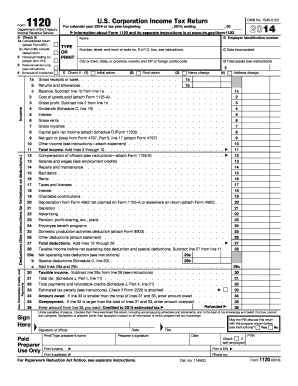

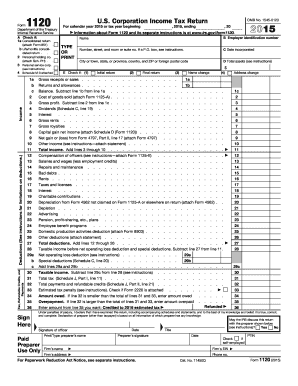

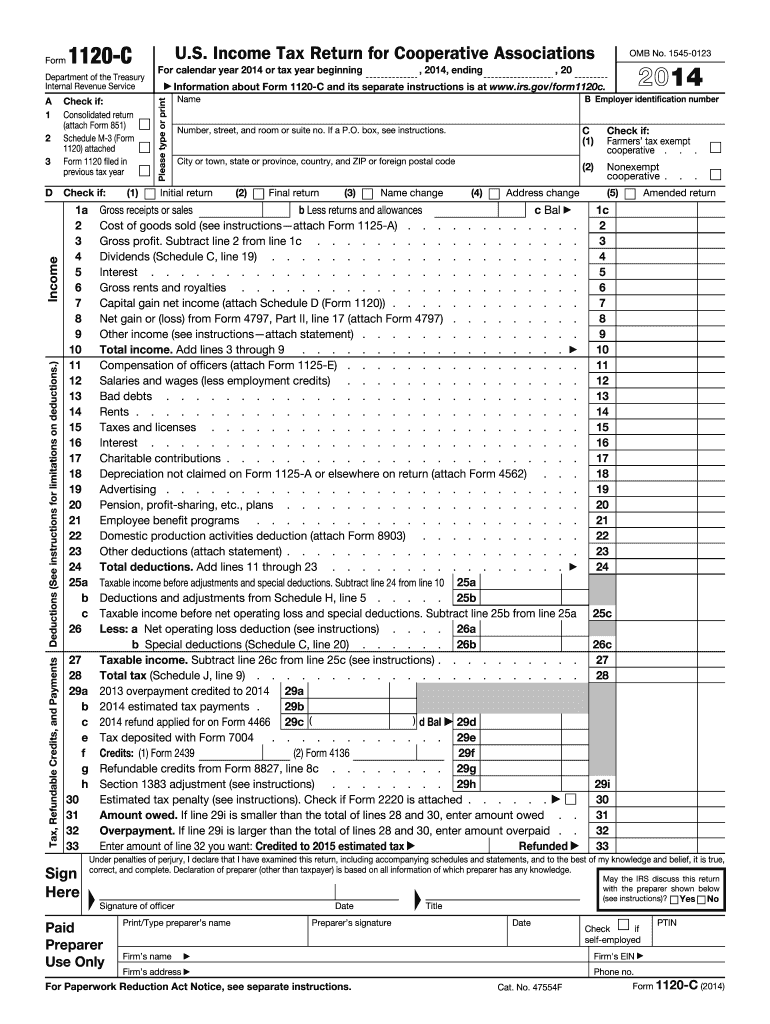

IRS 1120-C 2014 free printable template

Instructions and Help about IRS 1120-C

How to edit IRS 1120-C

How to fill out IRS 1120-C

About IRS 1120-C 2014 previous version

What is IRS 1120-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120-C

How can I correct mistakes after submitting my taxable income before adjustments?

If you discover mistakes after filing, you can submit an amended return for your taxable income before adjustments. This involves completing the relevant form and clearly indicating the changes made. Ensure you keep records of both your original and amended submissions for reference and to maintain accurate records.

What should I do if my e-file submission is rejected?

In the event your e-file submission of taxable income before adjustments is rejected, carefully review the rejection code provided. This code will guide you on the specific error that caused the rejection. Once identified, correct the error and resubmit your filing promptly to avoid delays.

What are the data retention requirements for taxable income before adjustments?

It's essential to retain copies of your taxable income before adjustments and related documents for at least three years, as this is the general period for audits. Ensure your records are stored securely to protect your personal information from unauthorized access.

How can I verify the status of my filed taxable income before adjustments?

To check the status of your taxable income before adjustments, you can use the online tracking tools provided by the IRS or your tax software. This allows you to confirm whether your submission has been received and is being processed, and it can help you identify any potential issues early.

What should I include when preparing documentation for an audit regarding my taxable income before adjustments?

When preparing for an audit related to your taxable income before adjustments, gather all relevant financial documents, such as W-2s, 1099s, and any supporting documentation for deductions claimed. It’s also wise to include a copy of your filed return and any correspondence with the taxing authority.