VT DoT PTT-172 (formerly PT-172) 2023 free printable template

Show details

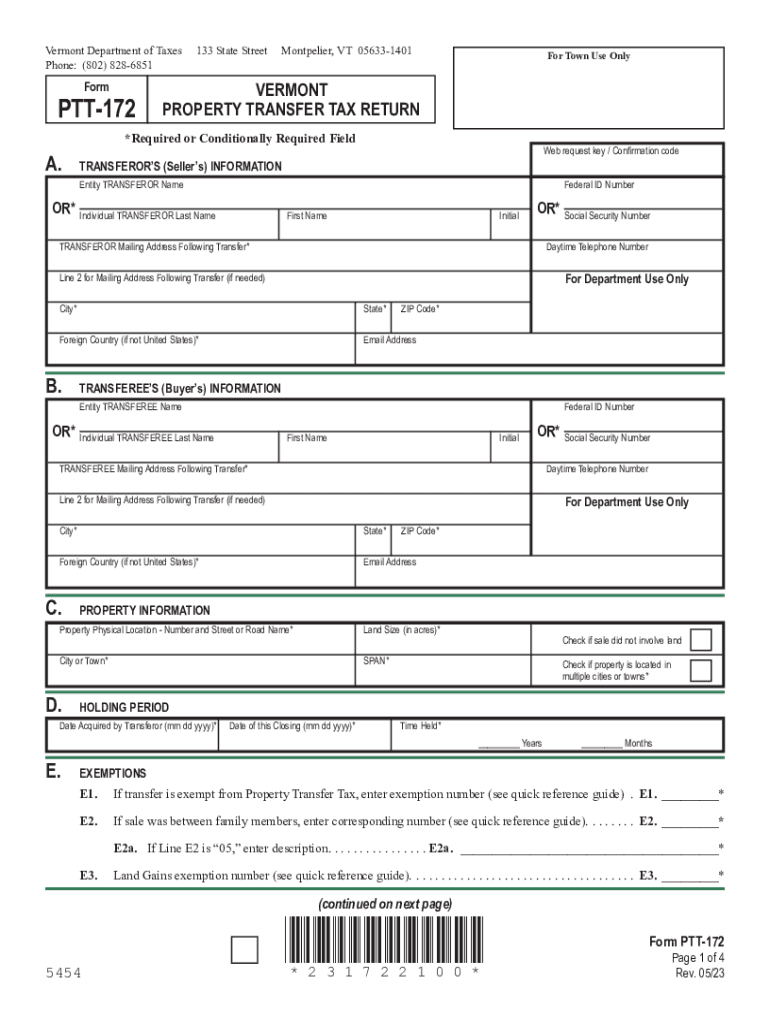

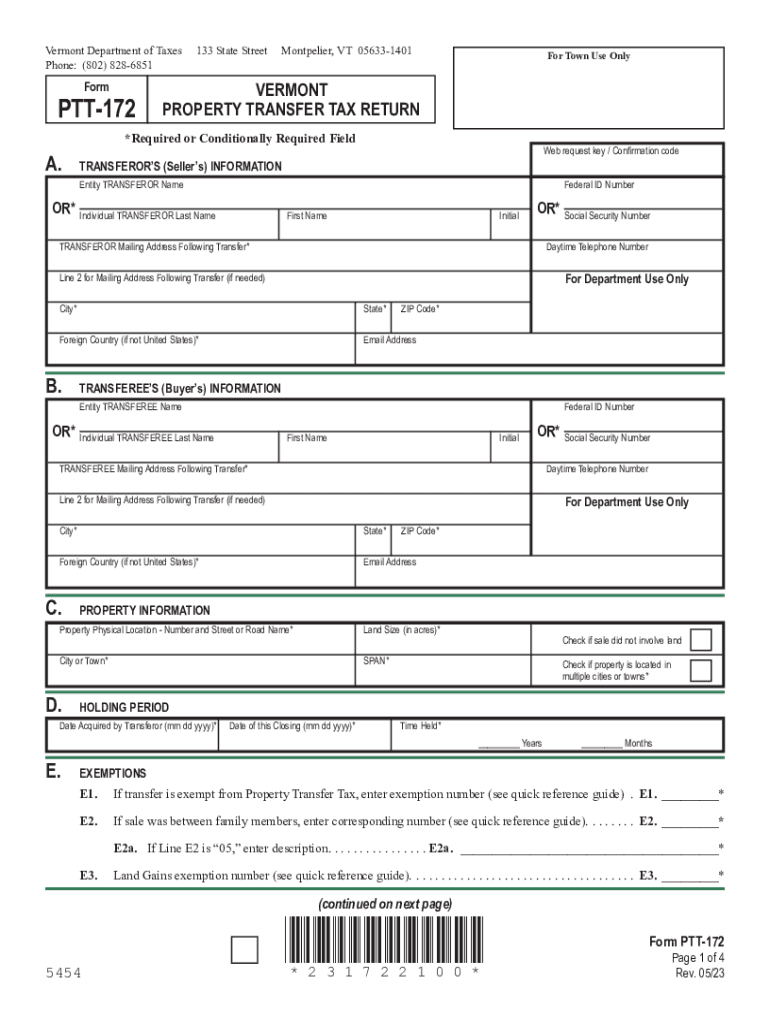

Vermont Department of Taxes

Phone: (802) 8286851FormPTT172133 State Street Montpelier, VT 056331401For Town Use OnlyVERMONT

PROPERTY TRANSFER TAX RETURN×Required or Conditionally Required Field.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign state of vermont property

Edit your state of vermont property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of vermont property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of vermont property online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state of vermont property. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT PTT-172 (formerly PT-172) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out state of vermont property

How to fill out VT DoT PTT-172 (formerly PT-172)

01

Obtain the VT DoT PTT-172 form from the Vermont Department of Transportation website or local office.

02

Fill in personal information including your name, address, and contact information at the top of the form.

03

Provide vehicle details including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the application in the designated section.

05

If applicable, provide information about any financial institutions involved or liens on the vehicle.

06

Sign and date the form to certify that all information is accurate and complete.

07

Submit the completed form to the appropriate VT DoT office along with any required fees or documentation.

Who needs VT DoT PTT-172 (formerly PT-172)?

01

Individuals applying for vehicle registration in Vermont.

02

Owners seeking to transfer ownership of a vehicle.

03

Those needing a duplicate title or correcting information on a current title.

04

New residents of Vermont who need to register their out-of-state vehicles.

Fill

form

: Try Risk Free

People Also Ask about

What form is used to calculate taxes?

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is the IRS form for figuring taxable Social Security benefits?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

What do you put for taxable income?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

How do you calculate taxable income manually?

Your gross income minus all available deductions is your taxable income.

How do you calculate taxable amount?

Now, one pays tax on his/her net taxable income. For the first Rs. 2.5 lakh of your taxable income you pay zero tax. For the next Rs. 2.5 lakhs you pay 5% i.e. Rs 12,500. For the next 5 lakhs you pay 20% i.e. Rs 1,00,000. For your taxable income part which exceeds Rs. 10 lakhs you pay 30% on the entire amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get state of vermont property?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the state of vermont property in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the state of vermont property in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your state of vermont property right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit state of vermont property on an iOS device?

Create, edit, and share state of vermont property from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is VT DoT PTT-172 (formerly PT-172)?

VT DoT PTT-172, formerly known as PT-172, is a form required by the Vermont Department of Transportation that documents information related to transportation and vehicle use, including details necessary for compliance with state regulations.

Who is required to file VT DoT PTT-172 (formerly PT-172)?

Entities or individuals who operate vehicles for commercial purposes or those who are involved in transportation services within the state of Vermont are required to file VT DoT PTT-172.

How to fill out VT DoT PTT-172 (formerly PT-172)?

To fill out VT DoT PTT-172, one must provide accurate information regarding vehicle identification, usage details, and any other relevant data as requested on the form. It is advisable to follow the instructions provided with the form to ensure all sections are completed correctly.

What is the purpose of VT DoT PTT-172 (formerly PT-172)?

The purpose of VT DoT PTT-172 is to collect data on vehicle usage and to ensure compliance with state transportation regulations, facilitating proper oversight and management of transportation activities in Vermont.

What information must be reported on VT DoT PTT-172 (formerly PT-172)?

The information that must be reported on VT DoT PTT-172 includes details such as vehicle identification numbers, types of vehicles, mileage, purpose of traveling, and any other pertinent information related to the operation of the vehicles in question.

Fill out your state of vermont property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Vermont Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.