Canada ES0005 2019-2025 free printable template

Show details

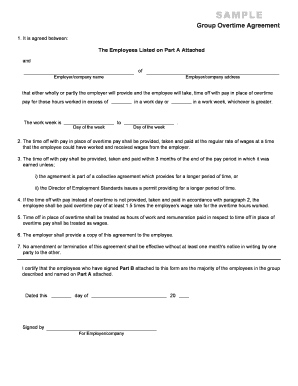

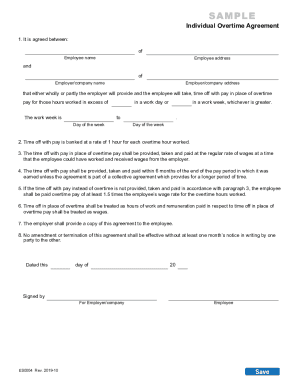

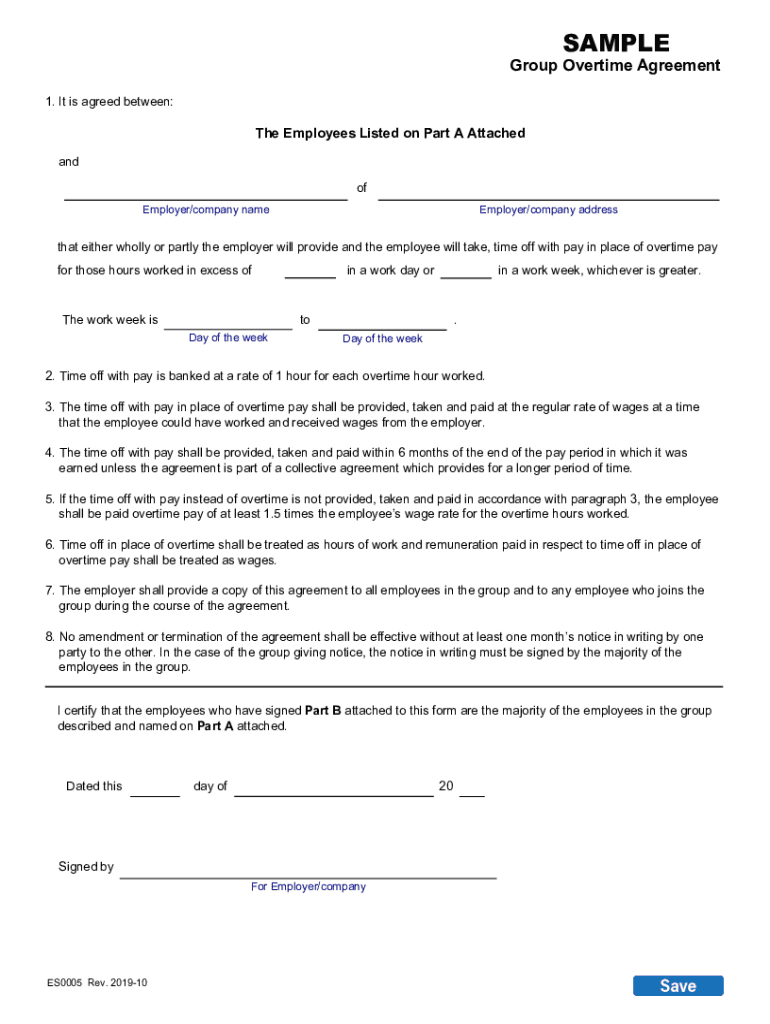

SAMPLEGroup Overtime Agreement

1. It is agreed between:The Employees Listed on Part A Attached

and

of

Employer/company nameEmployer/company addressthat either wholly or partly the employer will provide

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample group overtime agreement form

Edit your Canada ES0005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada ES0005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada ES0005 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada ES0005. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada ES0005 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada ES0005

How to fill out Canada ES0005

01

Obtain the Canada ES0005 form from the official website or local service office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details, including name, address, and contact information.

04

Provide the necessary identification information as per the guidelines.

05

Complete the section regarding your employment history and current situation.

06

Review the details for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form to the appropriate authority either by mail or in person.

Who needs Canada ES0005?

01

Individuals applying for specific services or benefits provided by the Canadian government.

02

Those who are required to report their employment status for taxation or support programs.

03

Applicants seeking to verify their eligibility for certain social benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the overtime law in California 2023?

Under California's Overtime Law, employers are required to pay all the eligible employees aged 18 years or more working in the state of California additional pay for the work done in excess of the standard 8 hours per workday or the standard 40 hours per workweek.

What is the maximum salary for a GS 15 employee?

GS-15 Federal Employee Base Salary GS-15 government employees will receive a base salary of between $117,518.00 and $152,771.00, depending on their General Schedule Step.

What does FLSA stand for?

Revised September 2016. The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

Which group of employees might be eligible for overtime pay ing to FLSA?

Employees covered by the Fair Labor Standards Act (FLSA) must receive overtime pay for hours worked in excess of 40 in a workweek of at least one and one-half times their regular rates of pay.

Can a GS 15 get overtime?

AD employees with salaries in excess of the GS-15, step 10, are not eligible for overtime or compensatory time. FLSA-nonexempt employees are not subject to this biweekly limit. professional in nature. There is no entitlement to overtime pay – management has right to compensate with compensatory time.

Can GS employees work overtime?

For all FLSA EXEMPT GS and FP employees whose basic pay is at a rate which does not exceed the minimum rate of basic pay for GS-10, the overtime hourly rate of pay is one and one half times the employee's rate of basic pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada ES0005 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your Canada ES0005, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the Canada ES0005 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your Canada ES0005 in seconds.

How do I fill out Canada ES0005 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign Canada ES0005. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is Canada ES0005?

Canada ES0005 is a tax form used for reporting and remitting the estimated taxes owed by individuals or businesses in Canada.

Who is required to file Canada ES0005?

Individuals or entities that expect to owe more than a certain amount in taxes and wish to make estimated tax payments are required to file Canada ES0005.

How to fill out Canada ES0005?

To fill out Canada ES0005, provide your personal or business information, calculate your estimated tax owing, and report the amounts for the tax periods specified.

What is the purpose of Canada ES0005?

The purpose of Canada ES0005 is to allow taxpayers to prepay their anticipated tax liability, thus avoiding a large lump-sum payment at the end of the tax year.

What information must be reported on Canada ES0005?

Canada ES0005 requires reporting personal details, estimated income, deductions, credits, and the amount of estimated tax to be paid for the current tax year.

Fill out your Canada ES0005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada es0005 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.