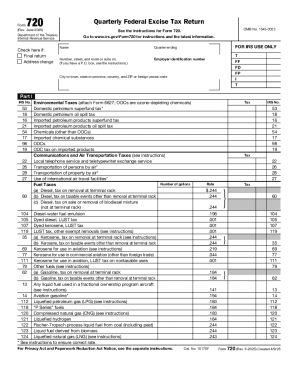

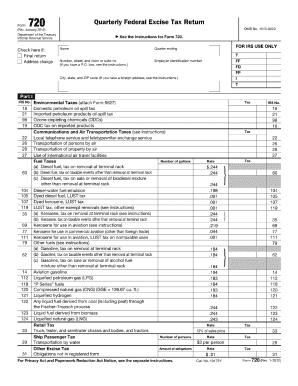

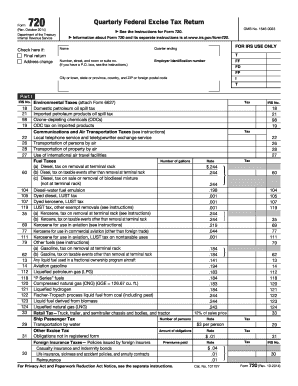

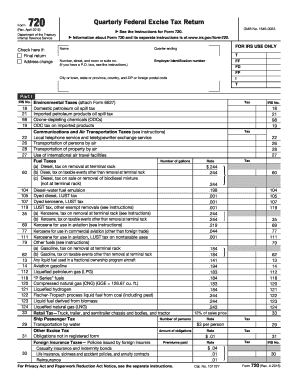

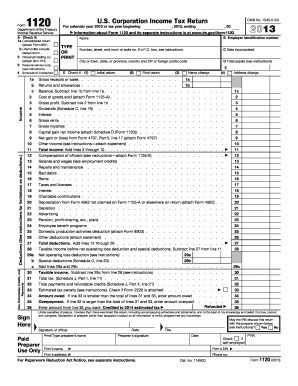

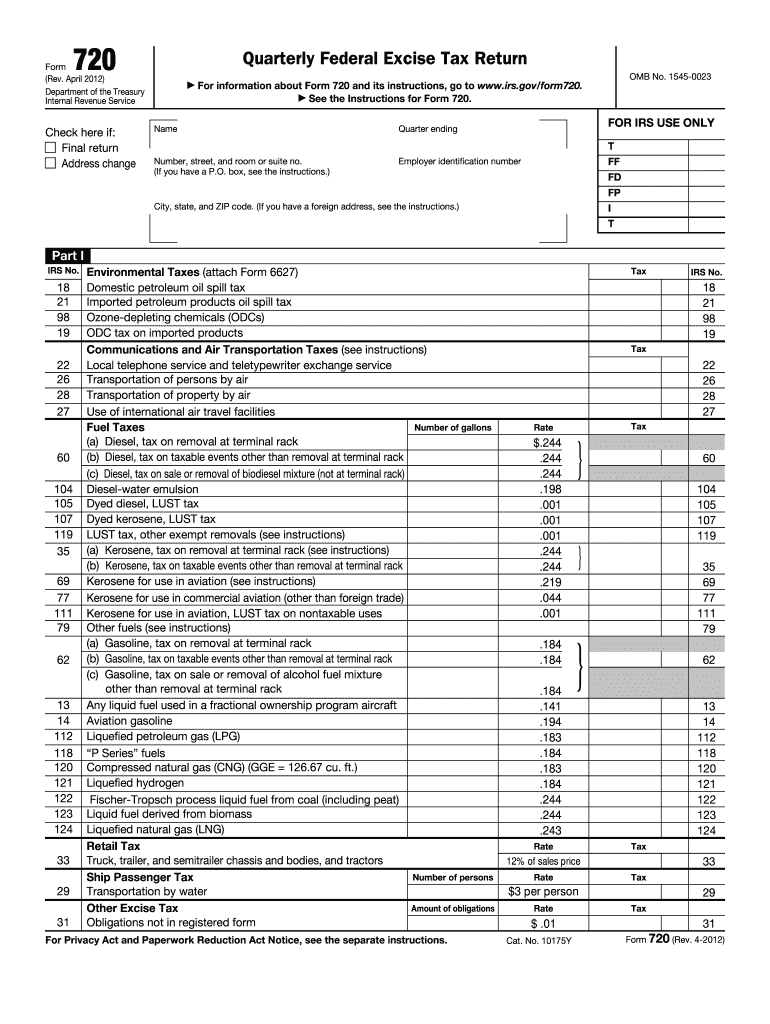

IRS 720 2012 free printable template

Instructions and Help about IRS 720

How to edit IRS 720

How to fill out IRS 720

About IRS previous version

What is IRS 720?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 720

What steps should I take if I realize I made an error on my submitted irs form 720 2012?

If you discover an error after submitting the irs form 720 2012, you can file an amended return. It's essential to clearly indicate on the amended form that it is a correction and to follow the IRS instructions for corrections. Make sure to submit this as soon as possible to rectify any issues and minimize potential penalties.

How can I verify the processing status of my irs form 720 2012 once submitted?

To track the status of your irs form 720 2012, you can use the IRS online tracking system or contact the IRS directly for updates. Be prepared to provide your personal details and specifics about your submission, such as the date filed, to assist in retrieving your status. It's wise to check regularly to ensure it’s being processed correctly.

What should I do if I receive a notice from the IRS after submitting my irs form 720 2012?

Upon receiving a notice from the IRS regarding your irs form 720 2012, read it carefully to understand its purpose. Respond promptly, providing any requested information or clarification and including any supporting documentation. If you're uncertain about the response, consider consulting with a tax professional for guidance.

Are there any common errors to watch out for when filing the irs form 720 2012?

Common errors when filing the irs form 720 2012 include incorrect payment amounts, failure to sign the form, and submitting it without the necessary attachments. Carefully reviewing your entries against IRS guidelines before submission can significantly reduce the likelihood of mistakes.

See what our users say