Who needs a CA-6 form?

This form is used by taxpayers in the state of Massachusetts to inform about an error on a tax return that has already been filed. As a result, the tax can be increased or decreased. For filing this form, the taxpayer has to meet three main requirements: 1) he must have filed the return during the application period 2) he must provide all the necessary documents and 3) he must submit the form within the time limits.

What is the purpose of the CA-6 form?

The form is an application for abatement/amended return. The taxpayer can file it to increase or decrease the amount of a previously filed tax return and dispute the penalties or audit. The error in filing can be made due to changes in federal or state law. The taxpayer can also ask for a hearing on his case with the Office of Appeals.

What other documents should accompany the CA-6 form?

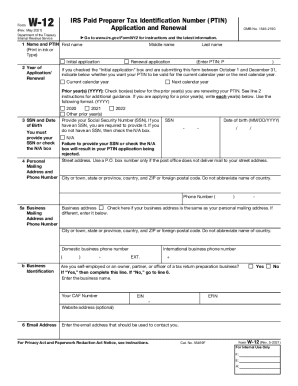

This application must be accompanied by all the required documents. Usually included are copies of federal or state law changes, a check or money order payable to the Commonwealth of Massachusetts, a W-2 Form, a 1099 Form, Schedules, etc.

When is the CA-6 form due?

The application must be filed within three years from the date of the tax return filing, within two years from the date the tax was assessed, and within one year from the date the tax was paid.

What information should be provided in the CA-6 form?

The form contains the following information:

- Taxpayer name

- Social Security or Federal Identification Number

- Spouse’s name and Social Security Number

- Address

- Explanation of issues involved in the application

- Reason for filing the application

- Type of tax

- Tax period

- Amended return

Where do I send the CA-6 form?

The completed form is forwarded to the Massachusetts Department of Revenue, Contact Center Bureau, Boston, MA.