IRS 8832 2013-2025 free printable template

Show details

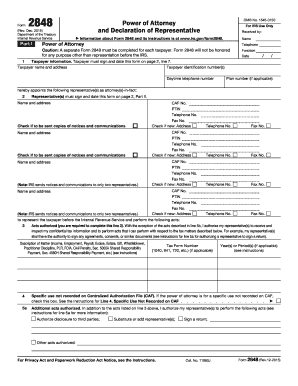

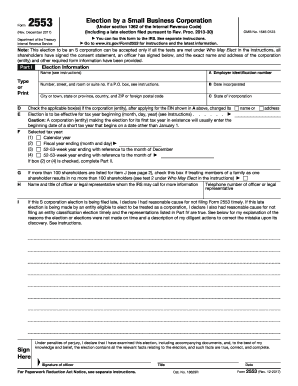

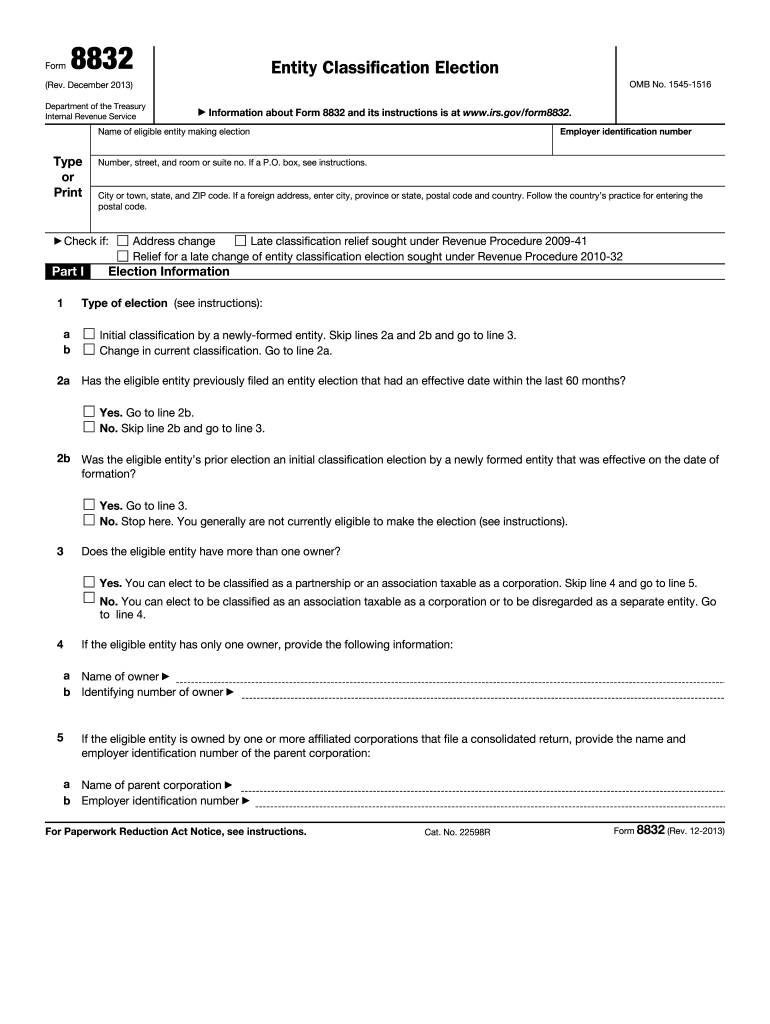

Form Entity Classification Election OMB No. 1545-1516 Rev. December 2013 Department of the Treasury Internal Revenue Service Information about Form 8832 and its instructions is at www.irs.gov/form8832. R.B. 1030 or its successor. If the IRS questions whether Form 8832 was filed an acceptable proof of filing is A certified or registered mail receipt timely postmarked from the U.S. Postal Service or its equivalent from a designated private Form 8832 with an accepted stamp date or An IRS letter...stating that Form 8832 has been accepted. Page 6 Specific Instructions Name. An indirect owner of the electing entity does not have to attach a copy of the Form 8832 to its tax return if an entity in which it has an interest is already filing a copy attach a copy of Form 8832 will not invalidate an otherwise valid election but penalties may be assessed against persons who are required to but do not attach Form 8832. 01 of Revenue Procedure 2009-41 have been satisfied. Page 4 General Instructions...Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8832 and its instructions such as legislation enacted after they were published go to www.irs.gov/form8832. The IRS will use the information entered on this form to establish the entity s filing and reporting requirements for federal tax purposes. Note. An entity must file Form 2553 if making an election under section 1362 a to be an S...corporation TIP Form 8832 if it will be using its default classification see Default Rules below. For details on the requirement to attach a copy of Form 8832 see Rev. Proc. 2009-41 and the instructions under Where To File. An eligible entity is classified for federal tax purposes under the default rules described below unless it files Form 8832 or Form 2553 Election by a Small Business Corporation. See Who Must File below. The IRS will use the information entered on this form to establish the...entity s filing and reporting requirements for federal tax purposes. For more information see Late Election Relief later. File Form 8832 with the Internal Revenue Service Center for your state listed later. Employer identification number Name of eligible entity making election Type or Print Number street and room or suite no. If a P. O. box see instructions. Check if Part I City or town state and ZIP code. If a foreign address enter city province or state postal code and country. Follow the...country s practice for entering the postal code. Address change Late classification relief sought under Revenue Procedure 2009-41 Relief for a late change of entity classification election sought under Revenue Procedure 2010-32 Election Information Type of election see instructions a b 2a Initial classification by a newly-formed entity. Skip lines 2a and 2b and go to line 3. Change in current classification* Go to line 2a* Has the eligible entity previously filed an entity election that had an...effective date within the last 60 months Yes.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8832

How to edit IRS 8832

How to fill out IRS 8832

Instructions and Help about IRS 8832

How to edit IRS 8832

Edit IRS 8832 by ensuring all required information is accurate and up to date. Use pdfFiller to streamline document alterations, such as adding signatures or correcting data before submission. Always double-check entries to prevent delays in processing.

How to fill out IRS 8832

Fill out IRS 8832 by carefully providing the necessary information on business entity classification. Collect data like the entity’s name, address, and Taxpayer Identification Number (TIN). Follow the specific instructions detailed in the form's guidelines to ensure completion is proper.

Latest updates to IRS 8832

Latest updates to IRS 8832

Check for the latest updates to IRS 8832 by visiting the IRS official website. Recent changes may include updates on eligibility criteria or filing procedures. Staying informed ensures compliance with current tax regulations.

All You Need to Know About IRS 8832

What is IRS 8832?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 8832

What is IRS 8832?

IRS 8832 is the form titled "Entity Classification Election." This form enables eligible domestic eligible entities to elect how they will be classified for federal tax purposes. Choices include being treated as a corporation or partnership, significantly impacting tax liabilities.

What is the purpose of this form?

The purpose of IRS 8832 is to allow certain business entities to change their tax status. By submitting this election, businesses can select the most beneficial tax treatment, which could lead to reduced tax burdens or simplified filing requirements. It is crucial for businesses that seek flexibility in their tax status.

Who needs the form?

Entities that need to file IRS 8832 include limited liability companies (LLCs), partnerships, and certain corporations seeking to change their classification. Businesses must evaluate their structures and tax implications to determine eligibility for submitting this form.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 8832 if your entity is already classified as a corporation under IRS rules or if you are a single-member LLC that defaults to being treated as a disregarded entity. Additionally, if you qualify for an automatic classification based on your structure, submission of this form is not necessary.

Components of the form

IRS 8832 contains several key components, including general information about the entity, the election being made, and the effective date of the classification. It is essential to complete all sections accurately to avoid administrative issues or delays in classification approval.

What are the penalties for not issuing the form?

The penalties for not issuing IRS 8832 could include potential misclassification of the entity, leading to overpayment of taxes or other negative tax implications. Incorrect classifications could also result in additional fines and interest on unpaid taxes, making timely submission critical.

What information do you need when you file the form?

When filing IRS 8832, you need the following information: the name and address of the entity, the TIN, the type of election being made, and the effective date of the election. Collecting this information beforehand will facilitate a smoother filing process.

Is the form accompanied by other forms?

IRS 8832 may be accompanied by other forms depending on the specific circumstances of the filing entity. For example, if the entity also has employees, it may need to file employment-related tax forms simultaneously. It's critical to read the instructions carefully to determine if additional forms are necessary.

Where do I send the form?

Send IRS 8832 to the appropriate address specified in the form’s instructions based on your location. Ensure to verify any updates on submission addresses on the IRS website before sending to avoid misdelivery.

See what our users say