Get the free Installment Loans & Tax Services in Sulphur Springs, tx

Show details

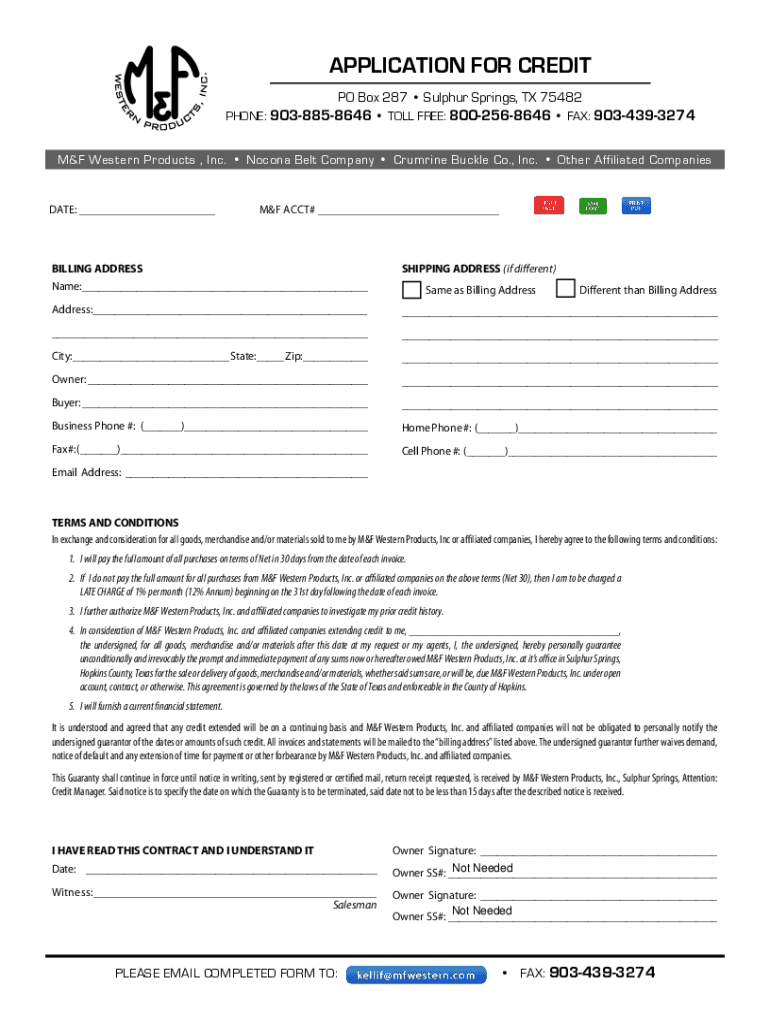

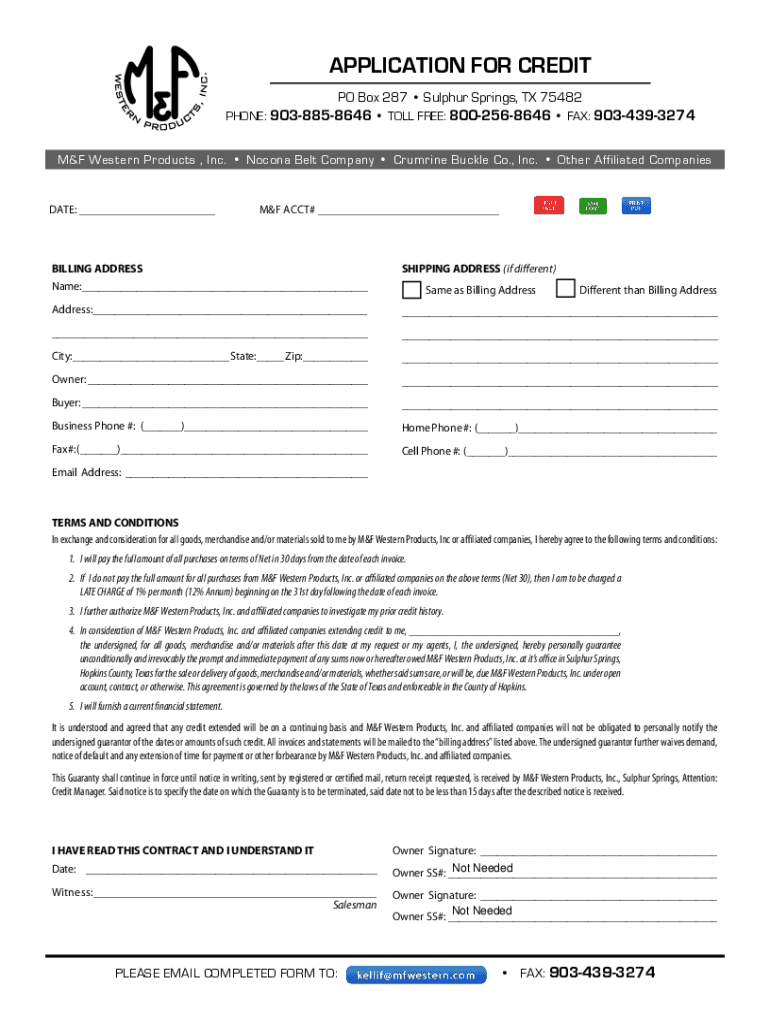

APPLICATION FOR CREDIT

PO Box 287 Sulfur Springs, TX 75482

PHONE:9038858646 TOLL FREE: 8002568646 FAX: 9034393274M&F Western Products, Inc. Noon Belt Company Crumbing Buckle Co., Inc. Other Affiliated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign installment loans ampamp tax

Edit your installment loans ampamp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment loans ampamp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing installment loans ampamp tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit installment loans ampamp tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out installment loans ampamp tax

How to fill out installment loans ampamp tax

01

Gather all necessary documents such as pay stubs, bank statements, and tax forms.

02

Research different installment loan options and choose one that fits your financial needs.

03

Fill out the application form accurately and truthfully, providing all required information.

04

Submit the application along with the necessary documents for verification.

05

Wait for approval and review the terms and conditions of the loan before signing any agreements.

06

Make sure to set up a payment plan and stick to it to avoid any penalties or late fees.

Who needs installment loans ampamp tax?

01

Individuals who need financial assistance for a large purchase or expense.

02

People who prefer a structured repayment plan over a lump sum payment.

03

Those who have a steady income but need help managing their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify installment loans ampamp tax without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your installment loans ampamp tax into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send installment loans ampamp tax for eSignature?

When you're ready to share your installment loans ampamp tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete installment loans ampamp tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your installment loans ampamp tax. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is installment loans ampamp tax?

Installment loans ampamp tax refers to a type of loan where the borrower pays back the loan amount in fixed monthly payments, which includes a portion of both the principal amount and the interest. The tax aspect comes into play when the interest paid on the loan is deductible on the borrower's income tax return.

Who is required to file installment loans ampamp tax?

Individuals or businesses who have taken out installment loans and paid interest on those loans may be required to report the interest paid on their tax returns.

How to fill out installment loans ampamp tax?

To fill out installment loans ampamp tax, you will need to gather all the necessary information regarding the loan, such as the total loan amount, interest rate, and amount of interest paid throughout the year. This information will then be reported on the appropriate tax forms.

What is the purpose of installment loans ampamp tax?

The purpose of installment loans ampamp tax is to allow individuals or businesses to take out loans for various purposes while also receiving a tax benefit through the deduction of interest paid.

What information must be reported on installment loans ampamp tax?

The information that must be reported on installment loans ampamp tax includes the total loan amount, interest rate, amount of interest paid, and any other relevant details of the loan.

Fill out your installment loans ampamp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Installment Loans Ampamp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.