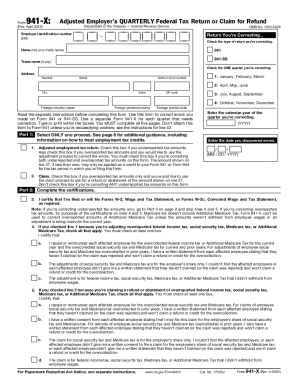

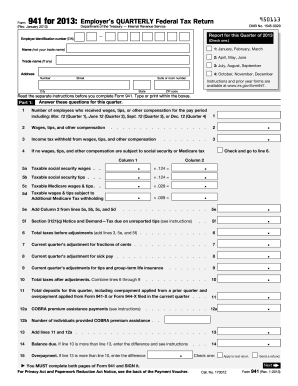

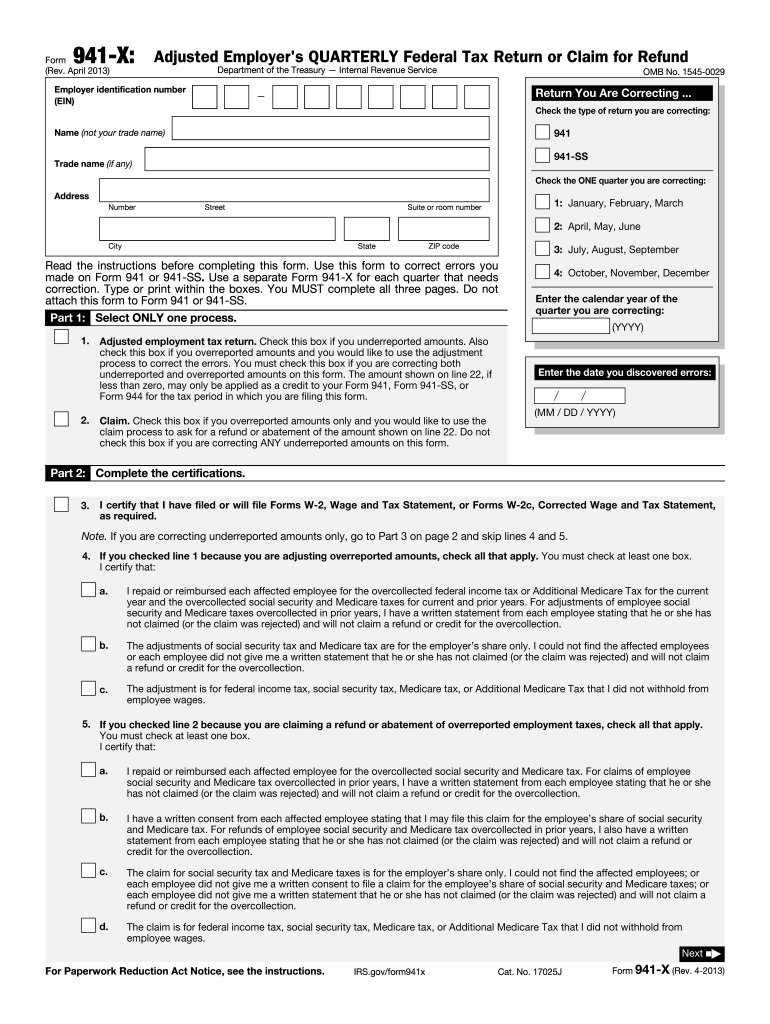

IRS 941-X 2013 free printable template

Instructions and Help about IRS 941-X

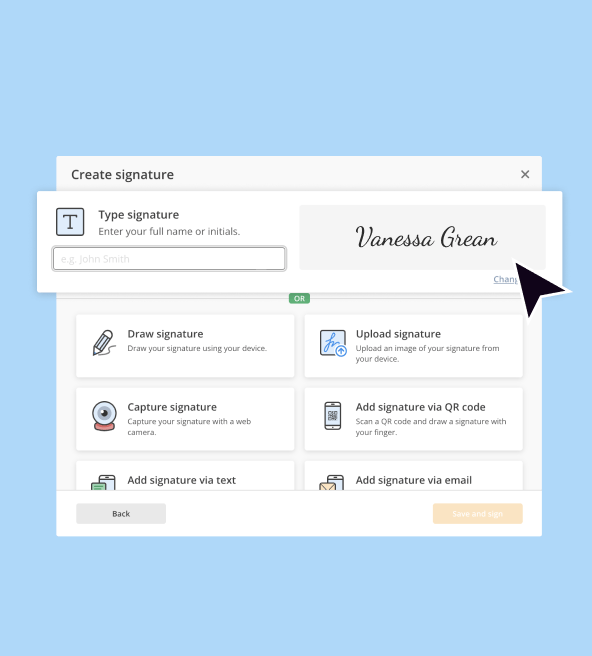

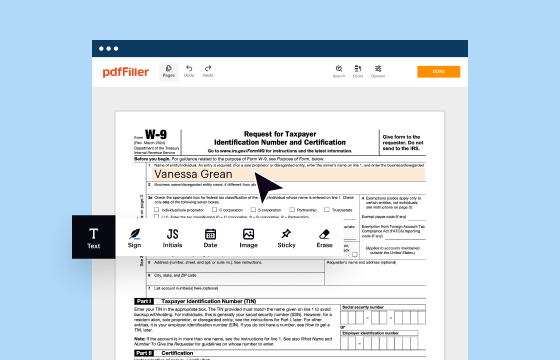

How to edit IRS 941-X

How to fill out IRS 941-X

About IRS 941-X 2013 previous version

What is IRS 941-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

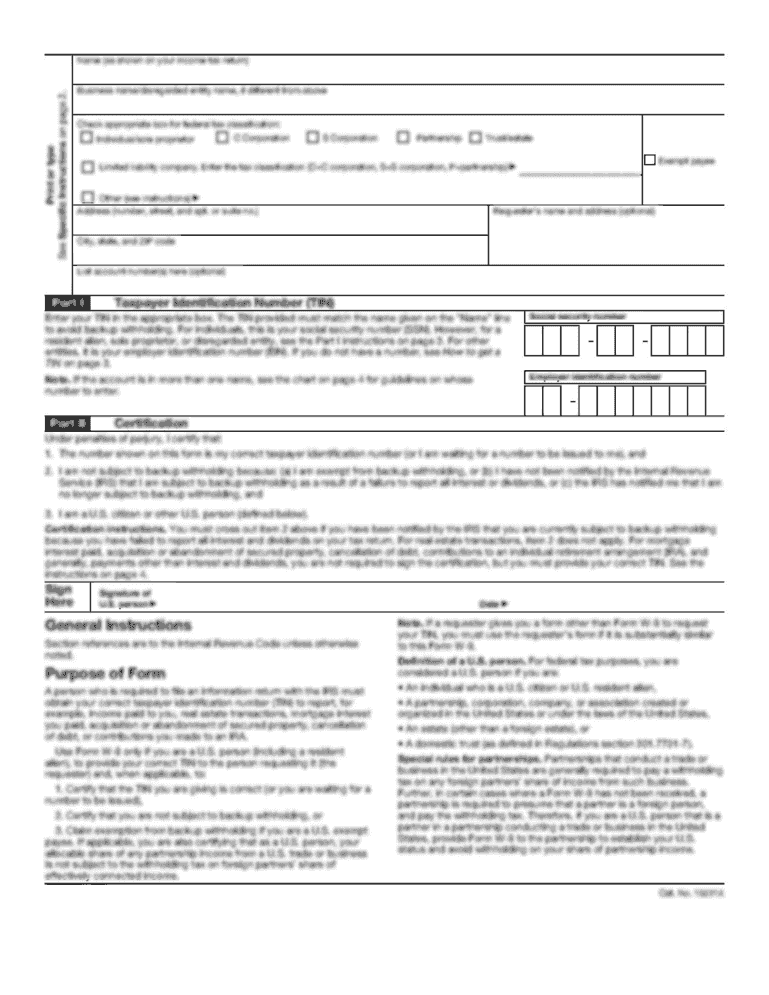

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

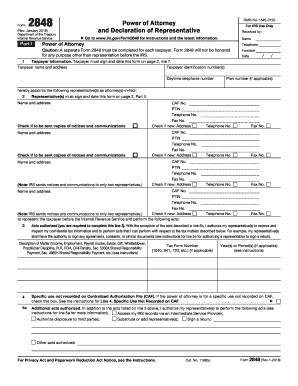

Is the form accompanied by other forms?

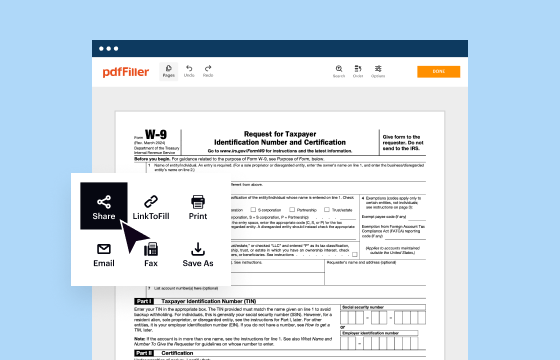

Where do I send the form?

FAQ about IRS 941-X

What steps can I take to correct mistakes made on form 941-x?

If you discover an error after submitting form 941-x, you can use form 941-X to correct it. This amended return allows you to report both under-reported and over-reported amounts for the applicable tax periods. Ensure that you provide clear explanations for the changes made and maintain copies for your records.

How can I track the status of my submitted form 941-x?

To verify the receipt and processing of your submitted form 941-x, you may contact the IRS directly or use the IRS online tools, if available. Be aware of common e-file rejection codes that might hinder processing, and always keep proof of submission for your records.

What should I do if I receive a notice or audit related to my form 941-x?

If you receive a notice regarding your form 941-x, it's essential to read it carefully and understand what is being questioned. Collect relevant documentation and prepare a response that addresses the IRS's concerns. If needed, consider consulting with a tax professional for assistance.

Are there any common errors I should avoid when submitting form 941-x?

Common mistakes when filing form 941-x include incorrect tax period markings or failing to sign the form. Ensure that all applicable fields are filled out accurately and verify the calculations to avoid unnecessary delays or rejections.

See what our users say