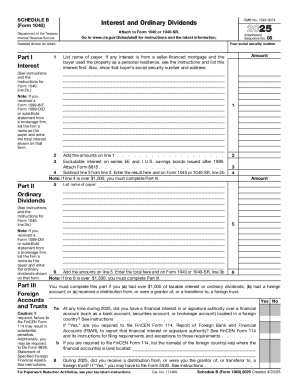

IRS 1040 - Schedule B 2011 free printable template

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

About IRS 1040 - Schedule B 2011 previous version

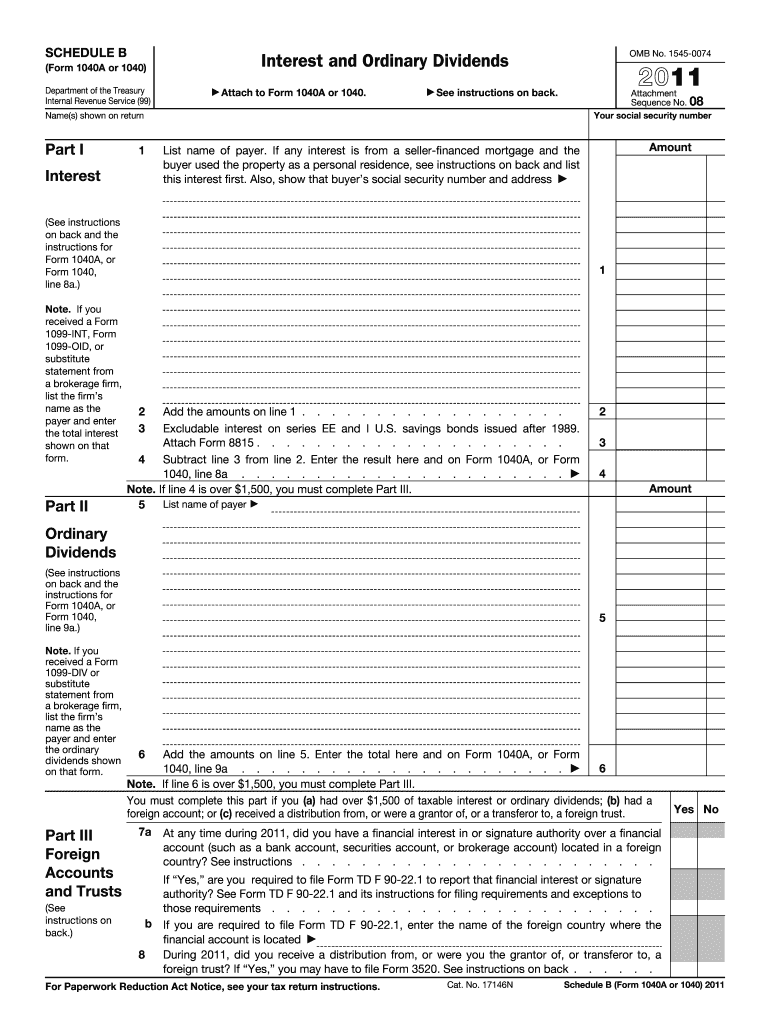

What is IRS 1040 - Schedule B?

When am I exempt from filling out this form?

Components of the form

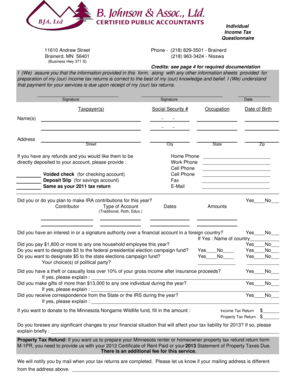

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

What are the penalties for not issuing the form?

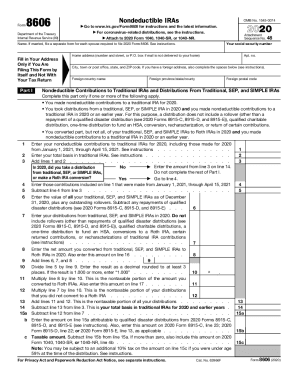

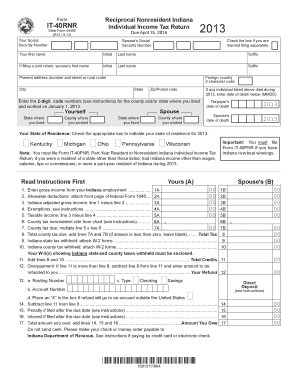

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule B

What should I do if I realize I made a mistake on my 2011 IRS Schedule B after submission?

If you discover an error on your 2011 IRS Schedule B after it's been submitted, you will need to file an amended return. This can be done by using Form 1040X, which allows you to correct any mistakes or omissions. Make sure to clearly indicate the changes made and keep track of the original submission in your records for future reference.

How can I verify if my 2011 IRS Schedule B was received and processed?

To track the status of your 2011 IRS Schedule B, you can use the IRS's online tool, 'Where's My Refund?', which provides updates on your return status. You may also receive notices from the IRS confirming receipt, and if your return has been accepted or requires additional information, they will communicate that as well.

What are some common mistakes to avoid when filing the 2011 IRS Schedule B?

Common errors when filing the 2011 IRS Schedule B include incorrect reporting of interest and dividend income, failing to include all necessary accounts, and mismatched amounts compared to the issuers' forms. Always double-check your figures, ensure all relevant income sources are included, and review your form before submission to minimize these mistakes.

Is an e-signature acceptable on my electronic submission of the 2011 IRS Schedule B?

Yes, an e-signature is acceptable for electronic submissions of the 2011 IRS Schedule B. When you e-file, the tax software you use will typically guide you through the e-signature process, allowing you to securely submit your form while maintaining compliance with IRS standards.

What steps should I take if I receive a notice regarding my submitted 2011 IRS Schedule B?

If you receive a notice from the IRS about your 2011 IRS Schedule B, carefully read the notice to understand the reason for the communication. Respond promptly, providing any requested documentation or clarification. Keep copies of all correspondence for your records, and consider consulting a tax professional if the matter is complex or requires further action.

See what our users say