Get the free CalSTRS Cash Balance Benefit Program - ohlone

Show details

This document provides information about the CalSTRS Cash Balance Benefit Program specifically designed for part-time instructors in California community colleges, detailing eligibility, contributions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calstrs cash balance benefit

Edit your calstrs cash balance benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calstrs cash balance benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit calstrs cash balance benefit online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit calstrs cash balance benefit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

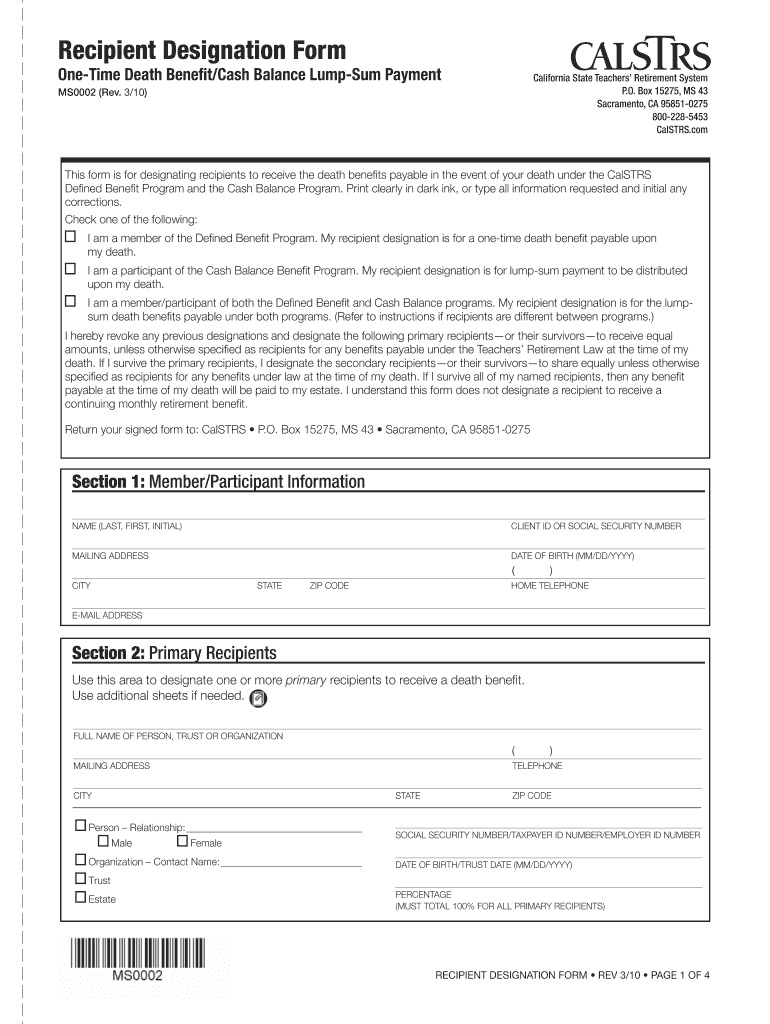

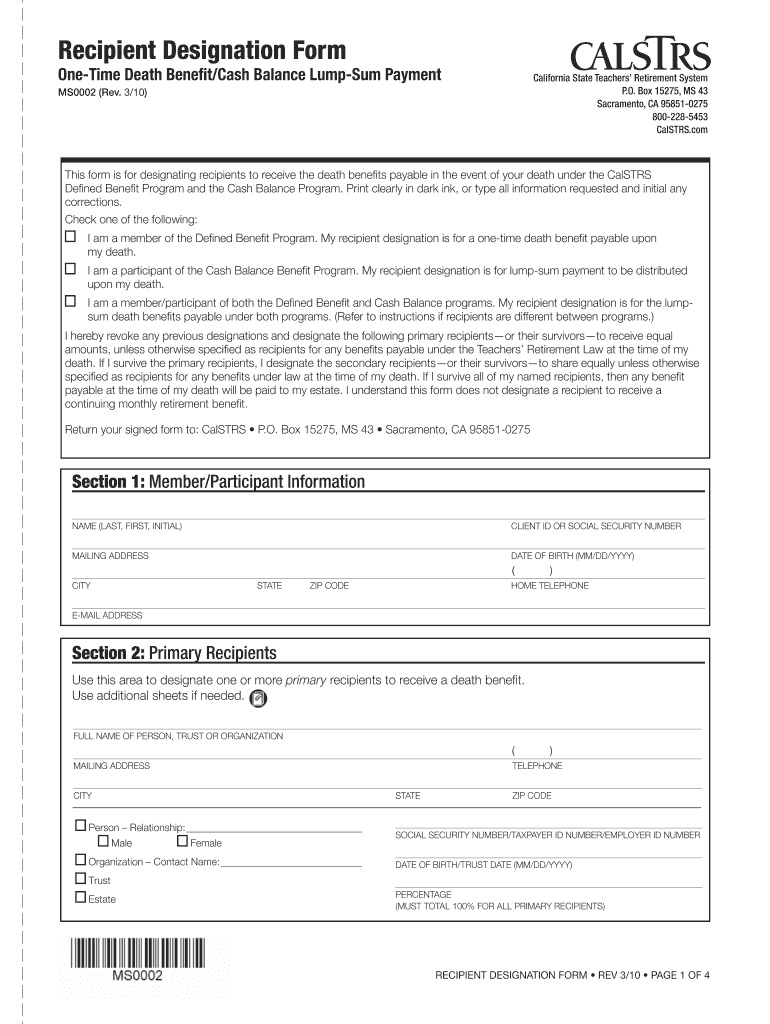

How to fill out calstrs cash balance benefit

How to fill out CalSTRS Cash Balance Benefit Program

01

Gather necessary personal information (name, address, Social Security number).

02

Obtain the application form for the CalSTRS Cash Balance Benefit Program from the official website or CalSTRS office.

03

Fill out personal details on the application form, ensuring accuracy.

04

Provide employment history, including the names of employers and dates of employment.

05

Specify your desired contribution amount or plan for contributions.

06

Review the terms and conditions of the program outlined in the application.

07

Sign and date the application form to confirm all information is correct.

08

Submit the completed application form to CalSTRS either by mail or online, as directed.

Who needs CalSTRS Cash Balance Benefit Program?

01

Individuals who work in California public education and want to save for retirement.

02

Those looking for a flexible retirement savings option with guaranteed benefits.

03

Educators who desire a safe investment with some growth potential.

04

Employees who may not be eligible for traditional pension plans.

05

Part-time or temporary employees in the education sector who want to contribute to a retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

What happens to my cash balance pension if I quit?

Most companies allow you to leave the money inside the cash balance plan even after you've left the firm. However, there is usually an age limit by which you must choose another option, typically age 65. If you leave the money in the plan, you will continue to earn interest credits.

What is the difference between a pension plan and a cash balance plan?

Cash balance plans tend to have more flexible funding requirements. The plan can be customized using an employee, pay credit, and interest credit. As a result, the company can customize these plans more than a traditional pension.

What is a downside to cash balance pension plan?

Most companies allow you to leave the money inside the cash balance plan even after you've left the firm. However, there is usually an age limit by which you must choose another option, typically age 65. If you leave the money in the plan, you will continue to earn interest credits.

Who is eligible for the cash balance plan?

Employees must work at least 1,000 hours a year to qualify for participation. Employees must be at least 21 years old to participate. You can exclude employees who were hired during the year.

Is a cash balance plan the same as a pension?

Top Cash Balance Pension Plan Disadvantages: Plan administration is expensive, although the plan benefits are high for the business owner. An excise tax could be assessed if minimum contributions are not met. But the actuary can help monitor the risk and benefit accruals.

What happens to my cash balance pension if I quit?

Most cash balance plans are established for the primary benefit of the owners or executives of a company. So, the contributions from the company for owners and executives are typically very large, with a smaller contribution provided to staff to meet Internal Revenue Service (IRS) requirements.

Can I borrow from my cash balance pension plan?

The maximum amount that the plan can permit as a loan is (1) the greater of $10,000 or 50% of your vested account balance, or (2) $50,000, whichever is less. For example, if a participant has an account balance of $40,000, the maximum amount that he or she can borrow from the account is $20,000.

Can I cash out my cash balance pension plan?

You can start withdrawing from the cash balance plan at age 59 1/2. But most people will roll the funds over into an IRA and then follow the IRA rules. Most sure you understand the early withdrawal penalty.

Can you withdraw cash balance pension?

You can start withdrawing from the cash balance plan at age 59 1/2. But most people will roll the funds over into an IRA and then follow the IRA rules. Most sure you understand the early withdrawal penalty.

What is a downside to cash balance pension plan?

Top Cash Balance Pension Plan Disadvantages: Plan administration is expensive, although the plan benefits are high for the business owner. An excise tax could be assessed if minimum contributions are not met. But the actuary can help monitor the risk and benefit accruals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CalSTRS Cash Balance Benefit Program?

The CalSTRS Cash Balance Benefit Program is a retirement plan designed for part-time educators and employees of California schools, allowing them to accumulate retirement savings through contributions that earn interest.

Who is required to file CalSTRS Cash Balance Benefit Program?

Individuals who are members of the Cash Balance Benefit Program, including part-time educators and eligible employees, are required to file the program documents.

How to fill out CalSTRS Cash Balance Benefit Program?

To fill out the CalSTRS Cash Balance Benefit Program forms, individuals must provide personal information, employment details, and designate their beneficiary, following the instructions outlined in the program documents.

What is the purpose of CalSTRS Cash Balance Benefit Program?

The purpose of the CalSTRS Cash Balance Benefit Program is to provide a safe retirement savings option for part-time educators, offering a blend of defined benefit and defined contribution features.

What information must be reported on CalSTRS Cash Balance Benefit Program?

The information that must be reported includes member's personal details, contribution amounts, investment choices, interest earned, and any updates related to the beneficiary designations.

Fill out your calstrs cash balance benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calstrs Cash Balance Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.