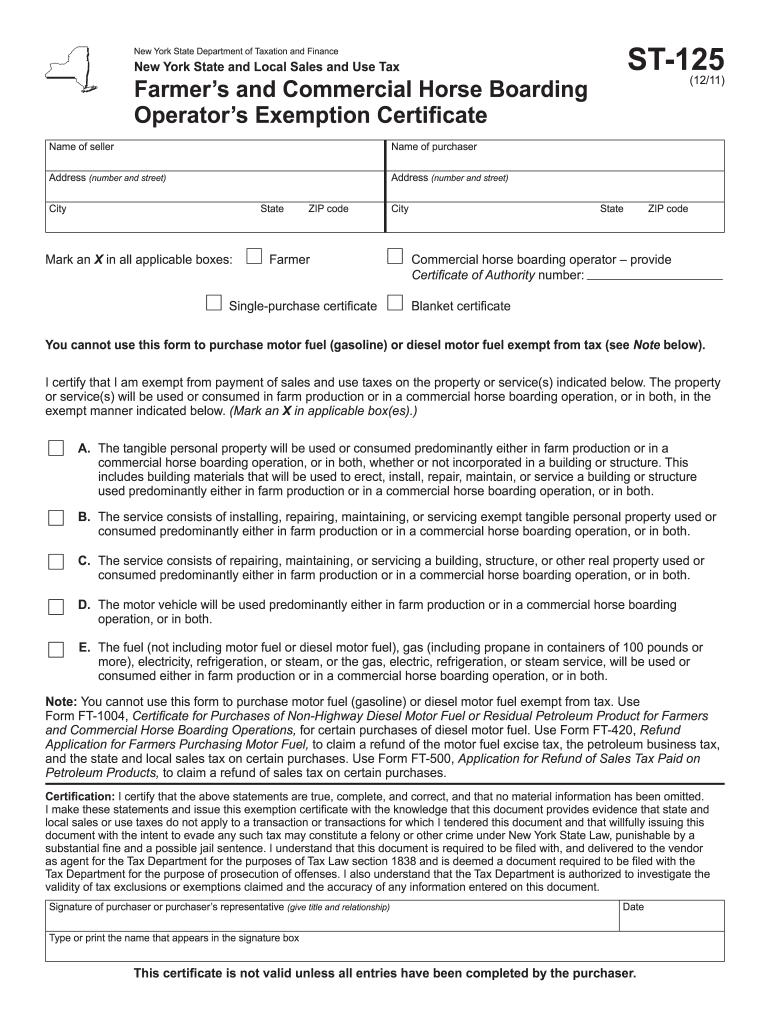

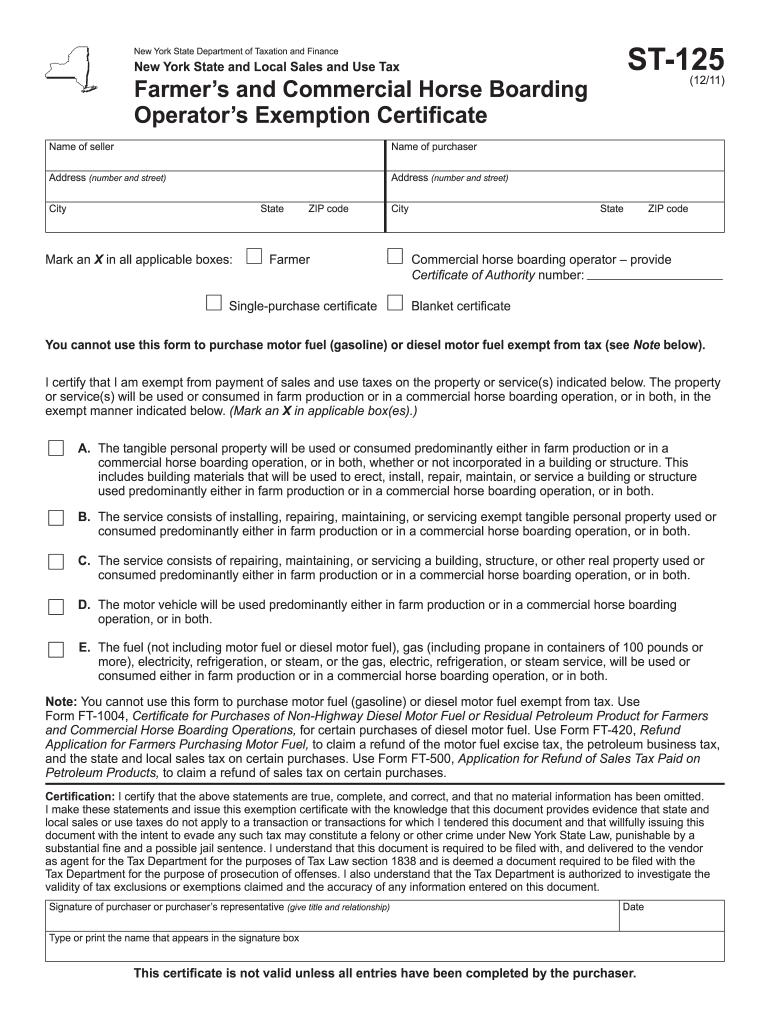

NY DTF ST-125 2011 free printable template

Get, Create, Make and Sign st 125 2011 form

How to edit st 125 2011 form online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-125 Form Versions

How to fill out st 125 2011 form

How to fill out NY DTF ST-125

Who needs NY DTF ST-125?

Instructions and Help about st 125 2011 form

[Music] without you aliens, and I'll tell you all about it when I see you and when we begin [Music] and through that [Music] [Applause] [Music] [Applause] [Music] long day without you my friend, and I'll tell you all about it when I see you we've come from where we begin [Music] again [Music] [Music] first you both go out your way and the vibe is feeling strong and what's small turn to a friendship turn to a bond and that bond will never be broken [Music] then I have to be [Music] yeah you [Music] [Music] [Applause] Oh spin alum day without you my friend, and I'll tell you all about it when I see you again we've come a long way from where we began oh I'll tell you [Music] [Music] [Music] hey guys, so we're out here in LA right now working our first record on the label so very exciting we're super stoked about it, I've got a few other things too but yeah, so we just wanted to say thank you real quick because you guys have been so amazing and so supportive over the past few years I guess we've been able to tour the world put out a ton of music 2 EPS and a couple singles and meet so so many of you, so we just want to thank you guys and celebrate a little, and we're excited to announce that we'll be living on a headlining world tour the gravity world tour what Shh snack will be coming to sorry mushroom shiitake mushrooms will be coming to Southeast Asia Europe UK US and Canada and hopefully some more yeah definitely live or work on Mars yeah, but we can't wait to see you guys and hang out with you guys and meet you if we haven't yet and see you again hug you again if you're it have them at you so let us know if you're going to be coming in the comments to this video should be wild, so it's going to get fans gone but all right you guys soon bye

People Also Ask about

How do I become farm sales tax exempt in NY?

How do I register as a farm in NY?

What is the tax exemption form for NY?

Do NYS tax exempt forms expire?

How do I become exempt from sales tax in NY?

How do I get agricultural sales tax exemption in NY?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in st 125 2011 form?

How do I fill out st 125 2011 form using my mobile device?

How do I edit st 125 2011 form on an iOS device?

What is NY DTF ST-125?

Who is required to file NY DTF ST-125?

How to fill out NY DTF ST-125?

What is the purpose of NY DTF ST-125?

What information must be reported on NY DTF ST-125?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.