Get the free Income Contingent Repayment Plan & Income-Based Repayment Plan - mycornerstoneloan

Show details

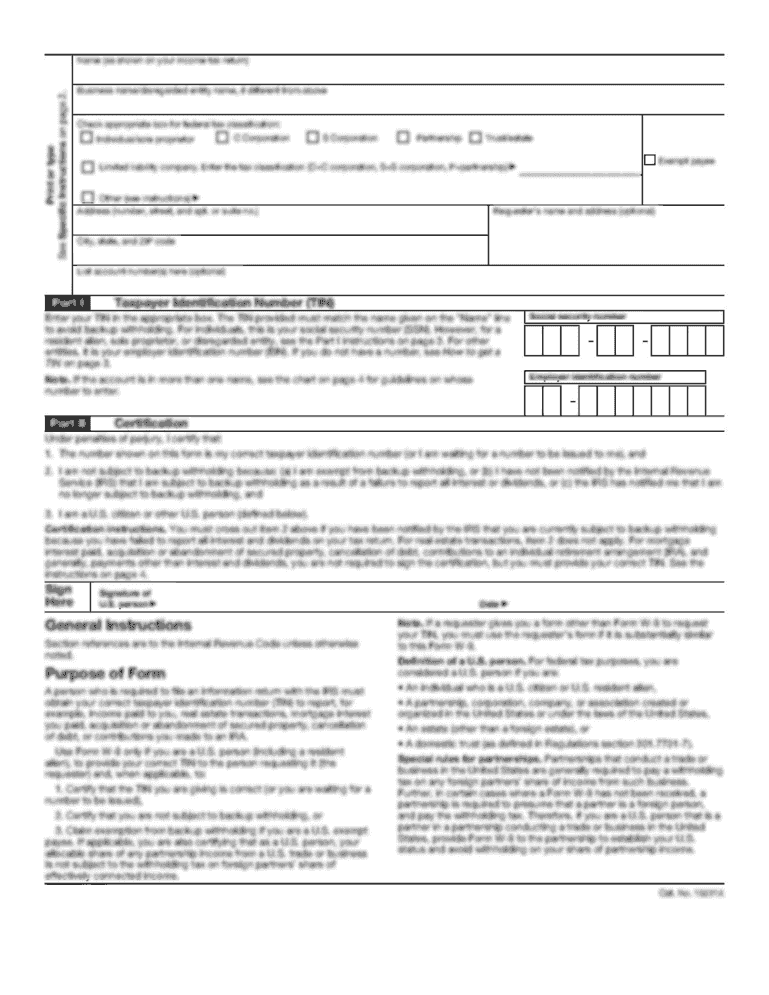

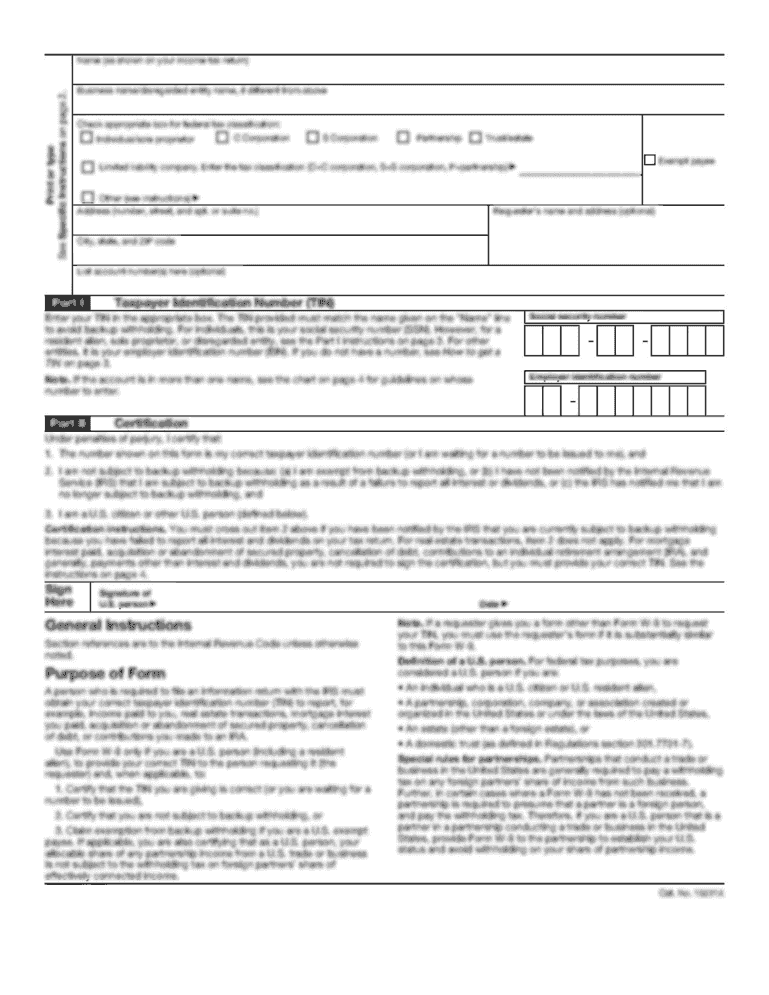

This document serves as the form for borrowers applying for income-driven repayment plans for federal student loans, requiring them to provide documentation of their income and potentially that of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income contingent repayment plan

Edit your income contingent repayment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income contingent repayment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income contingent repayment plan online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income contingent repayment plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income contingent repayment plan

How to fill out Income Contingent Repayment Plan & Income-Based Repayment Plan

01

Gather all necessary documents, including your income information, tax returns, and proof of family size.

02

Visit the federal student aid website or your loan servicer's website to access the application for Income Contingent Repayment (ICR) Plan and Income-Based Repayment (IBR) Plan.

03

Complete the online application or print it out to fill it manually, ensuring that you provide accurate and up-to-date information regarding your income and family size.

04

Specify your income details as instructed, including any deductions or special circumstances that may affect your payments.

05

Review the repayment plan options and understand the terms, including interest rates and how payments are calculated based on your income.

06

Submit the application to your loan servicer, either online or by mail. Ensure you keep copies of all submitted documents.

07

Wait for your loan servicer to process your application and then review the repayment plan terms sent to you.

08

If approved, make sure to follow the payment instructions provided and maintain communication with your loan servicer for any future adjustments.

Who needs Income Contingent Repayment Plan & Income-Based Repayment Plan?

01

Borrowers who have federal student loans and are experiencing financial hardship or have a low income.

02

Individuals whose loan payments under standard repayment plans would be too high relative to their income.

03

Borrowers considering long-term affordability for student loan repayments based on their current financial situation and family size.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of an income-based repayment plan?

Income-driven repayment disadvantages You'll pay more interest over time. Income-driven plans can extend your repayment term from the standard 10 years to 20 or 25 years. Since you'll be repaying your loan for longer, more interest will accrue on your loans.

What is the difference between income-based repayment and pay as you earn?

Personally I would choose PAYE every time in this situation because your payments would be capped at 10yr rates. You can always choose to pay more if you want. If you go on SAVE, you're obligated to pay whatever your monthly payment is even if it's more than the 10yr rate.

Which is better, pay as you earn or income-based repayment?

Overall, the Pay As You Earn (PAYE) plan comes out as the winner against Income-Based Repayment: PAYE lowers your monthly payments to 10% of your discretionary income. PAYE offers loan forgiveness after 20 years, no matter when you borrowed your loans.

What is the difference between income-contingent repayment and income-based?

Income-based plans allow you to use as little as 10% of your discretionary income as payment while an income-contingent plan requires you to use at least 20% of your discretionary income as payment. The repayment timetables and eligible loans also differ between the two plans.

Should I stay on PAYE or Switch to save?

ICR is generally the most expensive IDR plan, but it is the only plan available for borrowers with Parent PLUS loans or Direct Consolidation Loans that repaid Parent PLUS loans. ICR is not generally recommended for anyone except for Parent PLUS borrowers. Need more help choosing an IDR plan?

What are disadvantage of an income-based repayment plan?

Income-driven repayment disadvantages You'll pay more interest over time. Income-driven plans can extend your repayment term from the standard 10 years to 20 or 25 years. Since you'll be repaying your loan for longer, more interest will accrue on your loans.

Does income-contingent repayment qualify for forgiveness?

Loan Forgiveness Under ICR, your remaining balance will be forgiven after 25 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Contingent Repayment Plan & Income-Based Repayment Plan?

The Income Contingent Repayment Plan (ICRP) is a federal student aid repayment option that adjusts monthly payments based on income and family size. The Income-Based Repayment Plan (IBR) is another federal repayment option that also adjusts payments according to income but generally requires you to demonstrate financial hardship.

Who is required to file Income Contingent Repayment Plan & Income-Based Repayment Plan?

Borrowers with federal student loans who are looking for reduced monthly payments based on their income are eligible to file for either the Income Contingent Repayment Plan or the Income-Based Repayment Plan.

How to fill out Income Contingent Repayment Plan & Income-Based Repayment Plan?

To fill out either plan, borrowers must complete the necessary application form available through their loan servicer's website or the Federal Student Aid website, providing information about their income, family size, and financial situation.

What is the purpose of Income Contingent Repayment Plan & Income-Based Repayment Plan?

The purpose of these repayment plans is to provide a more manageable repayment structure for borrowers facing financial difficulties by adjusting loan payments based on discretionary income and ensuring that borrowers do not pay more than a certain percentage of their income.

What information must be reported on Income Contingent Repayment Plan & Income-Based Repayment Plan?

Borrowers must report their annual income, family size, and any changes in income or family circumstances that may affect their repayment plan eligibility or payment amounts.

Fill out your income contingent repayment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Contingent Repayment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.