Get the free Does Car Insurance Cover Fire Damage?

Show details

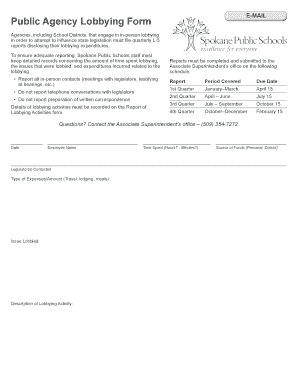

PREMIER POLICY WORDINGTable of Contents Table of Contents Private Car Policy Summary3Welcome to Hedgehog7Making a Claim8Private Car9Policy Definitions10Your Cover13Changes to Your Insurance14Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign does car insurance cover

Edit your does car insurance cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your does car insurance cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing does car insurance cover online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit does car insurance cover. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out does car insurance cover

How to fill out does car insurance cover

01

Step 1: Gather all necessary information about your car insurance policy.

02

Step 2: Determine the nature of the incident or damage that has occurred.

03

Step 3: Contact your car insurance company to report the incident and initiate a claim.

04

Step 4: Provide all the required information and documentation to support your claim.

05

Step 5: Cooperate with any investigations or assessments conducted by the insurance company.

06

Step 6: Review and understand the terms and conditions of your car insurance policy to determine the coverage applicable to your situation.

07

Step 7: Fill out the necessary forms and paperwork as required by your insurance company.

08

Step 8: Submit the completed forms and any supporting materials to your insurance company.

09

Step 9: Follow up with your insurance company to ensure the progress of your claim.

10

Step 10: Review and verify the settlement offer provided by your insurance company.

11

Step 11: If the offer is reasonable, accept it and follow any instructions to receive the claim payout.

12

Step 12: If the offer is not satisfactory, negotiate with your insurance company or seek legal advice if necessary.

13

Step 13: Once the claim is settled, make any necessary repairs to your vehicle and provide any requested proof of repair to the insurance company.

Who needs does car insurance cover?

01

Anyone who owns or operates a motor vehicle needs car insurance.

02

Car insurance is typically a legal requirement in most countries and states.

03

Individuals who want financial protection in the event of an accident, theft, or damage to their vehicle need car insurance.

04

Car insurance is important for both new and experienced drivers.

05

Those who want to protect themselves from the financial burden of a potential liability claim resulting from an accident involving their vehicle should have car insurance.

06

Car insurance is also beneficial for individuals who want coverage for medical expenses resulting from car accidents.

07

Businesses or companies that use vehicles as part of their operations or for transportation purposes also need car insurance to protect their assets and mitigate risks.

08

Additionally, car insurance is required by lenders or financial institutions when financing the purchase of a vehicle.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify does car insurance cover without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like does car insurance cover, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the does car insurance cover in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your does car insurance cover in seconds.

How do I edit does car insurance cover on an Android device?

You can make any changes to PDF files, such as does car insurance cover, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What does car insurance cover?

Car insurance typically covers liability for bodily injury and property damage, collision coverage for accidents, comprehensive coverage for non-collision incidents, personal injury protection, and uninsured/underinsured motorist coverage.

Who is required to file for car insurance coverage?

All drivers who own a vehicle are generally required to file for car insurance coverage as mandated by state laws.

How to fill out a car insurance coverage application?

To fill out a car insurance coverage application, gather your personal information, vehicle details, driving history, and any previous insurance information, then complete the application form provided by the insurance company.

What is the purpose of car insurance coverage?

The purpose of car insurance coverage is to provide financial protection in the event of an accident, theft, or damage to your vehicle, as well as to protect against liability for injuries or damages to other parties.

What information must be reported on a car insurance coverage application?

Information that must be reported includes the driver's name, address, date of birth, vehicle make and model, VIN (Vehicle Identification Number), driving history, and how the vehicle will be used.

Fill out your does car insurance cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Does Car Insurance Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.