IRS 1120S 2012 free printable template

Show details

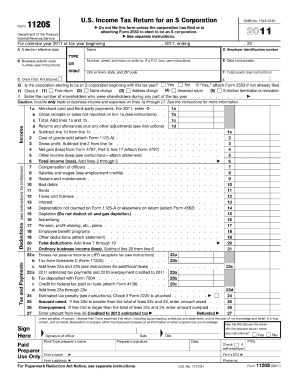

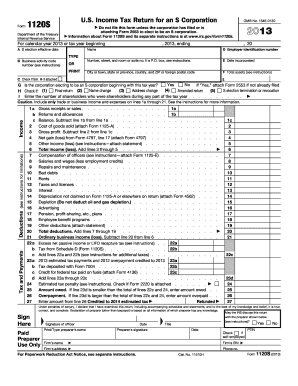

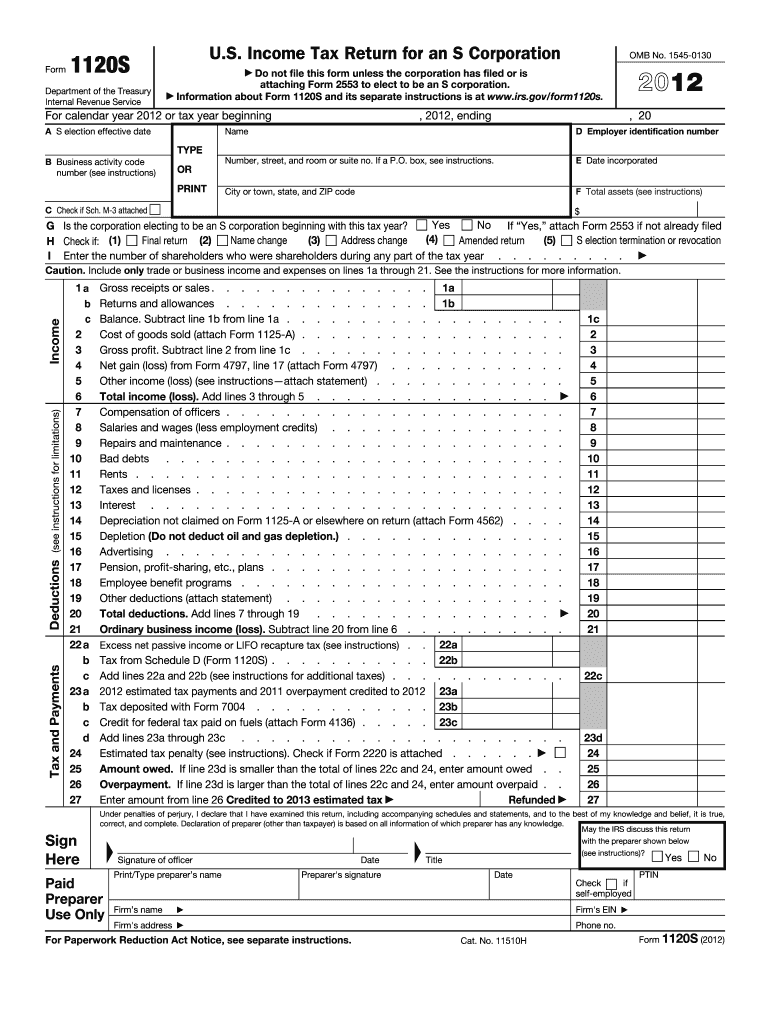

Subtract line 20 from line 6. Excess net passive income or LIFO recapture tax see instructions. 22a Tax from Schedule D Form 1120S. 22b Add lines 22a and 22b see instructions for additional taxes. 2012 estimated tax payments and 2011 overpayment credited to 2012 23a Tax deposited with Form 7004. For Paperwork Reduction Act Notice see separate instructions. Cat. No. 11510H PTIN Form 1120S 2012 Schedule B Page Other Information see instructions a See the instructions and enter the Check accounting...method Yes No Cash Accrual Other specify b Product or service At any time during the tax year was any shareholder of the corporation a disregarded entity a trust an estate or a nominee or similar person. Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation OMB No. 1545-0130 Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. Information about Form 1120S and its separate...instructions is at www.irs.gov/form1120s. For calendar year 2012 or tax year beginning A S election effective date TYPE B Business activity code number see instructions 2012 ending Name OR PRINT D Employer identification number Number street and room or suite no. If Yes enter the amount of principal reduction 13 a Did the corporation make any payments in 2012 that would require it to file Form s 1099. For calendar year 2012 or tax year beginning A S election effective date TYPE B Business...activity code number see instructions 2012 ending Name OR PRINT D Employer identification number Number street and room or suite no. If a P. O. box see instructions. E Date incorporated City or town state and ZIP code F Total assets see instructions C Check if Sch. M-3 attached Yes No If Yes attach Form 2553 if not already filed G Is the corporation electing to be an S corporation beginning with this tax year Name change Address change S election termination or revocation Final return 2 Amended...return H Check if 1 I Enter the number of shareholders who were shareholders during any part of the tax year. Caution. Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information. 1a. Form 1120S Department of the Treasury Internal Revenue Service U*S* Income Tax Return for an S Corporation OMB No* 1545-0130 Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation* Information about...Form 1120S and its separate instructions is at www*irs*gov/form1120s. For calendar year 2012 or tax year beginning A S election effective date TYPE B Business activity code number see instructions 2012 ending Name OR PRINT D Employer identification number Number street and room or suite no. If a P. O. box see instructions. E Date incorporated City or town state and ZIP code F Total assets see instructions C Check if Sch* M-3 attached Yes No If Yes attach Form 2553 if not already filed G Is the...corporation electing to be an S corporation beginning with this tax year Name change Address change S election termination or revocation Final return 2 Amended return H Check if 1 I Enter the number of shareholders who were shareholders during any part of the tax year.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

Instructions and Help about IRS 1120S

How to edit IRS 1120S

To edit IRS 1120S, you can use pdfFiller's features for manipulating forms effectively. Utilize the edit tool to input or adjust data directly on the form. You can also add signatures or notes as necessary. Make sure to verify changes for accuracy before submission.

How to fill out IRS 1120S

Filling out IRS 1120S requires attention to detail. Begin by entering your company's information, including its name, address, and Employer Identification Number (EIN). Follow the form's sections sequentially, reporting income, deductions, and credits accurately. Double-check calculations and ensure all necessary schedules are attached.

About IRS 1120S 2012 previous version

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120S 2012 previous version

What is IRS 1120S?

IRS 1120S is the tax form used by S corporations to report income, deductions, and credits to the federal government. This form allows S corporations to pass income directly to shareholders for tax purposes, avoiding double taxation on corporate income.

What is the purpose of this form?

The purpose of the IRS 1120S form is to provide the IRS with detailed information about the financial performance of an S corporation during the tax year. It enables the IRS to calculate the corporation's tax liabilities based on the reported figures and ensures compliance with tax regulations.

Who needs the form?

S corporations must file IRS 1120S. This status applies to corporations that have opted to be taxed under Subchapter S of the Internal Revenue Code, allowing them to pass income to shareholders. If your corporation has chosen this election with the IRS, filing this form is mandatory.

When am I exempt from filling out this form?

An S corporation is typically exempt from filing IRS 1120S if it meets certain criteria, such as having no income, no expenses, or being a qualified subchapter S subsidiary. Additionally, if the business is terminated during the year, filing may not be necessary.

Components of the form

IRS 1120S includes multiple sections, such as the identification section, income tax calculations, deductions, and the shareholder's basis. Important schedules accompany the form, detailing additional information like dividend distributions and other expenses. Accurate completion of these components is essential for proper tax filing.

Due date

The due date for filing IRS 1120S typically falls on the 15th day of the third month after the end of the corporation’s tax year. For a calendar year taxpayer, this means the due date is March 15. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

What payments and purchases are reported?

IRS 1120S reports various payments and purchases, including income from sales, cost of goods sold, salary payments to employees, and other business expenses. All receipts and disbursements impacting the corporation’s income need accurate reflection on this form to establish a correct tax liability.

How many copies of the form should I complete?

Typically, an S corporation needs to prepare one copy of IRS 1120S for submission to the IRS. Additionally, the corporation should retain copies for its records and provide each shareholder with a Schedule K-1, reporting their share of income, deductions, and credits.

What are the penalties for not issuing the form?

Failure to file IRS 1120S can lead to penalties for the S corporation. The IRS may impose a penalty for each month the return is late, which can accumulate quickly. Additionally, shareholders may face issues regarding their personal tax returns if the corporation fails to report income correctly.

What information do you need when you file the form?

When filing IRS 1120S, you need to gather various pieces of information, including the corporation's legal name and EIN, income statements, expense documentation, and any applicable schedules. It's crucial to have accurate financial records to complete the form correctly.

Is the form accompanied by other forms?

Yes, IRS 1120S is often accompanied by other forms and schedules. Most notably, Schedule K-1 must be provided to each shareholder, detailing their specific share of the corporation's income and deductions. Other supplemental forms may be necessary depending on the corporation's financial activities.

Where do I send the form?

IRS 1120S should be sent to the address specified in the form instructions, which varies based on the corporation's principal place of business. Ensure to check the latest IRS guidelines for the correct submission address to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Makes filling and distributing PDFs very easy

I did not realize that the pages did not replicate on the under forms. The only way I could do each secondary form is cut & paste. Big Waste of time

See what our users say