NM TRD RPD-41072 2012 free printable template

Show details

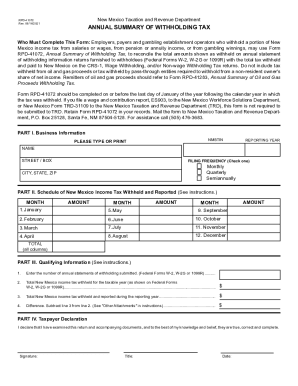

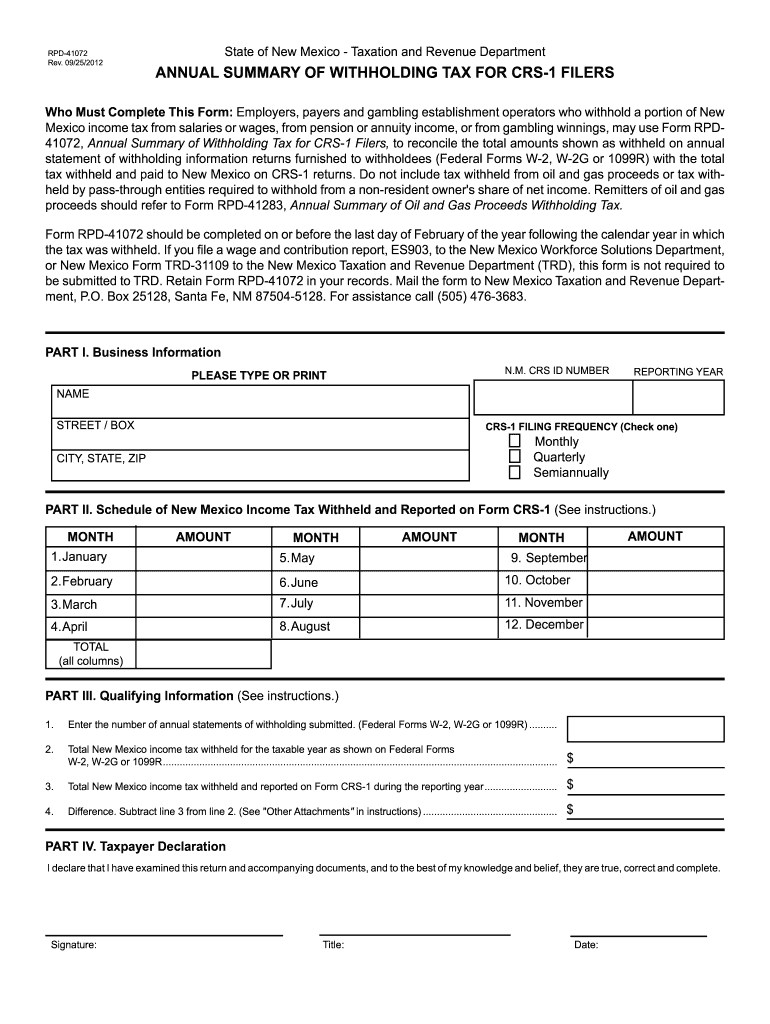

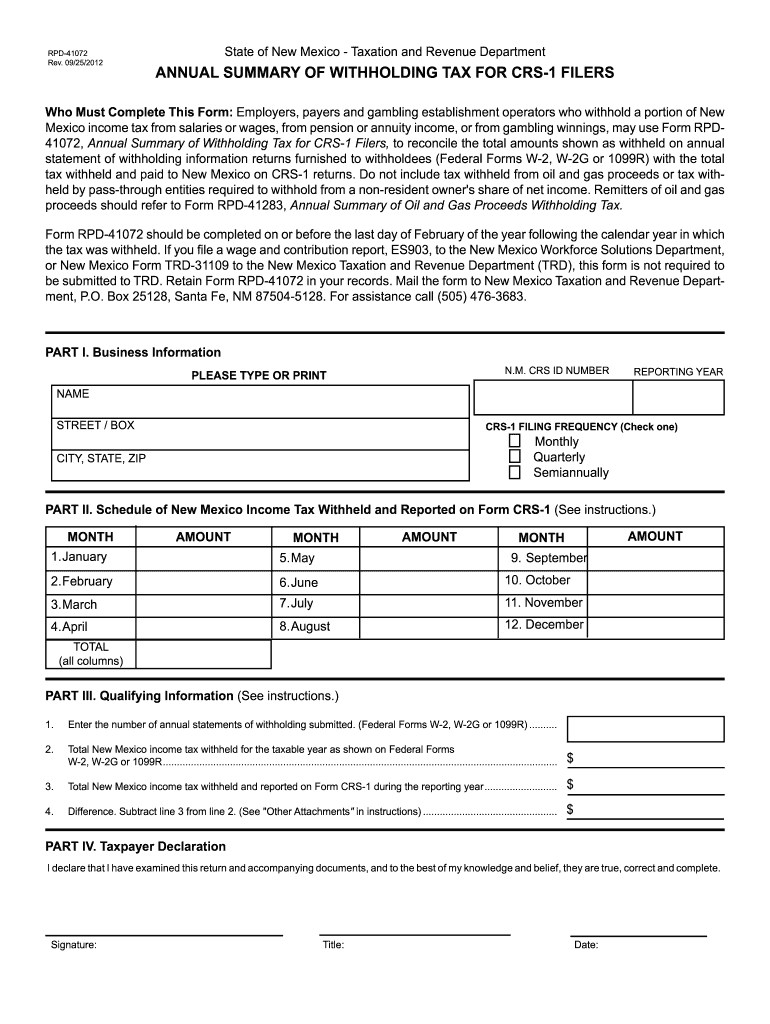

RPD-41072 Rev. 09/25/2012 State of New Mexico Taxation and Revenue Department ANNUAL SUMMARY OF WITHHOLDING TAX FOR CRS-1 FILERS Who Must Complete This Form: Employers, payers and gambling establishment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign crs 1

Edit your crs 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crs 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit crs 1 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit crs 1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41072 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out crs 1

How to fill out NM TRD RPD-41072

01

Obtain the NM TRD RPD-41072 form from the official website or local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details regarding your income for the specified tax year.

04

Report any deductions or credits you are eligible for.

05

Calculate your total tax liability or refund.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form.

08

Submit the form by the given deadline, either electronically or via mail.

Who needs NM TRD RPD-41072?

01

Individuals filing income taxes in New Mexico.

02

Taxpayers seeking to claim specific deductions or credits.

03

Residents who have taxable income and need to report it to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is CRS 1 vs 2?

Type 1 CRS (acute cardio- renal syndrome) is characterized by acute worsening of cardiac function leading to AKI (5, 6) in the setting of active cardiac disease such as ADHF, while type – 2 CRS occurs in a setting of chronic heart disease.

What is a CRS certificate for New Mexico?

During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

What is the meaning of crs1?

CRS 1 or cationic rapid setting type of bitumen emulsion is a type of liquid bitumen that has a low viscosity.

What is CRS 1?

CRS-1 consists of specially refined asphalt dispersed in water without the use of clay or similar substances as emulsifying or stabilizing agents. The cationic emulsified asphalt furnished under this specification shall be an emulsion of asphalt cement, water and emulsifying agent.

What is the New Mexico CRS 1?

What is CRS New Mexico? The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

How do I get a CRS number in New Mexico?

New Mexico Tax Account Numbers If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the crs 1 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your crs 1 in seconds.

How can I edit crs 1 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing crs 1, you can start right away.

How do I fill out the crs 1 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign crs 1 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is NM TRD RPD-41072?

NM TRD RPD-41072 is a tax form required by the New Mexico Taxation and Revenue Department (TRD) for reporting certain tax information.

Who is required to file NM TRD RPD-41072?

Any business or individual required to report specific transactions or taxes in New Mexico must file NM TRD RPD-41072.

How to fill out NM TRD RPD-41072?

To fill out NM TRD RPD-41072, provide the necessary personal or business information, detail the applicable tax transactions, calculate the tax owed, and ensure all required signatures are included.

What is the purpose of NM TRD RPD-41072?

The purpose of NM TRD RPD-41072 is to collect specific tax information to ensure compliance with New Mexico tax laws and to facilitate the accurate reporting of taxes due.

What information must be reported on NM TRD RPD-41072?

The information reported on NM TRD RPD-41072 typically includes identification details of the taxpayer, transaction specifics, calculated tax amounts, and any applicable exemptions or deductions.

Fill out your crs 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crs 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.