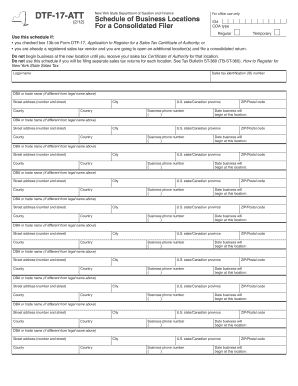

NY DTF DTF-17-I 2014 free printable template

Show details

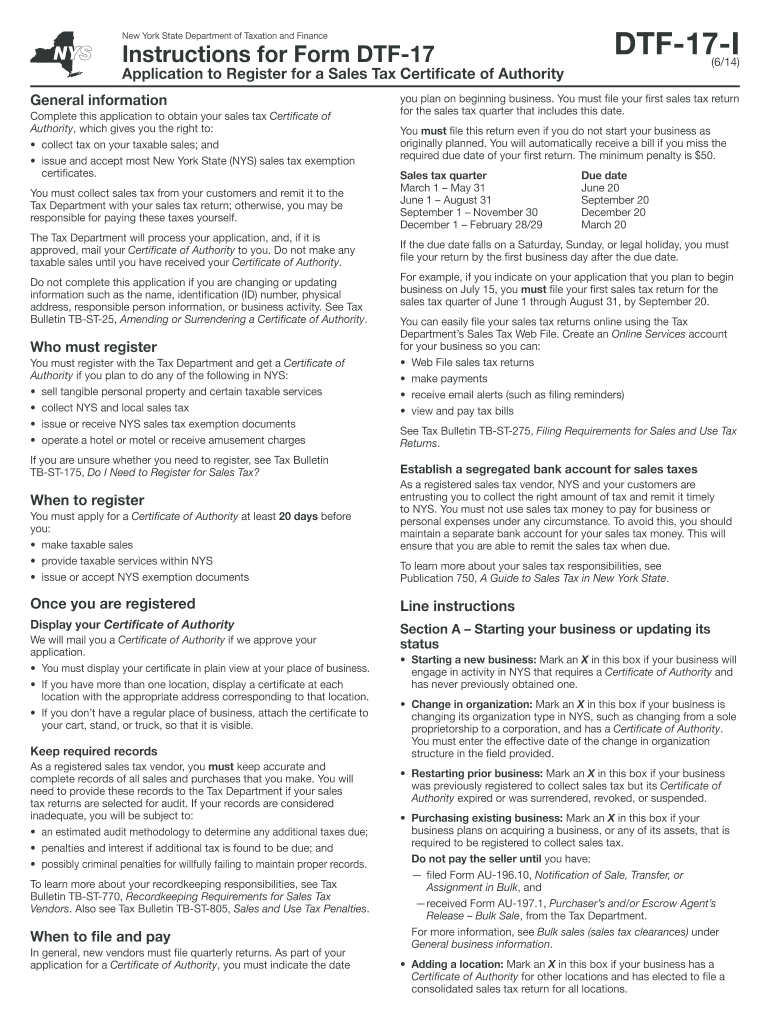

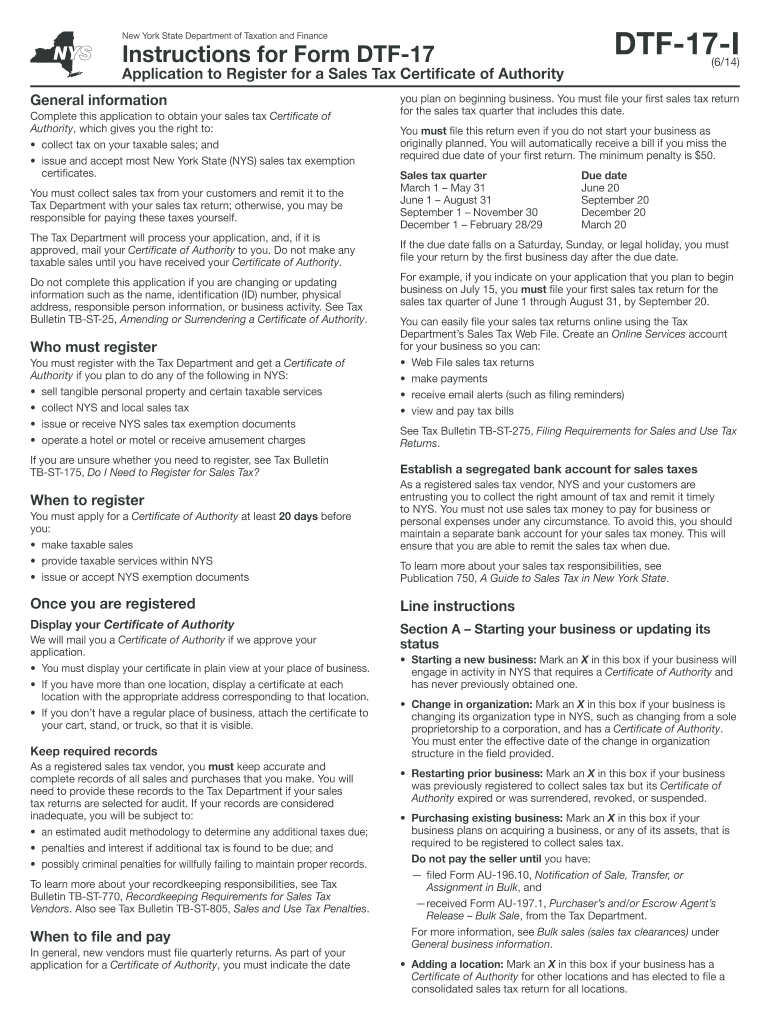

Of one or more members each having limited liability for the debts DTF-17-I 6/14 Page 3 of 6 and obligations of the business. Page 2 of 6 DTF-17-I 6/14 Also see Permanent place of business under General business Section B Business identification The following business information will appear on your Certificate of Authority legal name DBA or trade name if you have one federal employer ID number EIN or if you do not have one a temporary New York ID number assigned by the Tax Department...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF DTF-17-I

Edit your NY DTF DTF-17-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF DTF-17-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF DTF-17-I online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DTF DTF-17-I. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-17-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF DTF-17-I

How to fill out NY DTF DTF-17-I

01

Open the NY DTF DTF-17-I form.

02

Enter your name and address at the top of the form.

03

Provide your Social Security number or Employer Identification Number (EIN).

04

Fill in the tax year for which you are completing the form.

05

Report your total income for the year in the specified section.

06

Deduct any allowable expenses or adjustments as indicated on the form.

07

Calculate the net taxable amount as per the instructions.

08

Sign and date the form at the designated area.

09

Submit the completed form to the appropriate tax office by the deadline.

Who needs NY DTF DTF-17-I?

01

Individuals or businesses that are required to file an application for an extension to pay their New York State income tax.

02

Taxpayers who need to report their income and calculate their tax liabilities.

03

Those who owe taxes and are seeking to make installment payments.

Instructions and Help about NY DTF DTF-17-I

Fill

form

: Try Risk Free

People Also Ask about

What is a DTF 978 form?

Form DTF-978 — This is a notice to a judgment debtor or obligor, and it means the state intends to levy your assets.

Does a NY certificate of authority expire?

Expiration of a New York Resale certificate While a resale certificate itself doesn't expire, a certificate of authority is valid for a maximum of three years and is “renewable at the discretion of the Department of Taxation and Finance."

What services are exempt from sales tax in New York?

Sales tax also does not apply to most services. Examples of services not subject to sales tax are capital improvements to real property, medical care, education, and personal and professional services.

How do I get a reseller's permit in NY?

Quick List of Requirements to Apply for a General Vendor License Basic Individual License Application. Proof of Eligibility to Apply for a General Vendor License. Current Color Passport-size Photograph of License Applicant. Certificate of Authority. General Vendor Questionnaire. General Vendor Residence Form.

How much is a reseller permit in NY?

There are no fees associated with obtaining a certificate of authority or using a resale certificate. New York takes operating without a certificate of authority seriously: violations could result in a penalty of up to $10,000.

Do I need a reseller permit in NY?

ing to New York tax laws, any time you want to start selling anything as a business, you must get a reseller certificate -- known as a Certificate of Authority. A Certificate of Authority gives you the right to collect sales tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the NY DTF DTF-17-I electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete NY DTF DTF-17-I on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your NY DTF DTF-17-I, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out NY DTF DTF-17-I on an Android device?

Use the pdfFiller mobile app to complete your NY DTF DTF-17-I on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY DTF DTF-17-I?

NY DTF DTF-17-I is a form used by taxpayers in New York State to report and pay withholding tax on certain payments made to New York residents.

Who is required to file NY DTF DTF-17-I?

Any payer who has made reportable payments, such as wages or other compensation, to a New York resident must file NY DTF DTF-17-I.

How to fill out NY DTF DTF-17-I?

To fill out NY DTF DTF-17-I, provide the required taxpayer information, report the total amount of payments made, calculate the withholding tax, and sign the form before submitting it to the New York State Department of Taxation and Finance.

What is the purpose of NY DTF DTF-17-I?

The purpose of NY DTF DTF-17-I is to ensure that withholding taxes are properly reported and paid on income earned by New York residents.

What information must be reported on NY DTF DTF-17-I?

The information required on NY DTF DTF-17-I includes the payer's details, the recipient's details, total payment amounts, the calculated withholding tax, and any pertinent signatures.

Fill out your NY DTF DTF-17-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF DTF-17-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.