibility for the Earned Income Tax Credit.

When is the deadline to file eitc forms in 2023?

The deadline to file EITC forms for tax year 2023 is usually April 15th, but this date may be extended if it falls on a weekend or holiday.

What is the penalty for the late filing of eitc forms?

The penalty for the late filing of EITC forms is a potential loss of the Earned Income Tax Credit. It is important to file the forms before the deadline to avoid this penalty.

How can I send eitc forms 2011 for eSignature?

When your eitc forms 2011 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in eitc forms 2011 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your eitc forms 2011, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I fill out eitc forms 2011 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your eitc forms 2011 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your eitc forms 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.