Get the free E-RATE ONLINE LLC

Show details

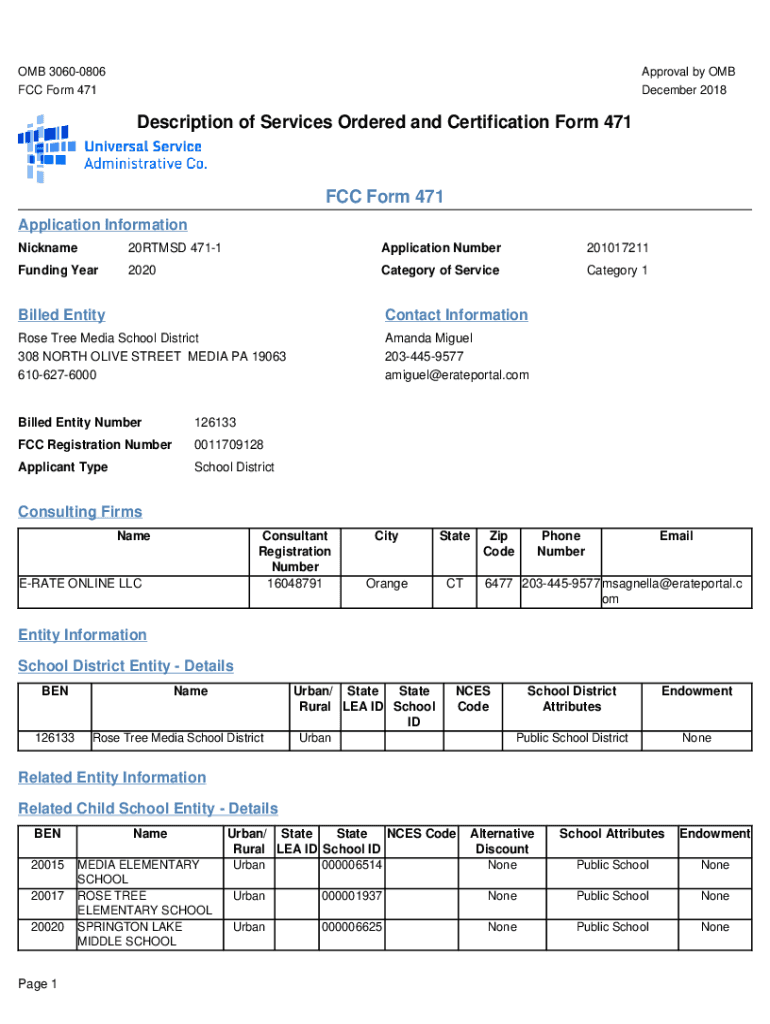

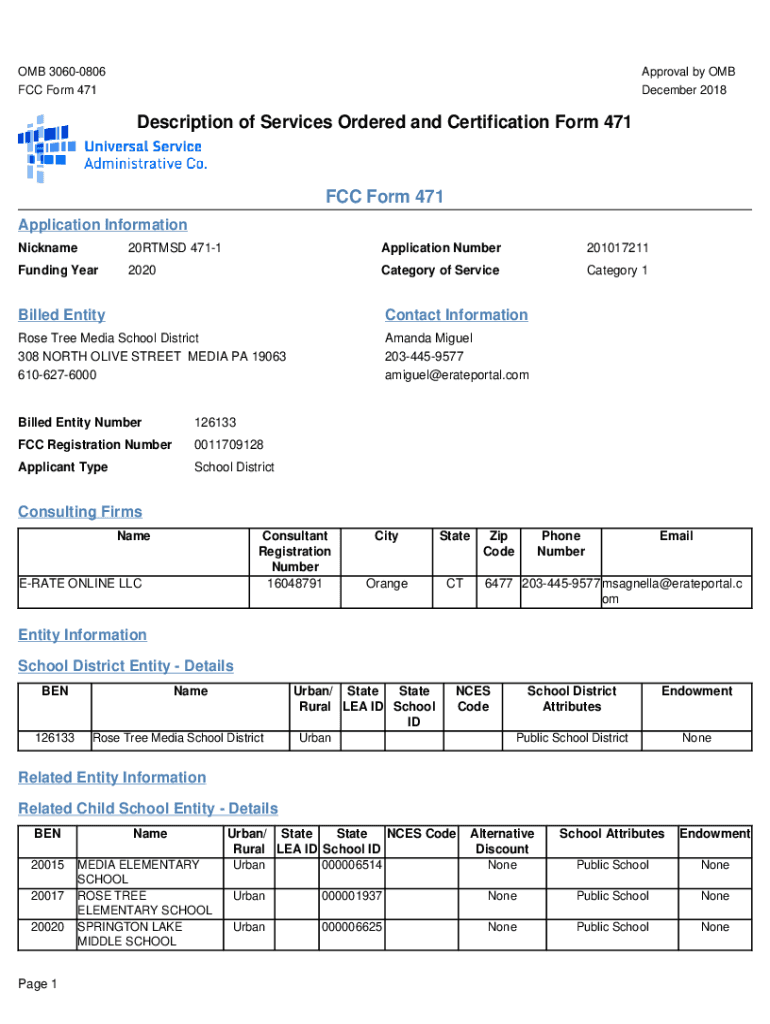

OMB 30600806 FCC Form 471Approval by OMB December 2018Description of Services Ordered and Certification Form 471FCC Form 471 Application Information Nickname20RTMSD 4711Application Number201017211Funding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign e-rate online llc

Edit your e-rate online llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e-rate online llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit e-rate online llc online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit e-rate online llc. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out e-rate online llc

How to fill out e-rate online llc

01

Visit the official E-rate Online LLC website.

02

Click on the 'Sign Up' button to create an account.

03

Fill out the required personal information, such as name, address, and contact details.

04

Provide information about your LLC, including the company name, type of business, and registered agent if applicable.

05

Complete the E-rate Online LLC application form, including details on the services or products your LLC offers.

06

Review your information for accuracy and submit the application.

07

Pay the necessary fees associated with the application, if any.

08

Wait for confirmation of your E-rate Online LLC registration via email or mail.

09

Once approved, you can start utilizing the benefits of E-rate Online LLC for your business.

Who needs e-rate online llc?

01

Small businesses looking to establish a legal entity for liability protection and tax benefits.

02

Entrepreneurs and startups aiming to separate their personal assets from their business liabilities.

03

Individuals involved in online businesses or e-commerce ventures.

04

Companies wishing to establish a professional image and credibility in the market.

05

Business owners seeking to access specific resources and benefits offered by E-rate Online LLC for their industry.

06

Anyone who wants to take advantage of the features and protection provided by an LLC structure for their business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send e-rate online llc for eSignature?

Once your e-rate online llc is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in e-rate online llc?

With pdfFiller, it's easy to make changes. Open your e-rate online llc in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit e-rate online llc straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing e-rate online llc right away.

What is e-rate online llc?

E-rate Online LLC refers to a program that provides discounts for internet access and telecommunications services to eligible schools and libraries in the United States.

Who is required to file e-rate online llc?

Eligible schools, libraries, and consortia that wish to receive E-rate funding must file E-rate Online LLC.

How to fill out e-rate online llc?

To fill out E-rate Online LLC, applicants must access the online application portal, provide the necessary organizational and service information, and submit it during the filing window.

What is the purpose of e-rate online llc?

The purpose of E-rate Online LLC is to provide financial assistance to schools and libraries for obtaining affordable telecommunications and internet access services.

What information must be reported on e-rate online llc?

Applicants must report details such as their eligibility status, service requests, funding requests, and information about their vendors.

Fill out your e-rate online llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E-Rate Online Llc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.