CT DRS CT-1041 2013 free printable template

Show details

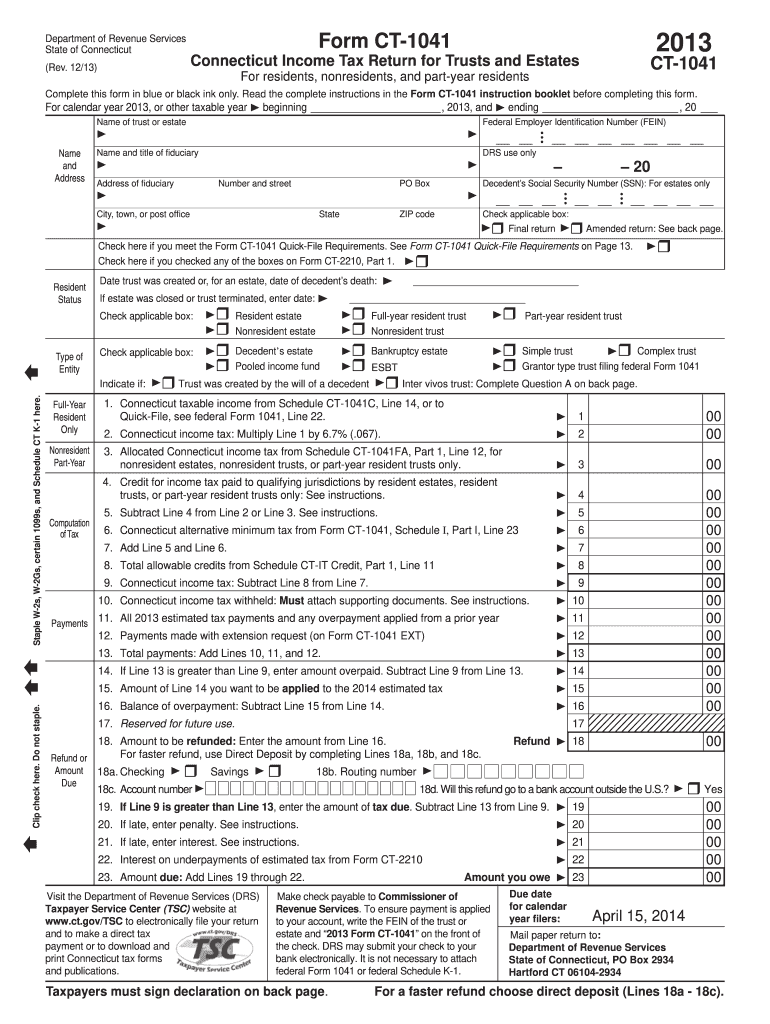

5. Subtract Line 4 from Line 2 or Line 3. See instructions. 6. Connecticut alternative minimum tax from Form CT-1041 Schedule I Part I Line 23 8. Department of Revenue Services State of Connecticut Rev. 12/13 Form CT-1041 Connecticut Income Tax Return for Trusts and Estates CT-1041 For residents nonresidents and part-year residents Complete this form in blue or black ink only. Does the trust or estate have an interest in real property or tangible personal property located in Connecticut Yes No...Completed CT-1041 schedules must be attached to the back of Form CT-1041 in the following order unless the trust or estate meets the Quick-File Requirements. Total allowable credits from Schedule CT-IT Credit Part 1 Line 11 9. Connecticut income tax Subtract Line 8 from Line 7. 11. All 2013 estimated tax payments and any overpayment applied from a prior year 12. Payments made with extension request on Form CT-1041 EXT 13. Check here if you meet the Form CT-1041 Quick-File Requirements. See Form...CT-1041 Quick-File Requirements on Page 13. Ct. gov/TSC to electronically le your return and to make a direct tax payment or to download and print Connecticut tax forms and publications. Amount you owe 23 Make check payable to Commissioner of Revenue Services. To ensure payment is applied to your account write the FEIN of the trust or estate and 2013 Form CT-1041 on the front of the check. DRS may submit your check to your bank electronically. It is not necessary to attach federal Form 1041 or...federal Schedule K-1. Taxpayers must sign declaration on back page. Due date for calendar year lers April 15 2014 Mail paper return to Hartford CT 06104-2934 Schedule A - Connecticut Fiduciary Adjustments See instructions. Type of Entity Indicate if Full-Year Only Clip check here. Do not staple. Decedent s estate Pooled income fund Full-year resident trust Nonresident trust Bankruptcy estate ESBT Part-year resident trust Simple trust Complex trust Grantor type trust ling federal Form 1041 Trust...was created by the will of a decedent Inter vivos trust Complete Question A on back page. 3. Allocated Connecticut income tax from Schedule CT-1041FA Part 1 Line 12 for nonresident estates nonresident trusts or part-year resident trusts only. Resident Status Date trust was created or for an estate date of decedent s death If estate was closed or trust terminated enter date Staple W-2s W-2Gs certain 1099s and Schedule CT K-1 here. Type of Entity Indicate if Full-Year Only Clip check here. Do not...staple. Decedent s estate Pooled income fund Full-year resident trust Nonresident trust Bankruptcy estate ESBT Part-year resident trust Simple trust Complex trust Grantor type trust ling federal Form 1041 Trust was created by the will of a decedent Inter vivos trust Complete Question A on back page. 3. Allocated Connecticut income tax from Schedule CT-1041FA Part 1 Line 12 for nonresident estates nonresident trusts or part-year resident trusts only. Total allowable credits from Schedule CT-IT...Credit Part 1 Line 11 9. Connecticut income tax Subtract Line 8 from Line 7.

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

How to fill out CT DRS CT-1041

Instructions and Help about CT DRS CT-1041

How to edit CT DRS CT-1041

To edit the CT DRS CT-1041, use a PDF editing tool. Open the form in a compatible software like pdfFiller, which allows you to easily make changes to existing fields. You can add, delete, or modify information before printing or submitting the form.

How to fill out CT DRS CT-1041

Filling out the CT DRS CT-1041 requires careful attention to detail. Start by entering your business information, including your name, address, and identification number in the designated fields. Follow the form’s instructions closely, and ensure all required sections are complete before submission to avoid penalties.

About CT DRS CT- previous version

What is CT DRS CT-1041?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS CT- previous version

What is CT DRS CT-1041?

CT DRS CT-1041 is a form used for reporting income and other relevant financial information by certain entities in Connecticut. This form is essential for ensuring compliance with state tax regulations and provides necessary information for tax assessment purposes.

What is the purpose of this form?

The primary purpose of the CT DRS CT-1041 is to report income and other required data to the Connecticut Department of Revenue Services. It is used by entities such as estates and trusts to disclose their income and inform the state of any tax liabilities that may arise from it.

Who needs the form?

Entities that must file the CT DRS CT-1041 include estates, trusts, and certain organizations that generate taxable income in Connecticut. If you fall into one of these categories, you are required to submit this form annually to comply with state tax laws.

When am I exempt from filling out this form?

You may be exempt from filing the CT DRS CT-1041 if your estate or trust does not have any reportable income for the tax year. Additionally, certain small trusts may qualify for exemptions based on specific criteria defined by the Connecticut Department of Revenue Services.

Components of the form

The CT DRS CT-1041 consists of various sections that capture essential information about the reporting entity. Key components include identification details, income reporting sections, and spaces to detail deductions and credits. Each section must be filled in correctly to avoid processing delays.

What are the penalties for not issuing the form?

Failing to submit the CT DRS CT-1041 by the due date can result in penalties imposed by the Connecticut Department of Revenue Services. These penalties may include monetary fines and potential interest on unpaid taxes, which can accumulate over time. It's crucial to file the form timely to avoid these financial consequences.

What information do you need when you file the form?

When filing the CT DRS CT-1041, you will need various information, such as your entity's name, identification number, income details, and any deductions or credits you plan to claim. Ensure that all figures are accurate to prevent issues with your filing.

Is the form accompanied by other forms?

In certain cases, the filing of the CT DRS CT-1041 may require accompanying schedules or additional forms to provide a complete financial overview. Be prepared to include any necessary supplementary documents that support your reported figures and claims.

Where do I send the form?

Completed CT DRS CT-1041 forms should be mailed to the Connecticut Department of Revenue Services at the designated address on the form. Ensure that you send it via a traceable method to confirm its delivery and keep a copy for your records.

See what our users say