Fidelity Investments Instructions for Completing IRS Section 83(b) Form free printable template

Get, Create, Make and Sign 83 b election form

How to edit 83 b election form online

Uncompromising security for your PDF editing and eSignature needs

Fidelity Investments Instructions for Completing IRS Section 83(b) Form Form Versions

How to fill out 83 b election form

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)

Who needs Fidelity Investments Instructions for Completing IRS Section 83(b)?

Instructions and Help about 83 b election form

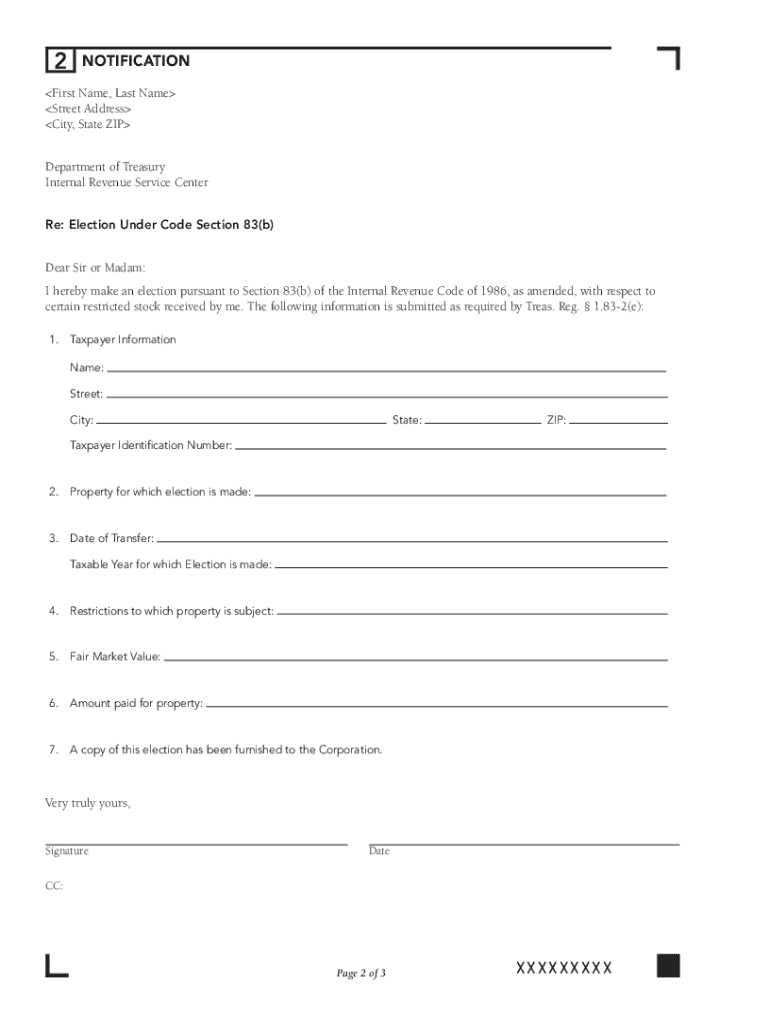

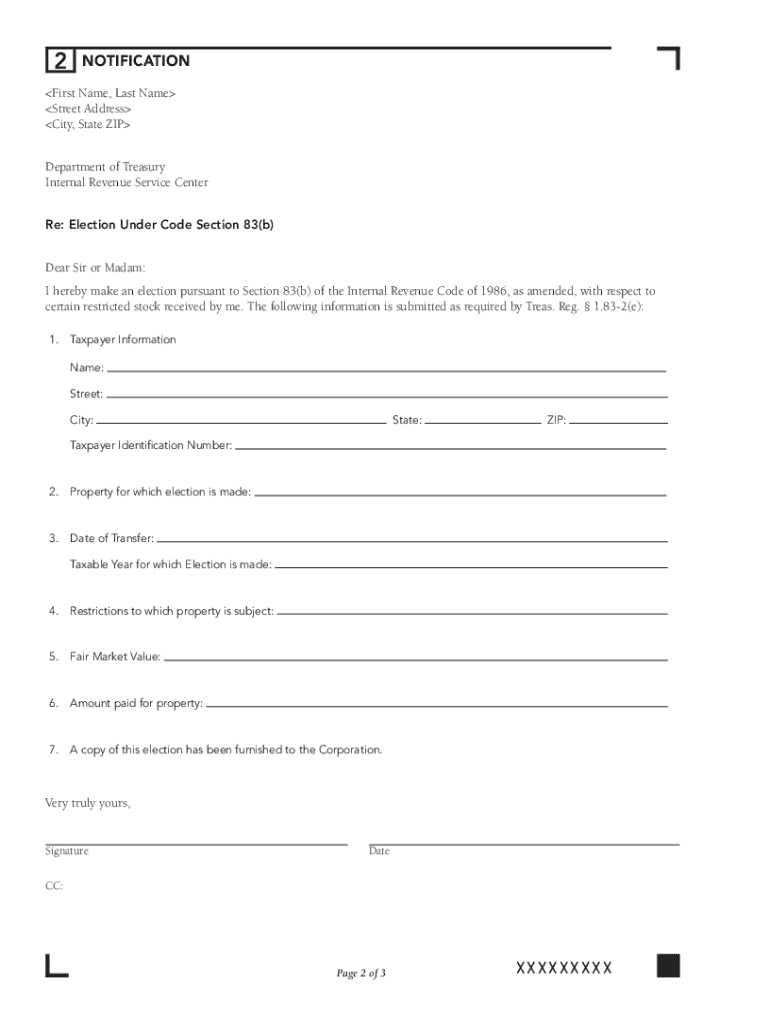

Although section 83 an is the actual law for recognition of income through the exchange of property for services section 83 B tends to be the ones that people are more familiar with primarily because there are some steps that individuals need to take what it boils down to is that the potential recognition that could be recognized through Internal Revenue Code section 83 a by default is going to be recognized as the stock vests and the amount of income is going to be based off of the fair market value at the point that the stock vests since the vesting schedules are typically over four years than whatever sort of appreciation may happen in the interim could then turn into income recognition if we go by the default treatment so if at the outset like I mentioned in the prior video there's a nominal value to the stock, but that stock value appreciates over time and the company is worth a hundred million dollars in the third year somebody who has you know a 25 stake in the company is going to be recognizing over half a million dollars a month in income and nothing has really changed all they have is the paper value that's represented by their stock ownership but typically no ability to actually liquidate the stock because there is no public market for a private company, so you can't sell the stock as at best in order to pay off the tax burden and instead all of a sudden founders recognizing millions of dollars a year in income and has the corresponding tax obligation that exceeds a million dollars a year that obviously would be a nightmare scenario, so the tax code provides a mechanism where you can recognize all the potential income all the potential a t-38 income from the vesting stock at the outset rather than as a vest, so you do this by electing to have the income recognized by the Internal Revenue Code section 83 B meaning that all the potential income that could be recognized gets recognized up front at the outset as though the stock were fully vested upon issuance in the scenario where it's a nominal value there's really no income to be recognized because presumably the nominal purchase price would just be met and the person would be purchasing it rather than recognizing any income in the event that there is some amount of income to be recognized because the corresponding fair market value purchase price is not being delivered whatever the fair market value is at that time is going to set the amount of ink that's going to be recognized under 83 an 83-b election happens by a simple letter that you sent to the IRS you say look here's the fair market value of the property that I'm receiving this is the property itself these are the restrictions that are placed on it and I want to be taxed under Internal Revenue Code section 83 B you have 30 days to do this from the date of transfer of the property there are no exceptions so if you miss that cutoff date then basically there are some severe corrective actions and potentially some problems to deal...

People Also Ask about

How do I file an electronic 83b?

Can 83 B elections be signed electronically?

What happens if you don't file 83 B within 30 days?

How to file 83b election electronically?

Does IRS accept electronic signatures?

Is there an 83b election form?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 83 b election form?

How do I edit 83 b election form online?

How do I fill out 83 b election form on an Android device?

What is Fidelity Investments Instructions for Completing IRS Section 83(b)?

Who is required to file Fidelity Investments Instructions for Completing IRS Section 83(b)?

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)?

What is the purpose of Fidelity Investments Instructions for Completing IRS Section 83(b)?

What information must be reported on Fidelity Investments Instructions for Completing IRS Section 83(b)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.