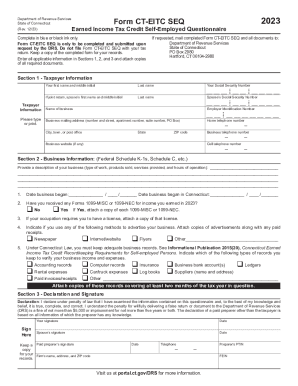

CT DRS CT-EITC SEQ 2020 free printable template

Get, Create, Make and Sign

How to edit ct eitc form online

CT DRS CT-EITC SEQ Form Versions

How to fill out ct eitc form 2020

How to fill out ct eitc form

Who needs ct eitc form?

Video instructions and help with filling out and completing ct eitc form

Instructions and Help about ct eitc seq form

Hey Sandra oh sorry I'm just really surprised at how expensive food has gotten we've been trying to put aside some money to buy your house, but lately we can barely make a full own paycheck to the next I'm in the same boat but with this additional money I'm getting from the at things are looking better at is the Earned Income Tax Credit I'm going to be getting almost twenty-five hundred dollars back what to find the nearest free tax preparation site call 211

Fill drs ct eitc questionnaire : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ct eitc form 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.