Get the free Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation...

Show details

This form is used by Indiana residents to apply for a mortgage deduction from assessed property valuation for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign statement of mortgage or

Edit your statement of mortgage or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of mortgage or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing statement of mortgage or online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit statement of mortgage or. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of mortgage or

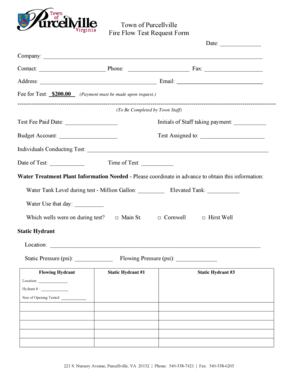

How to fill out Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation

01

Obtain a copy of the Statement of Mortgage or Contract Indebtedness form from your local tax assessor's office or website.

02

Fill in your property information including address, parcel number, and other identification details.

03

List the mortgage provider's name and contact information.

04

Enter the loan amount, the remaining balance on the mortgage, and the date the loan was originated.

05

Provide the terms of the mortgage including interest rate, monthly payment amount, and loan maturity date.

06

Sign and date the form certifying that the information provided is accurate.

07

Submit the completed form to your local tax assessor's office by the designated deadline.

Who needs Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

01

Property owners with an outstanding mortgage on their property seeking tax deductions on assessed valuation.

02

Individuals who have a contract indebtedness associated with the property.

03

Taxpayers who want to reduce their property tax based on mortgage debt.

Fill

form

: Try Risk Free

People Also Ask about

Is Indiana getting rid of the mortgage exemption?

BEGINNING IN 2023, THE STATE OF INDIANA HAS ELIMINATED THE MORTGAGE DEDUCTION FROM PROPERTY TAX BILLS. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE HOMESTEAD DEDUCTION FOR ALL FUTURE TAX CALCULATIONS.

Will my mortgage go down with homestead exemption?

0:01 1:16 And how to apply for a homestead. Exemption. To learn more check out these links which you can clickMoreAnd how to apply for a homestead. Exemption. To learn more check out these links which you can click in the description. Below.

What is the homeowners exemption in Indiana?

The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less. The supplemental homestead deduction is based on the assessed value of your property and equals: 35% of the assessed value of a property that is less than $600,000.

At what age do you stop paying property taxes in Indiana?

You need to meet these requirements to qualify for this Indiana property tax deduction: You must have turned 65 or older by December 31 of the previous year. If your spouse was 65 or older when they passed away, you can also qualify if you are 60 or older and haven't remarried.

Is Indiana doing away with a mortgage exemption?

However, beginning in 2023 (taxes payable in 2024) the State of Indiana no longer offers the mortgage deduction; it was previously lowering the taxable assessment by 3,000. Please note with this change, the homestead standard deduction is increasing from 45,000 to 48,000.

What is a mortgage statement for tax purposes?

What is Form 1098? Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders are required to file a separate Form 1098 for each mortgage that they hold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

The Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation is a form used by property owners to report their mortgage or contract indebtedness to reduce the assessed value of their property for tax purposes.

Who is required to file Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

Property owners who have an outstanding mortgage or contract indebtedness and wish to claim a deduction on their assessed valuation are required to file this statement.

How to fill out Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

To fill out the Statement of Mortgage or Contract Indebtedness, property owners must provide details about the mortgage or contract, including the lender's name, loan amount, current balance, and any relevant account numbers.

What is the purpose of Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

The purpose of this statement is to allow property owners to report their mortgage debts, which can result in a lower assessed valuation and consequently reduce their property tax burden.

What information must be reported on Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation?

The information that must be reported includes the property's legal description, the total amount of the mortgage, current outstanding balance, and the name and address of the lender.

Fill out your statement of mortgage or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Mortgage Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.