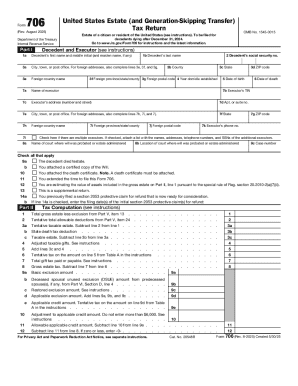

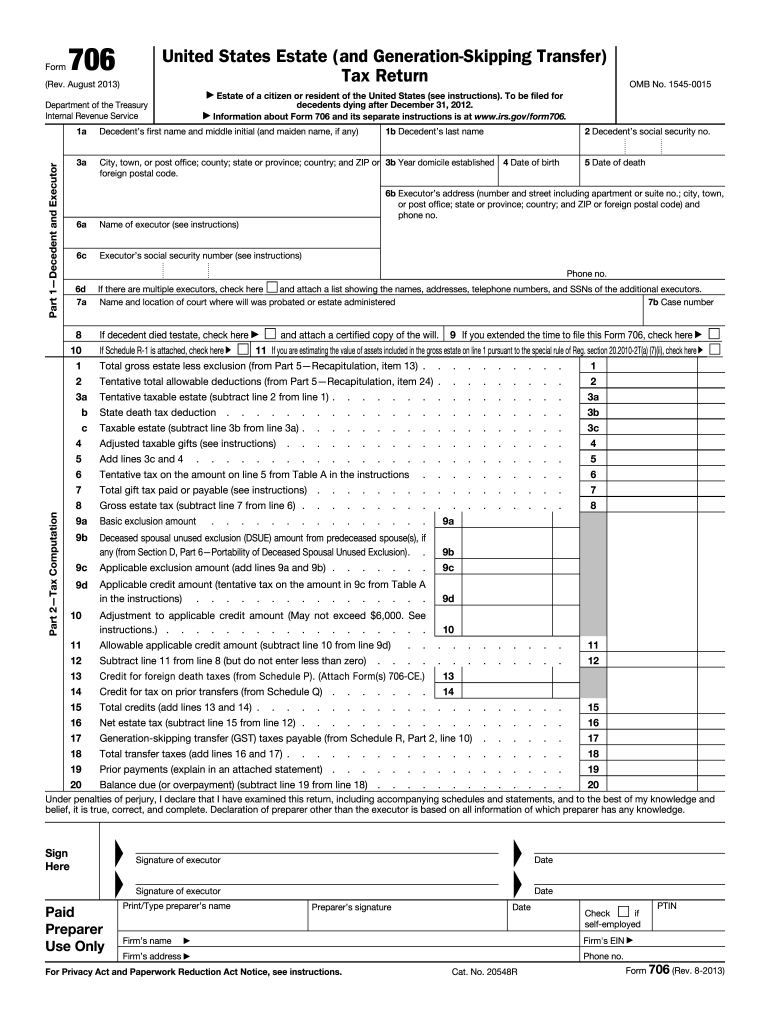

IRS 706 2013 free printable template

FAQ about IRS 706

What should I do if I realize I've made a mistake on my IRS 706 submission?

If you discover an error after filing your IRS 706, you can correct it by filing an amended return. Use a newly completed version of Form 706, marking it as 'amended' to ensure proper processing. It's advisable to submit the correction soon after the error is identified to avoid potential complications.

How can I verify if my IRS 706 is received and processed?

You can check the status of your IRS 706 by calling the IRS helpline or utilizing their online tools for tracking submissions. Common e-file rejection codes can help you understand if your form was not accepted, and knowing how to address these issues promptly is crucial for compliance.

What are some common errors to avoid when filing the IRS 706?

Common errors include mathematical mistakes, incorrect Social Security numbers, and failure to provide necessary documentation. It’s essential to double-check all entries, ensure all required schedules are attached, and use a checklist to catch these frequent pitfalls.

Are electronic signatures allowed on the IRS 706?

Yes, e-signatures are accepted for IRS 706 forms under certain conditions. Ensure you meet the IRS requirements for electronic signatures, and retain proper documentation to affirm consent and authenticity for future reference.

What should I do if I receive a notice from the IRS regarding my Form 706?

If you receive a notice related to your IRS 706, it’s important to read it carefully and respond promptly. Gather the relevant documents, address the concerns mentioned in the notice, and follow the IRS guidelines for submitting a response to ensure compliance.

See what our users say