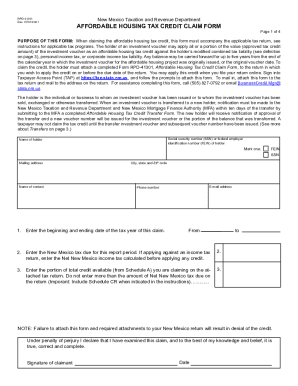

NM TRD RPD-41301 2014 free printable template

Show details

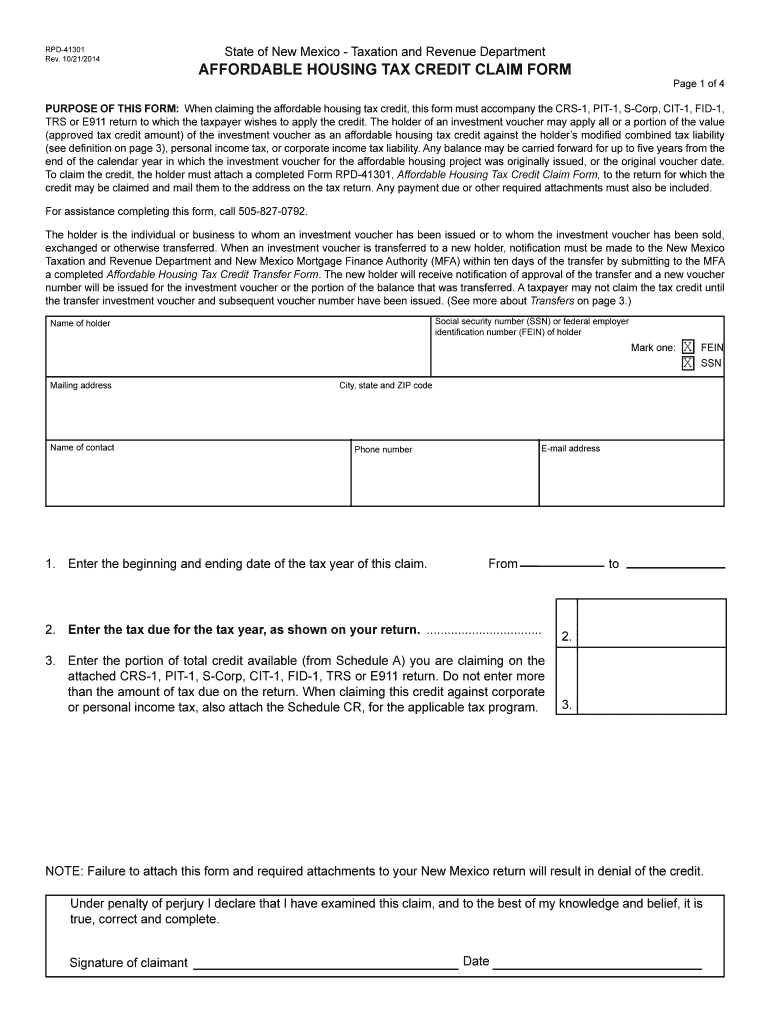

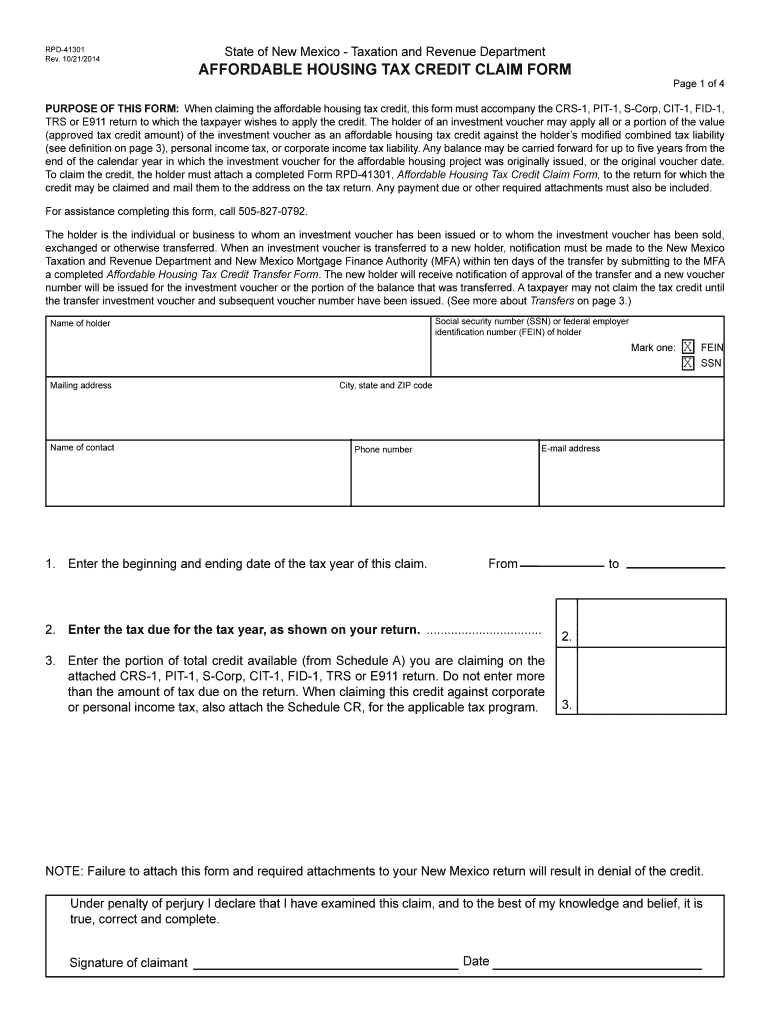

RPD-41301 Rev. 10/21/2014 State of New Mexico Taxation and Revenue Department AFFORDABLE HOUSING TAX CREDIT CLAIM FORM Page 1 of 4 PURPOSE OF THIS FORM: When claiming the affordable housing tax credit,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41301

Edit your NM TRD RPD-41301 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41301 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41301 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NM TRD RPD-41301. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41301

How to fill out NM TRD RPD-41301

01

Obtain the NM TRD RPD-41301 form from the New Mexico Taxation and Revenue Department website or your local office.

02

Fill in your personal information such as your name, address, and taxpayer identification number at the top of the form.

03

Indicate the tax year for which you are filing the report.

04

Complete the income section by entering all relevant income sources as required.

05

Fill in the deductions section, listing any applicable deductions you are claiming.

06

Calculate the total tax due by following the instructions provided on the form.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form according to the submission guidelines provided on the form.

Who needs NM TRD RPD-41301?

01

Taxpayers in New Mexico who need to report their income for state tax purposes must fill out the NM TRD RPD-41301.

02

Individuals and businesses who qualify for specific deductions or tax credits related to their income.

03

Anyone needing to reconcile their tax liability for the specified tax year.

Fill

form

: Try Risk Free

People Also Ask about

Who can take a other state tax credit for taxes paid to another state?

You may claim this credit if you had income that was taxed by California and another state. The credit will offset the taxes paid to the other state, so you are not paying taxes twice. This credit applies to: Individuals.

Do I qualify for NM $600 rebate?

How do I get the rebate? A: New Mexicans who have or will file their 2021 income taxes by May 31, 2023 do not need to take any action to get their rebates. They will receive them automatically by direct deposit or check, depending on how they received their refunds or made their payments.

What does credit for tax paid to other states mean?

It is, except that most states usually allow a credit on your resident return for the taxes you paid to the other (nonresident) state. This usually means that you won't pay any more tax than you would if you didn't have to complete the temporary state's return.

What does credit for taxes paid to another state mean?

Usually, if you are required to file taxes in multiple states, you might be eligible for a credit for taxes paid to another state. Various state laws provide these credits so that you don't pay taxes to multiple states on the same income.

What does it mean when it says tax credit?

How tax credits work. A tax credit is a dollar-for-dollar reduction of your income. For example, if your total tax on your return is $1,000 but are eligible for a $1,000 tax credit, your net liability drops to zero.

Does tax credit mean you get money back?

Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

Does New Mexico have a credit for taxes paid to another state?

Does New Mexico offer a credit for income tax paid to another state? Yes, but only for New Mexico state residents. The credit is based on the tax the other state imposes on the portion of gross income that is also included in New Mexico gross income.

Does NY give you credit for taxes paid to other states?

This credit is allowable only for the portion of the tax that applies to income sourced to and taxed by the other taxing authority (state, a local government within another state, the District of Columbia, or a Canadian province) while you were a New York State resident.

Is New Mexico tax friendly for seniors?

Is New Mexico a tax-friendly state for retirees? New Mexico is a moderately tax-friendly state for retirees. The state recently enacted a law that exempts social security from taxation up to $100,000 for individuals or $150,000 for couples. This exemption became effective in 2022.

At what age do seniors stop paying property taxes in New Mexico?

All New Mexico seniors at least 65 years old may claim a special exemption.

Does California allow a tax credit for taxes paid to Oregon?

California allows Oregon residents to claim a credit for taxes paid to Oregon on the California Non Resident return.

Does New Mexico offer a credit for income tax paid to another state?

Does New Mexico offer a credit for income tax paid to another state? Yes, but only for New Mexico state residents. The credit is based on the tax the other state imposes on the portion of gross income that is also included in New Mexico gross income.

What are NM business credits?

The New Markets Tax Credit program is a federal program designed to provide businesses in rural or low-income communities with greater access to capital in order to increase job creation and development activities.

How do I get my NM rebate?

How do I get the rebate? A: New Mexicans who have or will file their 2021 income taxes by May 31, 2023 do not need to take any action to get their rebates. They will receive them automatically by direct deposit or check, depending on how they received their refunds or made their payments.

Does California allow a credit for taxes paid to another state?

Federal/State Law Existing California law allows a tax credit for net income taxes paid to a state other than California. The credit is based on net income taxes paid to the other state on income that has a source in the other state, and is also taxable under California law.

What is the business tax in New Mexico?

The Gross Receipts Tax rate varies throughout the state from 5% to9. 3125%.2. Double-click a form to download it. TitleOpen FileGross Receipts Tax Filer's KitNontaxable Transaction CertificatesGRT-PV Gross Receipts Tax Payment VoucherOpen FileTRD-41413 Gross Receipts Tax ReturnOpen File1 more row

How do I get a tax rebate in New Mexico?

How to Get a New Mexico Tax Rebate. Taxpayers didn't have to do anything to receive a rebate. The Department of Taxation and Revenue automatically sent payments to those who filed a 2021 state tax return.

Are centenarians exempt from state taxes in New Mexico?

Uniquely, New Mexico has an income tax exemption for centenarians since tax year 2002, provided that they turn 100 (or older) at the end of the tax year they claim for exemption and they're not claimed as a dependent by another New Mexico taxpayer.

Do I qualify for the NM tax rebate?

Single or married individuals filing separately will receive $500 if they make less than $150,000 per year. An additional $250 will be issued for individuals that make less than $75,000 a year. For more information, please visit NM Taxation and Revenue.

Are centenarians in New Mexico exempt from taxes?

The income of a person 100 years old or older is exempt from New Mexico income tax if both of the following apply to that person: They cannot be claimed as a dependent by someone else. They must be 100 years or older at the end of the tax year for which they claim the exemption.

Do seniors pay state tax in New Mexico?

Gov. Beginning with tax year 2022, most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

What is the New Mexico Working Families Tax Credit?

For the 2021 and 2022 tax years, the Working Families Tax Credit will be worth 20 percent of the federal Earned Income Tax Credit, or EITC; it had previously been worth 17 percent of the EITC. Beginning in 2023, it will be worth 25 percent of the EITC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NM TRD RPD-41301 online?

With pdfFiller, the editing process is straightforward. Open your NM TRD RPD-41301 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the NM TRD RPD-41301 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NM TRD RPD-41301.

How do I complete NM TRD RPD-41301 on an Android device?

Complete your NM TRD RPD-41301 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NM TRD RPD-41301?

NM TRD RPD-41301 is a tax form used in New Mexico for reporting specific tax-related information to the New Mexico Taxation and Revenue Department.

Who is required to file NM TRD RPD-41301?

Taxpayers who have certain tax obligations or who are required to report various types of income and deductions in New Mexico must file NM TRD RPD-41301.

How to fill out NM TRD RPD-41301?

To fill out NM TRD RPD-41301, taxpayers should gather all necessary financial documentation, complete the form by entering required information, and then submit it to the New Mexico Taxation and Revenue Department by the due date.

What is the purpose of NM TRD RPD-41301?

The purpose of NM TRD RPD-41301 is to provide the New Mexico Taxation and Revenue Department with information necessary for evaluating taxpayers' compliance with state tax laws and regulations.

What information must be reported on NM TRD RPD-41301?

The information that must be reported on NM TRD RPD-41301 includes income details, deductions, exemptions, and other relevant tax data as applicable for the reporting period.

Fill out your NM TRD RPD-41301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41301 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.