CA BOE-266 - San Luis Obispo County 2020-2025 free printable template

Show details

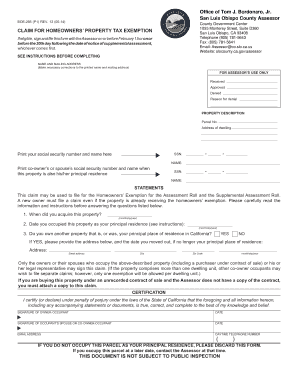

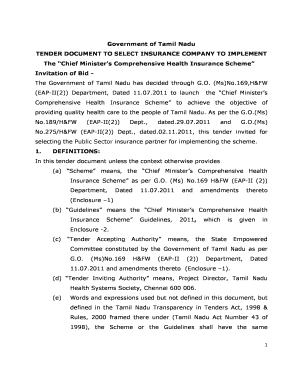

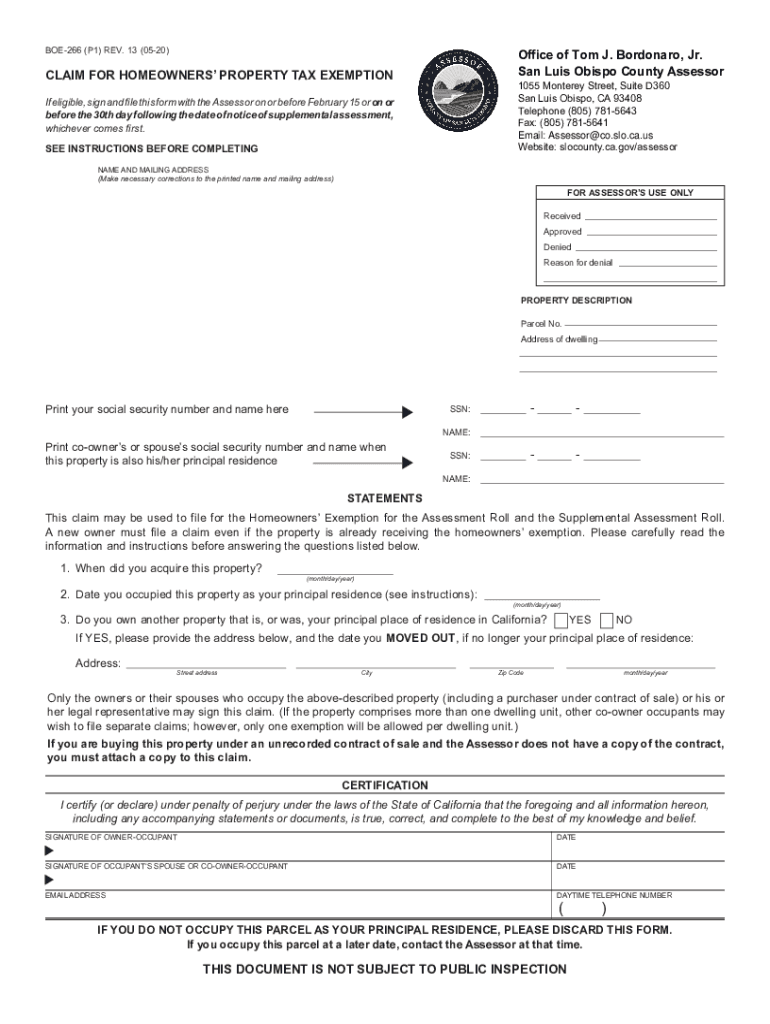

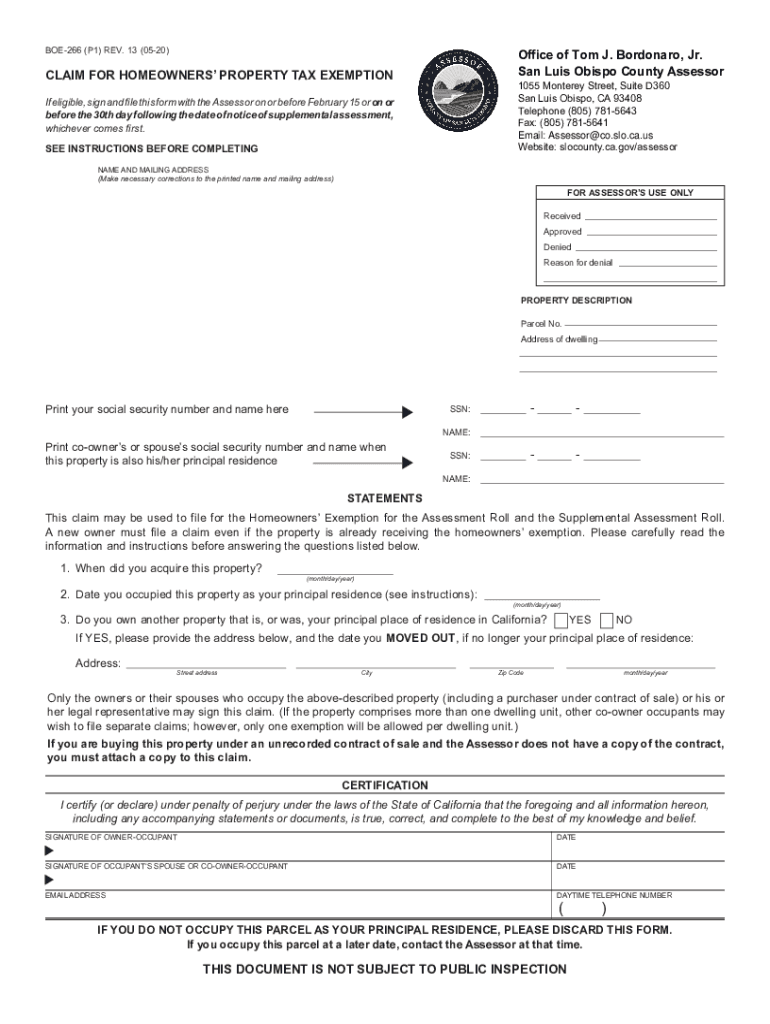

BOE266 (P1) REV. 13 (0520)Office of Tom J. Bolsonaro, Jr.

San Luis Obispo County AssessorCLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION1055 Monterey Street, Suite D360

San Luis Obispo, CA 93408

Telephone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign boe 266 form

Edit your ca property tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe 266 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form boe 266 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit homeowners property tax exemption form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-266 - San Luis Obispo County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california property tax exemption form

How to fill out CA BOE-266 - San Luis Obispo County

01

Obtain the CA BOE-266 form from the San Luis Obispo County website or the local county assessor's office.

02

Fill in your personal information including name, address, and contact details.

03

Provide the property information for which you are filing, including parcel number and property address.

04

Indicate the reason for filing the form (e.g., change in ownership, property tax exemption).

05

Attach any required documentation that supports your request, such as prior property tax bills or legal documents.

06

Review the completed form for accuracy and completeness.

07

Submit the form by mailing it to the appropriate county office or delivering it in person.

08

Keep a copy of the submitted form and any attachments for your records.

Who needs CA BOE-266 - San Luis Obispo County?

01

Property owners in San Luis Obispo County who need to report changes in property ownership or seek property tax exemptions.

02

Individuals applying for property tax relief or other tax-related adjustments.

Fill

california homeowners property tax exemption

: Try Risk Free

People Also Ask about edit pdf online

How do I claim homeowners property tax exemption in California?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

What is the homeowners tax exemption in San Diego?

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

Who qualifies for California homeowners property tax exemption?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

How to apply for homeowners exemption Orange county?

You may apply for a Homeowners' Exemption if you do not have this type of exemption on any other property. The Assessor will automatically send exemption applications to new homeowners. Call (714) 834-3821 for more information. Homeowners' Exemption applications are not available on-line.

How to claim for homeowners property tax exemption San Diego county?

Apply by mail: Whenever there is a purchase or transfer of residential property, the Assessor's Office automatically mails a Homeowner's Exemption Claim form. You may also request that one be mailed to you by calling our office at (619) 531-5772.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my claim homeowners property tax exemption in Gmail?

boe 266 pdf and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit claim form boe 266 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including homeowners exemption boe 266, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I edit ca homeowners property tax exemption on an iOS device?

Use the pdfFiller mobile app to create, edit, and share ca property tax exemption county from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is CA BOE-266 - San Luis Obispo County?

CA BOE-266 is a form used for reporting and remitting the local sales and use tax in San Luis Obispo County, California.

Who is required to file CA BOE-266 - San Luis Obispo County?

Businesses that collect sales tax or are engaged in selling tangible personal property in San Luis Obispo County are required to file CA BOE-266.

How to fill out CA BOE-266 - San Luis Obispo County?

To fill out CA BOE-266, provide your business information, report your total sales, calculate the sales tax collected, and include any applicable deductions. Ensure that all fields are completed accurately before submission.

What is the purpose of CA BOE-266 - San Luis Obispo County?

The purpose of CA BOE-266 is to facilitate the proper reporting and collection of sales and use taxes within San Luis Obispo County, ensuring compliance with local tax regulations.

What information must be reported on CA BOE-266 - San Luis Obispo County?

Information that must be reported includes the business name, address, total sales, total sales tax collected, and any exemptions or deductions applicable to the sales.

Fill out your 682750727 2020-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe 266 Claim Homeowners Property Tax Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to california boe 266 form

Related to homeowners property tax exemption form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.