Get the free Notice 2009-24

Show details

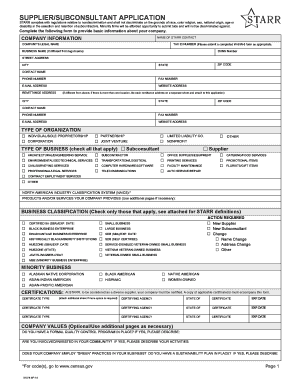

This document outlines additional procedures for the allocation of tax credits under the qualifying advanced coal project program specified by section 48A of the Internal Revenue Code, detailing application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice 2009-24

Edit your notice 2009-24 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice 2009-24 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice 2009-24 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit notice 2009-24. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice 2009-24

How to fill out Notice 2009-24

01

Obtain Form 2009-24 from the IRS website.

02

Fill in your personal information, including your name and taxpayer identification number.

03

Provide details regarding the specific situation that requires the notice.

04

Clearly state the reason for filing the notice, referencing any relevant tax laws or regulations.

05

Attach any supporting documentation that is required for your situation.

06

Review the information for accuracy and completeness.

07

Submit the completed Notice 2009-24 to the appropriate IRS office.

Who needs Notice 2009-24?

01

Individuals or businesses that are seeking relief or guidance related to taxes affected by economic circumstances.

02

Taxpayers who have specific inquiries or issues that fall under the guidance provided in Notice 2009-24.

03

Professionals who are assisting clients with tax-related issues covered by the notice.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for company owned life insurance?

Reporting Requirements. The IRS has released Form 8925 that is required to be filed by employers (with their income tax return) that own “employer-owned life insurance contracts”. The form itself contains the instructions. The form asks if the employer has a valid consent form for each covered employee.

What happens to life insurance through an employer?

Employer-paid life insurance plans typically end when the employee leaves the company. You can always search for an independent plan if this happens, but the quotes you receive then may be higher than they would be now. That's because life insurance costs vary by age.

What is the IRS procedure 2010 34?

This procedure proposes a safe harbor for contracts with a maturity date of 100, which are intended to qualify as life insurance contracts under section 7702 of the Code and avoid characterization as a MEC under section 7702A, provided the contract complies with certain testing methodologies set out in the revenue

How do I report employer-owned life insurance contracts?

Use Form 8925 to report the number of employees covered by employer-owned life insurance contracts issued after August 17, 2006, and the total amount of employer-owned life insurance in force on those employees at the end of the tax year.

Is company-owned life insurance taxable?

IRC section 79 provides an exclusion for the first $50,000 of group-term life insurance coverage provided under a policy carried directly or indirectly by an employer. There are no tax consequences if the total amount of such policies does not exceed $50,000.

Who owns employer-provided life insurance?

Employer-owned life insurance contract: A life insurance contract that is (1) owned by a person engaged in a trade or business and under which such person (or a related person) is directly or indirectly a beneficiary under the contract, and (2) which covers the life of an insured who is an employee of the "applicable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice 2009-24?

Notice 2009-24 is a guidance issued by the IRS regarding the tax implications and reporting requirements for certain transactions involving nonqualified deferred compensation plans.

Who is required to file Notice 2009-24?

Employers who maintain nonqualified deferred compensation plans that are affected by the changes outlined in the notice are required to file Notice 2009-24.

How to fill out Notice 2009-24?

To fill out Notice 2009-24, employers must provide their identifying information, details of the nonqualified deferred compensation plan, and any tax-related information required by the IRS.

What is the purpose of Notice 2009-24?

The purpose of Notice 2009-24 is to clarify the tax treatment and reporting obligations for nonqualified deferred compensation plans, ensuring compliance with IRS regulations.

What information must be reported on Notice 2009-24?

Information required on Notice 2009-24 includes the name and identifying number of the employer, a description of the plan, and details regarding the deferral amounts and plan participants.

Fill out your notice 2009-24 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice 2009-24 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.