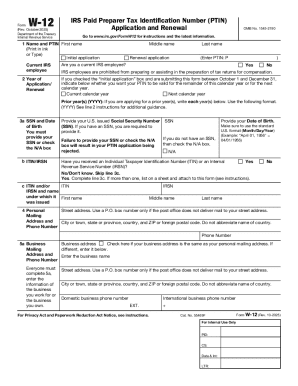

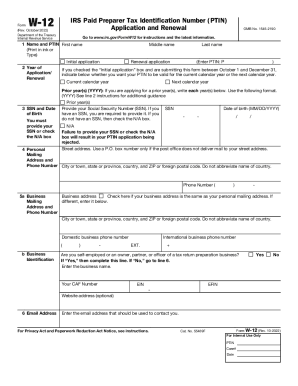

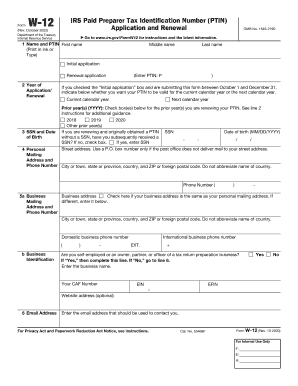

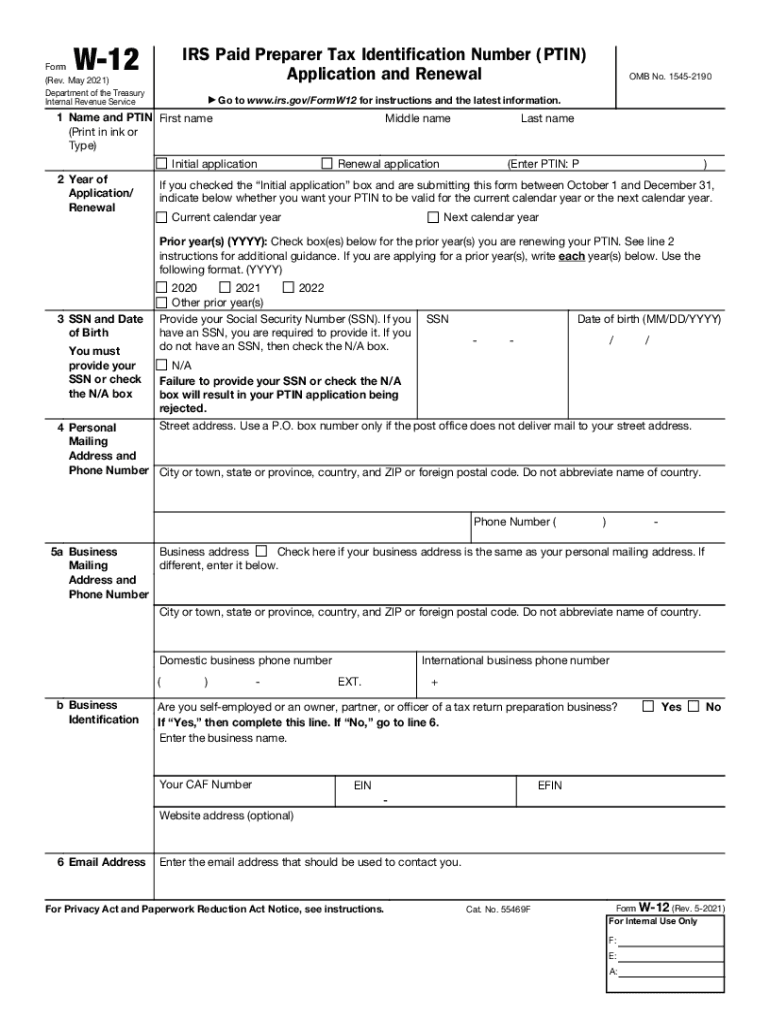

IRS W-12 2021 free printable template

Instructions and Help about IRS W-12

How to edit IRS W-12

How to fill out IRS W-12

About IRS W-12 2021 previous version

What is IRS W-12?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

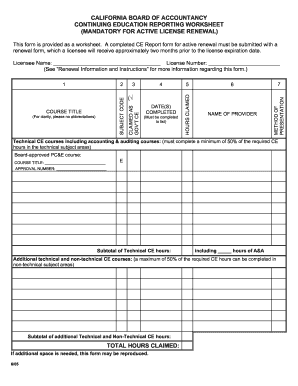

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-12

What should I do if I realize I made an error after submitting the IRS W-12?

If you discover an error after submission, you can correct it by filing an amended IRS W-12. It’s important to act quickly to ensure that your records are accurate and to minimize potential issues related to the mistake.

How can I verify if my IRS W-12 submission has been received and processed?

To verify the status of your submitted IRS W-12, check the IRS online portal or contact their support. Be sure to have your submission details handy for reference. This will help you track the processing status effectively.

What e-file rejection codes should I watch for when submitting the IRS W-12 online?

Common e-file rejection codes for the IRS W-12 include mismatches in taxpayer identification numbers and missing information. Make sure to validate all entries before submitting to reduce the likelihood of rejection.

How do privacy and data security impact the submission of the IRS W-12?

When filing the IRS W-12, it’s crucial to ensure that sensitive information is handled securely. Utilize encrypted transmission methods and store records in a safe manner to protect against unauthorized access.

Are there any specific service fees associated with e-filing the IRS W-12?

Yes, some e-filing platforms may charge service fees for submitting the IRS W-12 electronically. It’s advisable to compare rates across different services to find one that suits your needs while ensuring reliability and security.