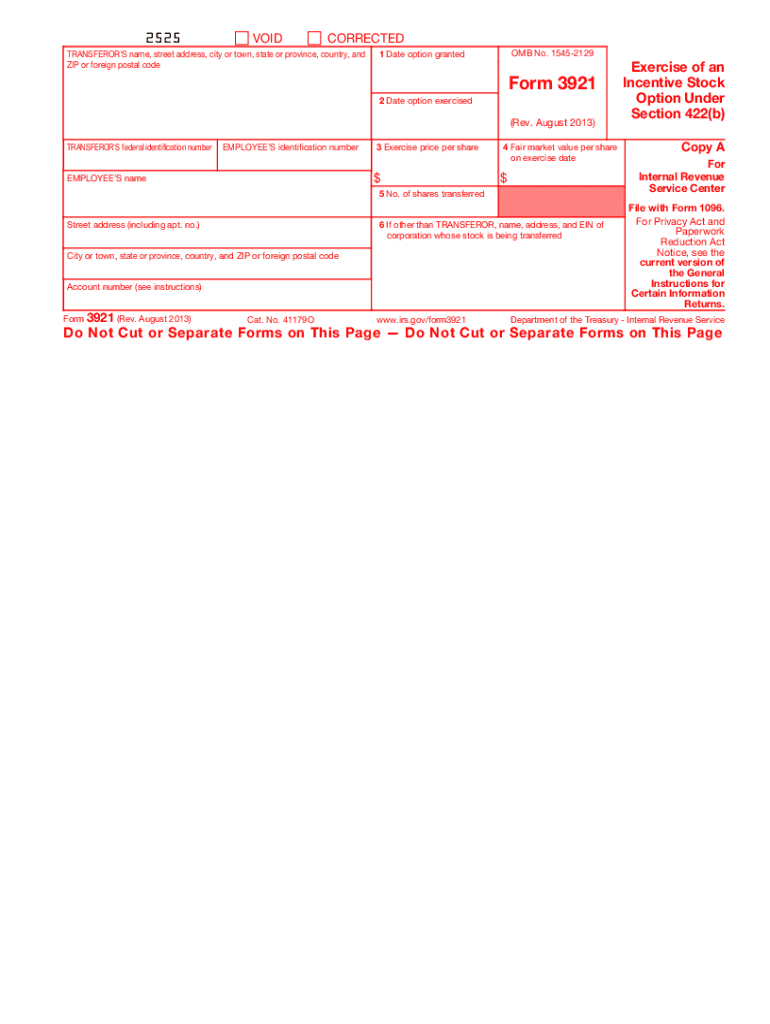

Who has to file IRS Form 3921?

Form 3921 is the US Internal Revenue Service form, officially called the Exercise of an Incentive Stock Option Under Section 422(b). The form is designed to be used by any corporation that transfers to any person a share of stock pursuant to the transferee's exercise of an incentive stock option as described in section 422(b) and is applicable to the calendar year during which the transfer was made.

What is the purpose of Form 3921?

The IRS 3921 form serves as an information statement furnishing employees with the details of incentive stock options that were exercised during the year.

Is Form 3921 accompanied by any other forms?

The submission of the completed Form 3921 to the employee does not necessitate attaching any accompanying forms or documents.

When is the Exercise of an Incentive Stock Option form due?

The employer should provide the exercising employees with the 3921 Form by or on February 1. The same form should be directed to the IRS local office by the end of February for the previous calendar year.

How do I fill out the 3921 Form?

To be properly completed, the form must include the following details:

- Information about the Transferor (name and address)

- Transferor's federal identification number

- Information about the Employee (name, address, account number)

- Dates of options granting and exercising

- Exercise price per share

- Number of transferred shares

- Fair market value of a share

- Data about the corporation whose stock is transferred (if other than the Transferor)

What should be done with all four copies of the 3921 Form?

There are detailed instructions about where to submit the four copies (A, B, C and D) on each corresponding page of the document.