VA DoT 760 2013 free printable template

Show details

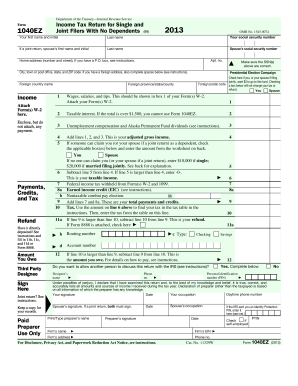

PL E ST A 2013 Virginia Resident Form 760 2601031 01/13 Individual Income Tax Return File by May 1 2014 - PLEASE USE BLACK INK Your first name M. I. Last name LOO LQ DOO RYDOV WKDW DSSO Suffix Name or filing status has changed since last filing Spouse s first name joint returns only M. I. Virginia return was not filed last year Dependent on another s return Number and Street - If this is a change you must fill in oval Amended Return - Fill in oval if result of NOL City town or post office and...state ZIP Code LUVW OHWWHUV RI RXU ODVW QDPH RXU 6RFLDO 6HFXULW 1XPEHU - I We authorize the Dept. of Taxation to discuss my our return with my our preparer 6SRXVH V 6RFLDO 6HFXULW 1XPEHU LOLQJ 6WDWXV 1 Single. Did you claim federal head of household Yes 2 Married filing joint return Enter spouse s SSN above B Spouse s Name DWH RI LUWK RXU LUWK DWH PP GG RX RU 2OGHU HSHQGHQWV 6SRXVH x 930 OLQG 6SRXVH 7RWDO x 800 6SRXVH V LUWK DWH Forms W-2 W-2G 1099 and VK-1 reporting VA withholding here....STAPLE. /266 10. Deductions- QWHU 6WDQGDUG LOLQJ 6WDWXV 3 000 6 000 3 000 25 WHPL HG D 7RWDO WHPL HG HGXFWLRQV E 6WDWH DQG /RFDO QFRPH 7D HV FODLPHG RQ 6FK 8. GG /LQHV DQG. MINUS 7. Subtractions from DWWDFKHG Schedule ADJ Line 7. You must attach Schedule ADJ* 6. State Income Tax refund or overpayment credit reported as income on federal return. 5. Social Security Act and equivalent Tier 1 Railroad Retirement Act benefits. Reported as taxable on federal return* 9. 9LUJLQLD GMXVWHG URVV QFRPH 9...6XEWUDFW /LQH IURP /LQH. Staple payment here 11. Exemptions. Total from Exemption Section A multiplied by 930 plus total from Exemption Section B multiplied by 800. 12. Deductions from Virginia Adjusted Gross Income Schedule ADJ Line 9. 14. 9LUJLQLD 7D DEOH QFRPH 6XEWUDFW /LQH IURP /LQH. / 5 /7 GG WKH ROODU PRXQWV DQG QWHU 7RWDO RQ /LQH 4. Deduction for age on January 1 2014. See Instructions. Be sure to provide date of birth above. 1. HGHUDO GMXVWHG URVV QFRPH. From federal return - NOT...FEDERAL TAXABLE INCOME 2. Total Additions from DWWDFKHG Schedule ADJ Line 3. /RFDOLW RGH 6HH LQVWUXFWLRQV HPSWLRQV Fill in oval to indicate status VSRXVH V ODVW QDPH Office Use 3DJH RUP HDU Your SSN D QWHU RXU 9 EHORZ E QWHU 6SRXVH V 9 EHORZ 15. Amount of Tax from Tax Table or Tax Rate Schedule round to whole dollars. 16. Spouse Tax Adjustment Filing Status 2 only. Enter 9 in whole dollars below. See instructions. 17. 1HW PRXQW RI 7D 6XEWUDFW /LQH IURP /LQH. 18. Virginia tax withheld for 2013....18a* Your Virginia withholding. D 18b. Spouse s Virginia withholding Filing Status 2 only. E 26. If Line 17 is less than Line 24 subtract Line 17 from Line 24. This is Your Tax Overpayment. 27. Amount of overpayment you want credited to next year s estimated tax. 19. Estimated Tax Paid for taxable year 2013 from Form 760ES. Include overpayment credited from taxable year 2012. 20. Extension Payments from Form 760IP. 21. Tax Credit for Low-Income Individuals or Earned Income Credit from DWWDFKHG...Sch* ADJ Line 17.

pdfFiller is not affiliated with any government organization

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

Instructions and Help about VA DoT 760

How to edit VA DoT 760

To edit the VA DoT 760 form, you may use pdfFiller to make the necessary modifications. Upload the form to pdfFiller, which allows you to add, delete, or change text fields easily. Once you have completed the necessary edits, save the changes to ensure your updates are recorded.

How to fill out VA DoT 760

Filling out the VA DoT 760 form requires attention to specific informational details. Follow these steps:

01

Gather all necessary financial documents related to payments and purchases you need to report.

02

Enter your personal information accurately, including your name and contact details.

03

Provide the appropriate payment and purchase information in the designated sections of the form.

04

Review all entries for accuracy to avoid mistakes that could lead to penalties.

05

Sign and date the form where indicated.

About VA DoT previous version

What is VA DoT 760?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About VA DoT previous version

What is VA DoT 760?

The VA DoT 760 form is a document used by the Virginia Department of Taxation. It is specifically designed for reporting certain economic activities, including transactions involving specific purchases and payments as required under state law.

What is the purpose of this form?

The purpose of the VA DoT 760 form is to collect detailed information related to taxable transactions. This form helps the Virginia Department of Taxation track compliance with state tax regulations and allows for the appropriate assessment of taxes owed based on reported data.

Who needs the form?

Individuals and entities that engage in specific taxable activities in Virginia are required to file the VA DoT 760. This may include businesses reporting sales or purchases subject to Virginia tax laws, as well as individuals participating in applicable economic transactions.

When am I exempt from filling out this form?

Exemptions from filing the VA DoT 760 may apply to certain transactions or individuals, such as those not engaging in taxable activities within the state. For instance, nonprofit organizations may qualify for exemptions under specific conditions laid out by Virginia tax regulations.

Components of the form

The form consists of several key sections designed to capture different types of information. This includes sections for basic identification details, descriptions of transactions, and specific payment categories. Understanding the components is essential for accurate completion.

What are the penalties for not issuing the form?

Failure to file the VA DoT 760 form can result in significant penalties, including fines and interest on unpaid taxes. The Virginia Department of Taxation may also impose additional fees for noncompliance, which underscores the importance of timely filing and accurate reporting.

What information do you need when you file the form?

When filing the VA DoT 760, you need to provide detailed personal information, including your name, address, and Social Security number or Employer Identification Number (EIN). Additionally, you should have comprehensive records of all financial transactions that must be reported under the form’s guidelines.

Is the form accompanied by other forms?

In some cases, the VA DoT 760 may need to be submitted alongside additional forms based on the specific tax situation or type of transactions being reported. It's essential to review the filing requirements carefully to determine if supplementary documentation is necessary.

Where do I send the form?

The completed VA DoT 760 form must be mailed to the address specified by the Virginia Department of Taxation. Ensure that you check the latest instructions on their website or any recent updates to determine the correct submission address to avoid delays.

See what our users say