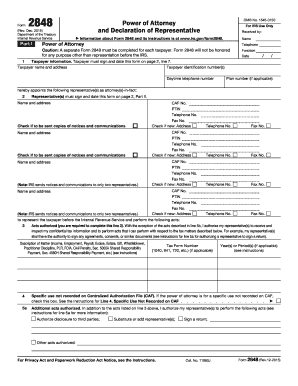

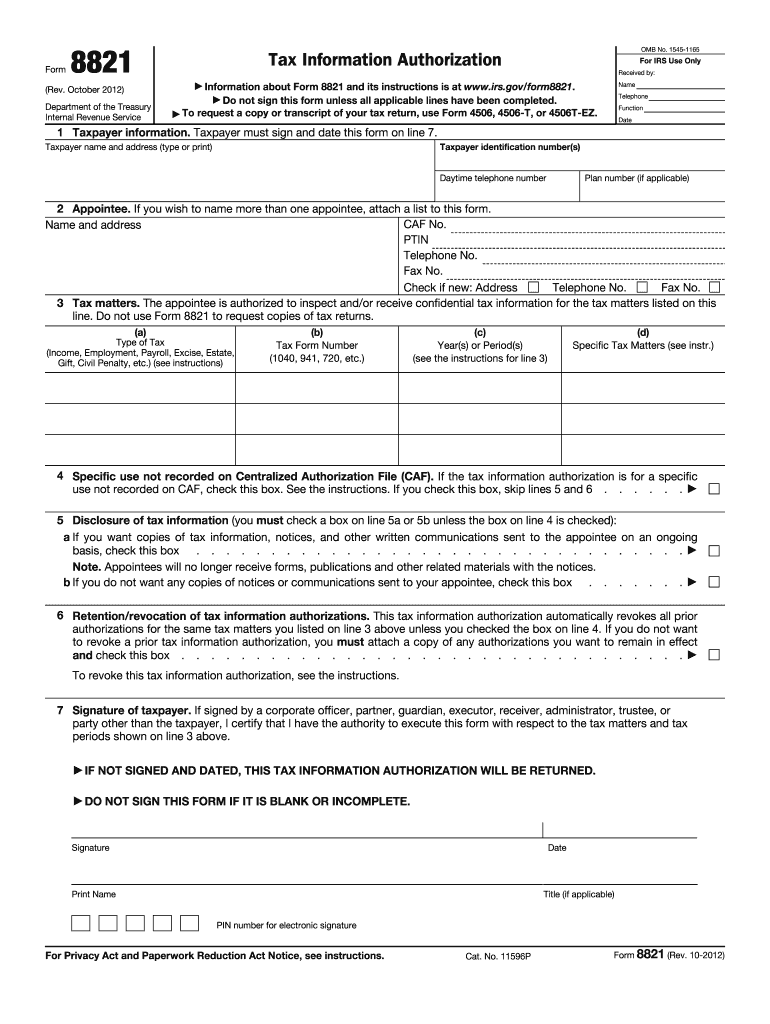

IRS 8821 2012 free printable template

Instructions and Help about IRS 8821

How to edit IRS 8821

How to fill out IRS 8821

About IRS 8 previous version

What is IRS 8821?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8821

What should I do if I realize I've made a mistake on my 2012 form 8821 after submission?

If you need to correct mistakes on your 2012 form 8821 after filing, you can submit an amended form. Ensure that you clearly indicate that it is a correction and provide the correct information. It's advisable to retain copies of both the original and revised forms for your records.

How can I verify the receipt and processing status of my 2012 form 8821?

To verify the receipt and processing of your 2012 form 8821, you can check online through the IRS’s e-file status tool or contact their helpline. Keep your submission confirmation handy, as it may be required for inquiries regarding your form's status.

What legal nuances should I know about when filing the 2012 form 8821 as a nonresident?

Nonresidents filing the 2012 form 8821 should ensure they have the necessary ITIN or foreign tax identification number, as this may affect processing. Additionally, be aware that different privacy and data security regulations might apply based on your residency status when providing personal information.

What are some common errors I should avoid when submitting the 2012 form 8821?

Common errors when submitting the 2012 form 8821 include failing to sign the form, providing incorrect information, or neglecting to check the details before submission. Review for any potential discrepancies to minimize the chances of rejection or delays.

How does the e-filing process for the 2012 form 8821 interact with various software and devices?

When e-filing the 2012 form 8821, ensure your software is compatible with IRS e-filing systems. Keep in mind that certain browsers and mobile devices may have specific technical requirements, so it's best to check the IRS website for up-to-date compatibility information before submitting your form.

See what our users say