NM TRD RPD-41301 2013 free printable template

Show details

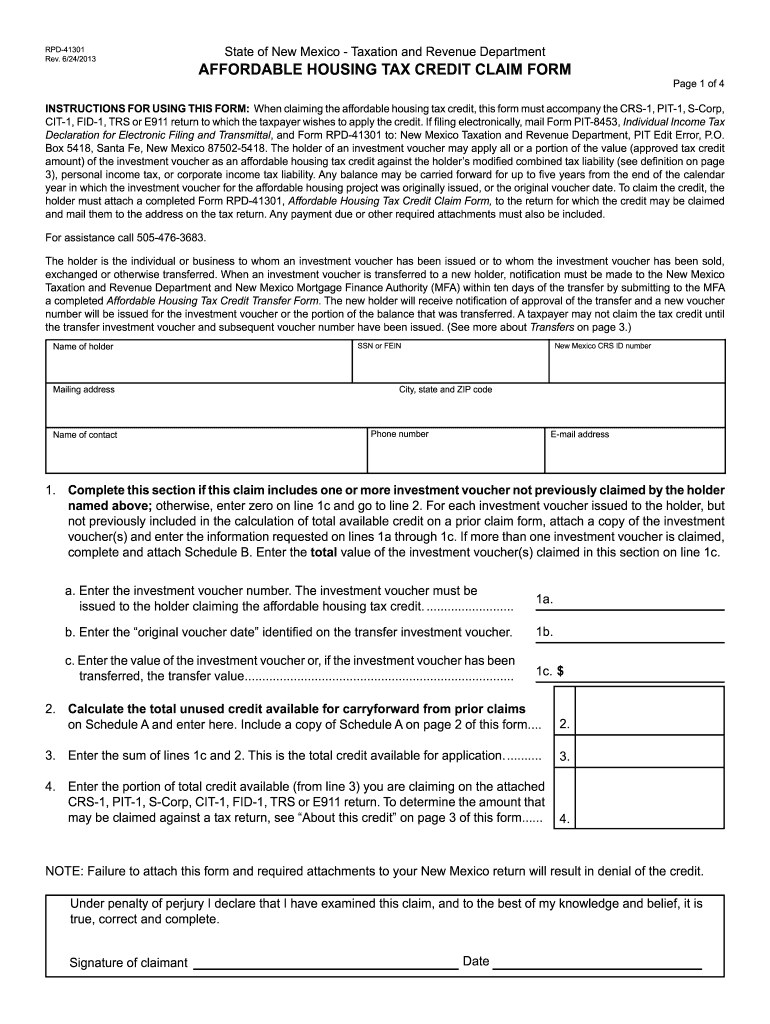

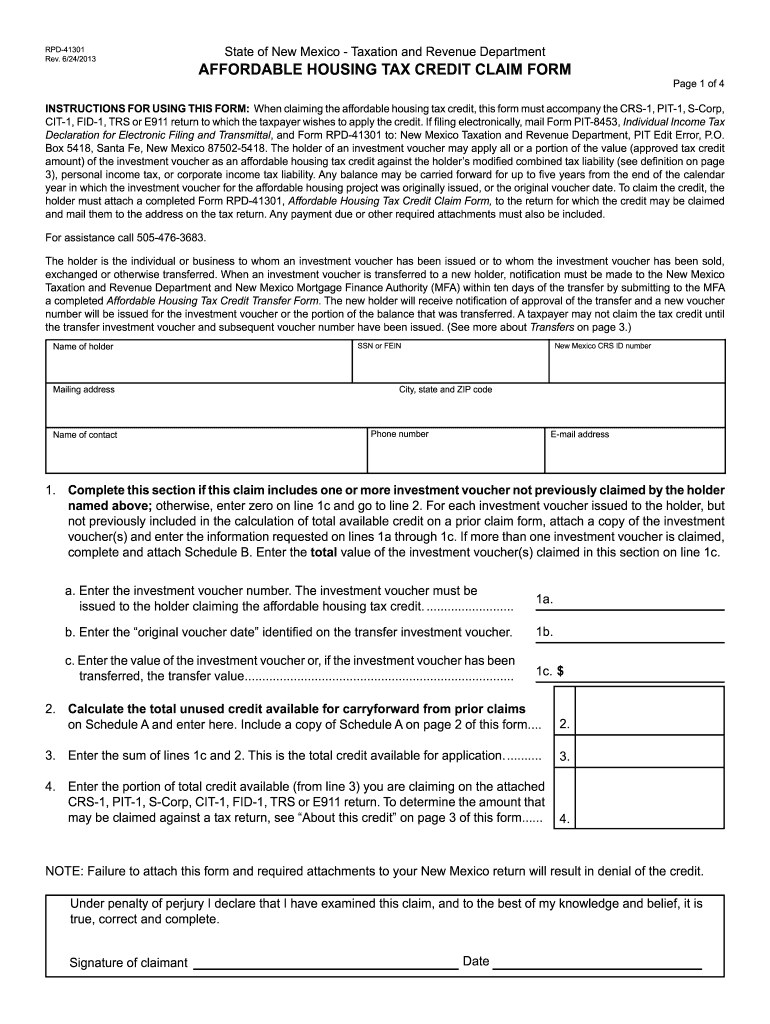

RPD-41301 Rev. 6/24/2013 State of New Mexico Taxation and Revenue Department AFFORDABLE HOUSING TAX CREDIT CLAIM FORM Page 1 of 4 INSTRUCTIONS FOR USING THIS FORM: When claiming the affordable housing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41301

Edit your NM TRD RPD-41301 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41301 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD RPD-41301 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD RPD-41301. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41301

How to fill out NM TRD RPD-41301

01

Obtain the NM TRD RPD-41301 form from the New Mexico Taxation and Revenue Department website or office.

02

Fill in the taxpayer's name, address, and identification number in the designated fields.

03

Provide the appropriate tax year for which you are completing the form.

04

Enter the amount of income that is subject to the New Mexico Gross Receipts Tax.

05

Include any deductions or exemptions you are claiming, ensuring to reference applicable statutes.

06

Calculate your total deductions and subtract them from your gross receipts amount.

07

Review all entries for accuracy to ensure you have filled out the form correctly.

08

Sign and date the form, certifying that the information provided is true and accurate.

09

Submit the completed form to the appropriate office or via the prescribed e-filing method.

Who needs NM TRD RPD-41301?

01

Individuals or businesses engaged in activities subject to the New Mexico Gross Receipts Tax.

02

Tax preparers who are assisting clients with their tax obligations in New Mexico.

03

Anyone seeking to claim deductions or exemptions related to gross receipts in New Mexico.

Fill

form

: Try Risk Free

People Also Ask about

Who can take a other state tax credit for taxes paid to another state?

You may claim this credit if you had income that was taxed by California and another state. The credit will offset the taxes paid to the other state, so you are not paying taxes twice. This credit applies to: Individuals.

Do I qualify for NM $600 rebate?

How do I get the rebate? A: New Mexicans who have or will file their 2021 income taxes by May 31, 2023 do not need to take any action to get their rebates. They will receive them automatically by direct deposit or check, depending on how they received their refunds or made their payments.

What does credit for tax paid to other states mean?

It is, except that most states usually allow a credit on your resident return for the taxes you paid to the other (nonresident) state. This usually means that you won't pay any more tax than you would if you didn't have to complete the temporary state's return.

What does credit for taxes paid to another state mean?

Usually, if you are required to file taxes in multiple states, you might be eligible for a credit for taxes paid to another state. Various state laws provide these credits so that you don't pay taxes to multiple states on the same income.

What does it mean when it says tax credit?

How tax credits work. A tax credit is a dollar-for-dollar reduction of your income. For example, if your total tax on your return is $1,000 but are eligible for a $1,000 tax credit, your net liability drops to zero.

Does tax credit mean you get money back?

Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

Does New Mexico have a credit for taxes paid to another state?

Does New Mexico offer a credit for income tax paid to another state? Yes, but only for New Mexico state residents. The credit is based on the tax the other state imposes on the portion of gross income that is also included in New Mexico gross income.

Does NY give you credit for taxes paid to other states?

This credit is allowable only for the portion of the tax that applies to income sourced to and taxed by the other taxing authority (state, a local government within another state, the District of Columbia, or a Canadian province) while you were a New York State resident.

Is New Mexico tax friendly for seniors?

Is New Mexico a tax-friendly state for retirees? New Mexico is a moderately tax-friendly state for retirees. The state recently enacted a law that exempts social security from taxation up to $100,000 for individuals or $150,000 for couples. This exemption became effective in 2022.

At what age do seniors stop paying property taxes in New Mexico?

All New Mexico seniors at least 65 years old may claim a special exemption.

Does California allow a tax credit for taxes paid to Oregon?

California allows Oregon residents to claim a credit for taxes paid to Oregon on the California Non Resident return.

Does New Mexico offer a credit for income tax paid to another state?

Does New Mexico offer a credit for income tax paid to another state? Yes, but only for New Mexico state residents. The credit is based on the tax the other state imposes on the portion of gross income that is also included in New Mexico gross income.

What are NM business credits?

The New Markets Tax Credit program is a federal program designed to provide businesses in rural or low-income communities with greater access to capital in order to increase job creation and development activities.

How do I get my NM rebate?

How do I get the rebate? A: New Mexicans who have or will file their 2021 income taxes by May 31, 2023 do not need to take any action to get their rebates. They will receive them automatically by direct deposit or check, depending on how they received their refunds or made their payments.

Does California allow a credit for taxes paid to another state?

Federal/State Law Existing California law allows a tax credit for net income taxes paid to a state other than California. The credit is based on net income taxes paid to the other state on income that has a source in the other state, and is also taxable under California law.

What is the business tax in New Mexico?

The Gross Receipts Tax rate varies throughout the state from 5% to9. 3125%.2. Double-click a form to download it. TitleOpen FileGross Receipts Tax Filer's KitNontaxable Transaction CertificatesGRT-PV Gross Receipts Tax Payment VoucherOpen FileTRD-41413 Gross Receipts Tax ReturnOpen File1 more row

How do I get a tax rebate in New Mexico?

How to Get a New Mexico Tax Rebate. Taxpayers didn't have to do anything to receive a rebate. The Department of Taxation and Revenue automatically sent payments to those who filed a 2021 state tax return.

Are centenarians exempt from state taxes in New Mexico?

Uniquely, New Mexico has an income tax exemption for centenarians since tax year 2002, provided that they turn 100 (or older) at the end of the tax year they claim for exemption and they're not claimed as a dependent by another New Mexico taxpayer.

Do I qualify for the NM tax rebate?

Single or married individuals filing separately will receive $500 if they make less than $150,000 per year. An additional $250 will be issued for individuals that make less than $75,000 a year. For more information, please visit NM Taxation and Revenue.

Are centenarians in New Mexico exempt from taxes?

The income of a person 100 years old or older is exempt from New Mexico income tax if both of the following apply to that person: They cannot be claimed as a dependent by someone else. They must be 100 years or older at the end of the tax year for which they claim the exemption.

Do seniors pay state tax in New Mexico?

Gov. Beginning with tax year 2022, most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

What is the New Mexico Working Families Tax Credit?

For the 2021 and 2022 tax years, the Working Families Tax Credit will be worth 20 percent of the federal Earned Income Tax Credit, or EITC; it had previously been worth 17 percent of the EITC. Beginning in 2023, it will be worth 25 percent of the EITC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NM TRD RPD-41301 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NM TRD RPD-41301 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my NM TRD RPD-41301 in Gmail?

Create your eSignature using pdfFiller and then eSign your NM TRD RPD-41301 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out NM TRD RPD-41301 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NM TRD RPD-41301. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NM TRD RPD-41301?

NM TRD RPD-41301 is a tax form used in New Mexico for reporting certain tax information related to withholding tax.

Who is required to file NM TRD RPD-41301?

Employers who have withheld income tax from employees' wages and certain other entities that are required to report withholding must file NM TRD RPD-41301.

How to fill out NM TRD RPD-41301?

To fill out NM TRD RPD-41301, you need to provide information such as employer details, the amount of taxes withheld, and any other required tax information in the designated fields on the form.

What is the purpose of NM TRD RPD-41301?

The purpose of NM TRD RPD-41301 is to report the withholding tax collected by employers and ensure compliance with New Mexico state tax laws.

What information must be reported on NM TRD RPD-41301?

The information that must be reported on NM TRD RPD-41301 includes the total amount of withholding tax, employer identification details, and other relevant financial data pertaining to employee wages.

Fill out your NM TRD RPD-41301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41301 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.