IRS 944-PR 2011-2025 free printable template

Show details

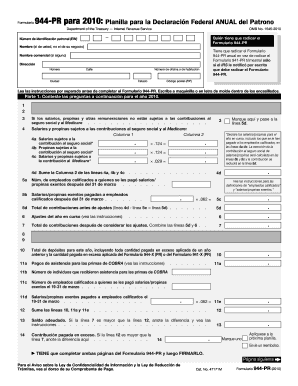

Formulario 944-PR para 2011 Planilla para la Declaraci n Federal ANUAL del Patrono Department of the Treasury Internal Revenue Service OMB No. 1545-2010 Qui n tiene que radicar el Formulario 944-PR N mero de identificaci n patronal EIN Nombre el de usted no el de su negocio Tiene que radicar el Formulario 944-PR anual en vez de radicar el si el IRS le notific por escrito que debe radicar el Formulario 944-PR. Formularios para a os anteriores est n disponibles en www.irs.gov/form944pr. Nombre...comercial si alguno Direcci n N mero Calle N mero de oficina o de habitaci n Estado Ciudad C digo postal ZIP Lea las instrucciones por separado antes de completar el Formulario 944-PR. Escriba a maquinilla o en letra de molde dentro de los encasillados. Parte 1 Conteste las preguntas a continuaci n para el a o en curso. Si los salarios propinas y otras remuneraciones no est n sujetos a las contribuciones al Seguro Social y al Medicare. Salarios y propinas sujetos a las contribuciones al Seguro...Social y al Medicare Columna 1 4a Salarios sujetos a la contribuci n al Seguro Social. 4b Propinas sujetas a la Medicare Marque aqu y pase a la l nea 6. La tasa para el a o 2011 de la corresponde a la parte del empleado es 4. 2 y la tasa de Medicare es 1. 45. La tasa de la contribuci n al Seguro Social que le corresponde a la parte del patrono es 6. 2 y la tasa de Medicare es 1. 45. 4d Sume la Columna 2 de las l neas 4a 4b y 4c. 4d Ajustes del a o en curso vea las instrucciones Total de...contribuciones despu s de considerar los ajustes. Combine las l neas 4d y 6. Total de dep sitos para este a o incluyendo toda cantidad pagada en exceso aplicada de un a o anterior y la cantidad pagada en exceso aplicada del Formulario 944-X PR o del Formulario 941-X PR 9a Pagos de asistencia para las primas de COBRA vea las instrucciones 9b N mero de individuos que recibieron asistencia para las primas de COBRA Sume las l neas 8 y 9a. Saldo adeudado. Si la l nea 7 es mayor que la l nea 10 anote...la diferencia y vea las instrucciones. Contribuci n pagada en exceso. Si la l nea 10 es mayor que la l nea 7 anote la diferencia aqu. Marque uno Apl quese a la pr xima planilla* Env e un reembolso. TIENE que completar ambas p ginas del Formulario 944-PR y luego FIRMARLO. P gina siguiente Para el Aviso sobre la Ley de Confidencialidad de Informaci n y la Ley de Reducci n de Tr mites vea al dorso de su Comprobante de Pago. Cat* No* 47171M Inf rmenos sobre su itinerario de dep sitos y obligaci n...contributiva para el a o en curso. La l nea 7 es menos de 2 500. Pase a la Parte 3. La l nea 7 es 2 500 o m s. Anote la obligaci n contributiva para cada mes. Si es depositante de itinerario bisemanal o si acumula 100 000 o m s por concepto de obligaci n en cualquier d a durante el per odo de dep sito tiene que completar el Formulario 943A-PR en lugar de los encasillados a continuaci n* ene. 13a feb. 13b mar. 13c abr. 13d mayo 13e jun* 13f jul* 13g ago. 13h sep* oct. 13i 13j nov* 13k dic*...Obligaci n contributiva total para el a o.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 944-PR

How to edit IRS 944-PR

How to fill out IRS 944-PR

Instructions and Help about IRS 944-PR

How to edit IRS 944-PR

To edit IRS 944-PR, you can use a form editor like pdfFiller that simplifies the process. This tool allows you to access the form digitally, input your details, and make necessary changes without the hassle of paper forms. Once completed, ensure all information is accurate before submission.

How to fill out IRS 944-PR

Filling out IRS 944-PR requires specific information needed for the tax year. Start by obtaining the form from the IRS website or by using a form creation tool like pdfFiller. Follow these steps to fill out the form:

01

Download or access IRS 944-PR.

02

Enter your personal and business information, including your Employer Identification Number (EIN).

03

Fill in the total wages paid and the tax withheld during the year.

04

Sign and date the form at the bottom.

Latest updates to IRS 944-PR

Latest updates to IRS 944-PR

IRS 944-PR has undergone revisions and updates in response to changes in tax law and filing requirements. Check the IRS website for the latest updates regarding due dates, eligibility criteria, and changes in reporting requirements to stay compliant.

All You Need to Know About IRS 944-PR

What is IRS 944-PR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 944-PR

What is IRS 944-PR?

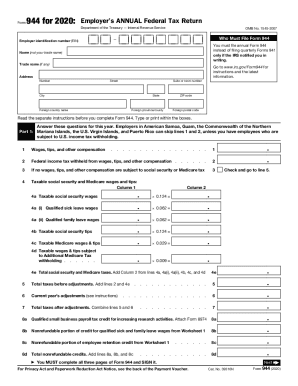

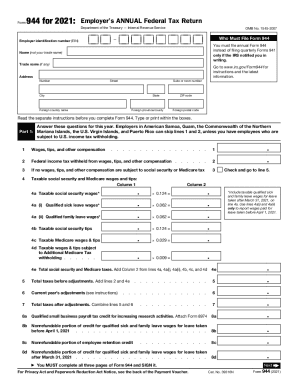

IRS 944-PR is the “Employer's Annual Federal Tax Return” specifically designed for small employers in Puerto Rico. This form allows eligible employers to report and pay federal income tax withheld and Social Security and Medicare taxes on behalf of their employees. It streamlines tax filing for businesses that pay less than $1,000 in federal payroll taxes annually.

What is the purpose of this form?

The purpose of IRS 944-PR is to simplify the tax filing process for qualifying small employers. Instead of filing quarterly, eligible employers can use this form to report their annual payroll tax liabilities, making it easier to manage finances throughout the year.

Who needs the form?

Employers in Puerto Rico who reported less than $1,000 in federal payroll taxes during the previous year are required to file IRS 944-PR. It is intended for small businesses that have opted for less frequent filing compared to larger employers who typically file Form 941.

When am I exempt from filling out this form?

You are exempt from filing IRS 944-PR if your tax liability for the previous year was $1,000 or more, or if you no longer have employees who require reporting on payroll taxes. Additionally, businesses that no longer meet the criteria for small employers should also refrain from using this form.

Components of the form

IRS 944-PR includes several key components that need to be filled out accurately. These components typically include the employer’s name, address, EIN, total wages paid, taxes withheld, and the employer's signature. Each section is crucial and must be completed with the exact figures to avoid penalties.

Due date

The due date for submitting IRS 944-PR is generally January 31 of the year following the tax year being reported. If this date falls on a weekend or holiday, the due date is extended to the next business day. It’s essential to file on time to avoid penalties.

What are the penalties for not issuing the form?

Failing to file IRS 944-PR or inaccuracies can lead to penalties from the IRS. The penalties can include a percentage of the unpaid taxes and additional fines for late filing. It is critical to comply with reporting deadlines to avoid unnecessary fees.

What information do you need when you file the form?

When filing IRS 944-PR, gather necessary information such as your EIN, total wages you paid, amounts of federal income tax withheld, and Social Security and Medicare tax amounts for your employees. Having accurate records is essential to ensure a smooth filing process.

Is the form accompanied by other forms?

IRS 944-PR is typically filed independently; however, you might also need to submit related paperwork depending on your payroll situation. Check whether other forms, such as state tax forms or additional IRS forms, are necessary before filing.

Where do I send the form?

Send IRS 944-PR to the appropriate address provided by the IRS based on your location. This may vary depending on whether you are filing with payments or without. Ensure that you check the IRS website for the correct mailing address to avoid processing delays.

See what our users say