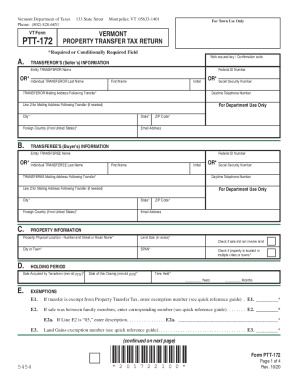

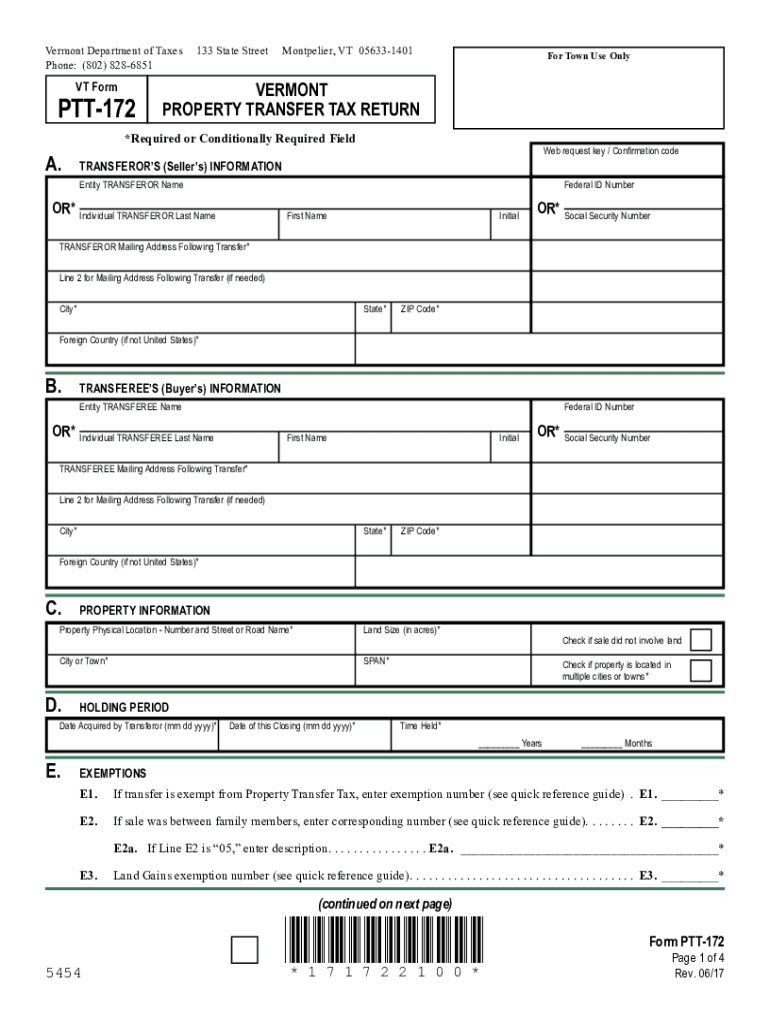

VT DoT PTT-172 (formerly PT-172) 2017 free printable template

Show details

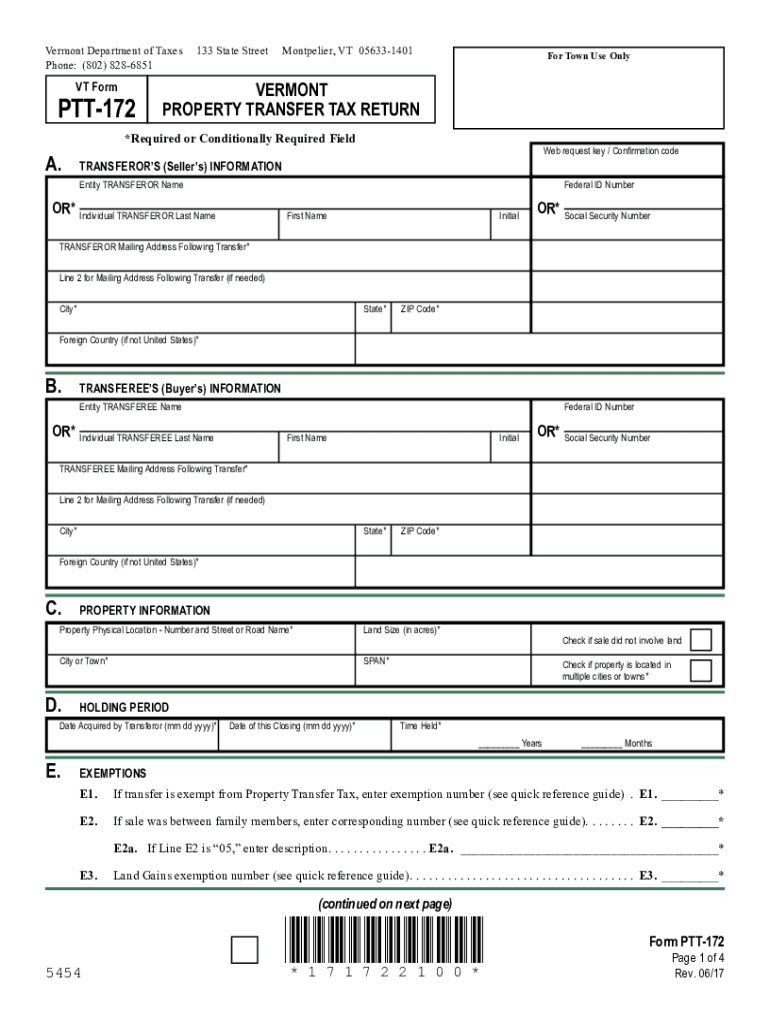

VERMONT Property Transfer Tax Return A. PT-172 081721199 Replaces Form PT-1 Form SELLER S TRANSFEROR S INFORMATION BLACK OUT ON TOWN COPY ONLY Entity SELLER 1 Federal ID number Individual SELLER 1 Social Security Number First Name Initial City or Town State Zip Code TOTAL number of SELLERS B. Farm. Other. Woodland. Miscellaneous. Attachment for Additional Use Form PT-172-B to list additional BUYERS SELLERS PT-172-S Entity SELLER 2 Name Entity SELLER 3 or Individual SELLER 4 Mailing Address...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign state of vermont property

Edit your state of vermont property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of vermont property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of vermont property online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state of vermont property. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VT DoT PTT-172 (formerly PT-172) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out state of vermont property

How to fill out VT DoT PTT-172 (formerly PT-172)

01

Obtain the VT DoT PTT-172 form from the Vermont Department of Transportation's website or office.

02

Fill out the applicant's information, including name, address, and contact details.

03

Provide vehicle information, such as make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the application, whether it is for a new title, registration, or other services.

05

Complete any required declarations or statements regarding the vehicle's history.

06

Sign and date the form at the designated spot.

07

Submit the completed form along with any required documentation and fees to the appropriate VT DoT office.

Who needs VT DoT PTT-172 (formerly PT-172)?

01

Individuals or businesses seeking to register a vehicle in Vermont.

02

People looking to apply for a title for a vehicle in Vermont.

03

Anyone who has recently purchased a vehicle and needs to formalize ownership.

04

Entities involved in transferring vehicle ownership.

Fill

form

: Try Risk Free

People Also Ask about

How much is the Vermont real estate transfer tax?

Vermont Property transfer tax The amount of the transfer tax is generally 1.45 % of the purchase price. The tax is discounted to one half of one percent for the first $100,000.00 of the purchase price if you use the property as your primary residence. Learn more about tax considerations here.

How much is transfer tax in Vermont?

A primary residence in Vermont pays at a varying rate – 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

How is Vermont property transfer tax calculated?

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

Who pays transfer tax in VT?

Who Pays Transfer Taxes in Vermont: the Buyer or the Seller? In Vermont, the home buyer traditionally pays the transfer tax as part of closing costs.

What is a PTT 172?

The Property Transfer Tax is a tax on the transfer by deed (as defined below) of title to real property in Vermont. Form PTT-172 must be filed with the town clerk whenever a deed transferring title of real property is delivered for recording.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete state of vermont property online?

Filling out and eSigning state of vermont property is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the state of vermont property in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your state of vermont property and you'll be done in minutes.

How do I complete state of vermont property on an Android device?

Use the pdfFiller mobile app and complete your state of vermont property and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is VT DoT PTT-172 (formerly PT-172)?

VT DoT PTT-172 (formerly PT-172) is a form used by the Vermont Department of Taxes to report passenger vehicle transportation tax.

Who is required to file VT DoT PTT-172 (formerly PT-172)?

Individuals and businesses that operate passenger vehicles for hire in Vermont are required to file VT DoT PTT-172.

How to fill out VT DoT PTT-172 (formerly PT-172)?

To fill out VT DoT PTT-172, provide accurate vehicle and operational details, including the number of passengers transported, and submit the completed form to the Vermont Department of Taxes.

What is the purpose of VT DoT PTT-172 (formerly PT-172)?

The purpose of VT DoT PTT-172 is to collect transportation taxes from operators providing passenger vehicle services in Vermont.

What information must be reported on VT DoT PTT-172 (formerly PT-172)?

Information required includes the vehicle identification number, passenger capacity, total miles driven for hire, and the total amount of fares collected.

Fill out your state of vermont property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Vermont Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.