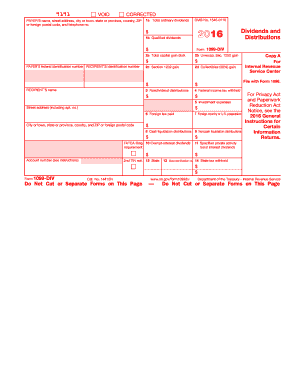

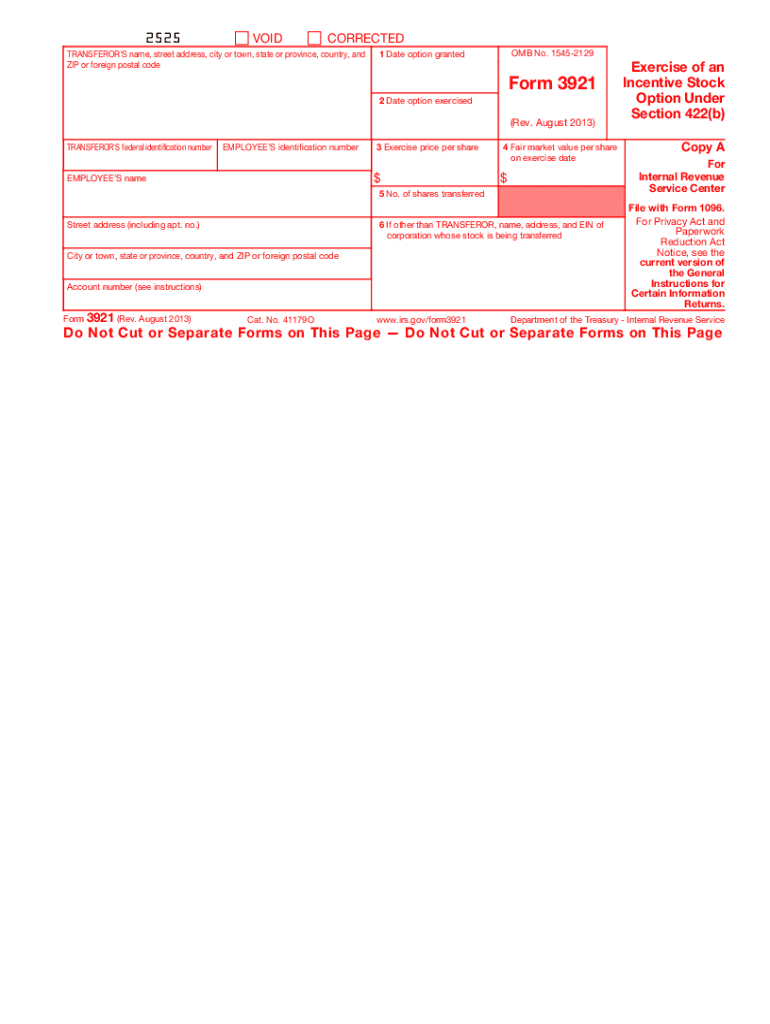

IRS 3921 2013 free printable template

Instructions and Help about IRS 3921

How to edit IRS 3921

How to fill out IRS 3921

About IRS 3 previous version

What is IRS 3921?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 3921

What should I do if I realize I've made a mistake on form 3921 2013 after submission?

If you discover an error on form 3921 2013 after submission, you should consider filing an amended form to correct the mistake. Ensure you clearly indicate that the form is an amendment and provide the correct information. It’s vital to retain documentation related to the correction for your records.

How can I confirm that my form 3921 2013 has been received and processed?

To verify the status of your submitted form 3921 2013, check with the IRS or the relevant tax authority. They often provide tools or services that allow you to track your form after submission. Be prepared to address any common e-file rejection codes should your submission not be processed as expected.

Are there any specific records I need to keep after submitting form 3921 2013?

After filing form 3921 2013, it’s essential to retain a copy of the submitted form along with any supporting documentation. The IRS typically suggests keeping records for a minimum of three years to ensure compliance and for reference in case of audits.

What if I need someone else to file form 3921 2013 on my behalf?

If someone, such as an authorized representative or Power of Attorney (POA), is filing form 3921 2013 on your behalf, ensure that they have the necessary authorization documented. This representation can streamline the filing process, but make sure to comply with privacy and disclosure regulations.