NY DTF ST-125 2008 free printable template

Show details

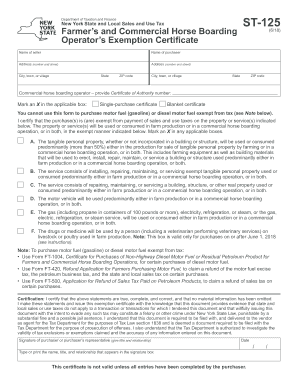

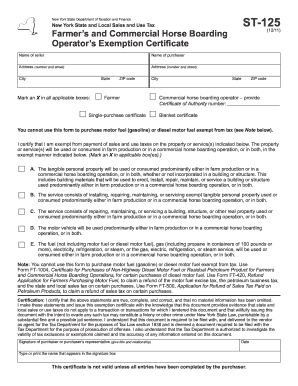

New York State Department of Taxation and Finance Farmer s and Commercial Horse Boarding Operator s Exemption Certificate ST-125 7/08 State and Local Sales and Use Tax This certificate is not valid unless all entries have been completed by the purchaser. Name of seller Name of purchaser Street address City State Mark an X in all applicable boxes ZIP code Farmer Single purchase certificate Commercial horse boarding operator provide Certificate of Authority number Blanket certificate You...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 125 2008 form

Edit your st 125 2008 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 125 2008 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 125 2008 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit st 125 2008 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-125 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 125 2008 form

How to fill out NY DTF ST-125

01

Obtain the NY DTF ST-125 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your name and address in the designated fields.

03

Indicate your New York sales tax identification number, if applicable.

04

Provide the description of the property you are purchasing.

05

Specify the reason for the exemption (e.g., resale, use in production).

06

Review the certification statement and sign the form.

07

Submit the completed form to the seller during the purchase transaction.

Who needs NY DTF ST-125?

01

Individuals or businesses making tax-exempt purchases in New York state, particularly those buying items for resale or use in production.

Instructions and Help about st 125 2008 form

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid paying property taxes in NY?

You can get help with property tax exemptions for homeowners, including: Clergy Property Tax Exemption. Crime Victim Property Tax Exemption. Disabled Homeowners' Exemption (DHE) School Tax Relief for Homeowners (STAR) Senior Citizen Homeowners' Exemption (SCHE) Veterans Property Tax Exemption.

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

How do I become farm sales tax exempt in NY?

Services – Agricultural Unit To receive the exemption, the landowner must apply for agricultural assessment and attach Form RP-305-e to that application.

What is an agricultural exemption in NY?

Any assessed valuation of the eligible land in excess of its agricultural assessment is exempt from taxation. To qualify, the owner must annually submit an application verifying that the land is located within an established agricultural district and that it satisfies the property use requirements.

What is an exemption in New York State?

Exemption from New York State and New York City withholding You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute st 125 2008 form online?

pdfFiller has made it easy to fill out and sign st 125 2008 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my st 125 2008 form in Gmail?

Create your eSignature using pdfFiller and then eSign your st 125 2008 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out st 125 2008 form on an Android device?

Use the pdfFiller mobile app and complete your st 125 2008 form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NY DTF ST-125?

NY DTF ST-125 is a sales tax exemption certificate used in New York State which allows certain purchasers to buy goods or services without paying sales tax.

Who is required to file NY DTF ST-125?

Organizations that qualify for sales tax exemptions, such as governmental entities, charitable organizations, and certain educational institutions, are required to file NY DTF ST-125.

How to fill out NY DTF ST-125?

To fill out NY DTF ST-125, the purchaser must provide their name, address, and exempt organization identification number (if applicable), along with a description of the purchase and the reason for the exemption.

What is the purpose of NY DTF ST-125?

The purpose of NY DTF ST-125 is to allow qualified organizations and entities to claim exemption from sales tax on eligible purchases, thereby reducing their tax burden.

What information must be reported on NY DTF ST-125?

NY DTF ST-125 must include the purchaser's name, address, type of exemption being claimed, description of the items being purchased, and the appropriate identification number for exempt organizations.

Fill out your st 125 2008 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 125 2008 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.