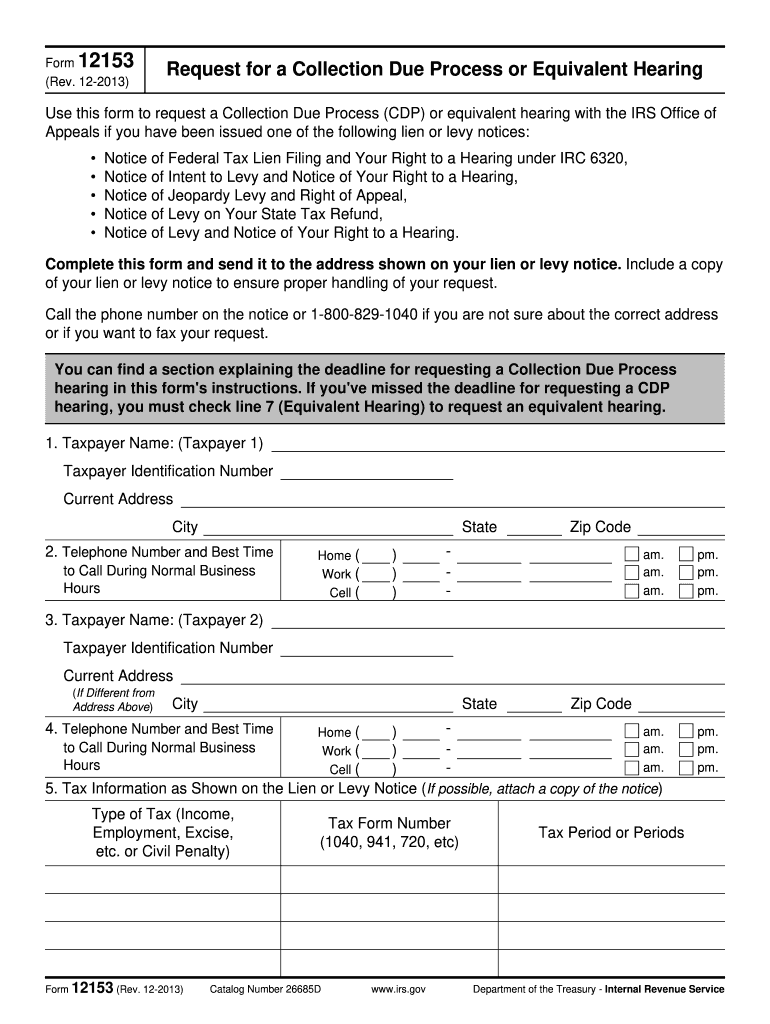

IRS 12153 2013 free printable template

Instructions and Help about IRS 12153

How to edit IRS 12153

How to fill out IRS 12153

About IRS 12 previous version

What is IRS 12153?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 12153

What should I do if I need to correct an error on an IRS Form 12153?

If you find an error after submitting your IRS Form 12153, you can submit an amended form to correct the mistake. Clearly mark the amended form as 'Amended' and include the necessary corrections. Ensure that you follow any specific filing guidelines provided by the IRS to avoid processing delays.

How can I track the status of my IRS Form 12153 submission?

To verify the receipt and processing of your IRS Form 12153, you can use the IRS online tools designed for this purpose. Check for common e-file rejection codes that can provide insights into potential issues with your submission. If you encounter any problems, reach out to IRS support for assistance.

What privacy and data security measures should I consider when filing IRS Form 12153?

When submitting your IRS Form 12153, it is crucial to ensure that your personal information is protected. Use secure methods for e-filing and consider the IRS's guidelines on data privacy. Retain records as prescribed by the IRS, generally for at least three years, to safeguard against potential audits.

Are there any special considerations for nonresidents filing IRS Form 12153?

Nonresidents or foreign payees filing IRS Form 12153 should be aware of specific regulations that apply to them. They may need to provide additional documentation or follow different procedures compared to residents. Consulting the IRS guidelines for nonresidents can help ensure compliance and smooth processing.

What are some common errors individuals make when submitting IRS Form 12153, and how can they be avoided?

Common errors on IRS Form 12153 include incorrect personal details and not providing sufficient supporting documentation. To avoid these mistakes, double-check your information for accuracy and make sure all required attachments are included. Consider using e-filing software that verifies your inputs to minimize the chances of errors.