NY DTF DTF-17-I 2016 free printable template

Show details

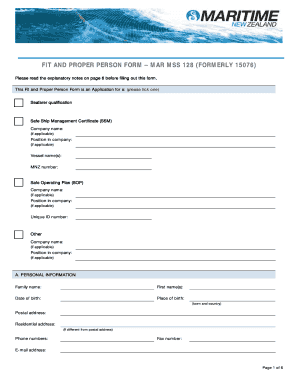

DTF-17-I 4/16 To learn more about your recordkeeping responsibilities see Tax Bulletin TB-ST-770 Recordkeeping Requirements for Sales Tax Vendors. Sales of goods and services Use Form DTF-17. 1 Business Contact and Responsible Person Questionnaire to obtain the information required for each RP of the business. Filing separate sales tax returns or one consolidated sales tax return have two options Line 14a Apply for a sales tax Certificate of Authority for each location by filing a separate...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF DTF-17-I

Edit your NY DTF DTF-17-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF DTF-17-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF DTF-17-I online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF DTF-17-I. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF DTF-17-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF DTF-17-I

How to fill out NY DTF DTF-17-I

01

Begin by downloading the NY DTF DTF-17-I form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number or Employer Identification Number.

03

Indicate the type of tax being reported in the designated section.

04

Provide detailed information regarding your income, deductions, and credits as requested in the form.

05

Complete any addenda or schedules that are applicable to your situation.

06

Review your entries for accuracy and ensure all required fields are filled in.

07

Sign and date the form where indicated, certifying the information provided is correct to the best of your knowledge.

08

Submit the completed form to the appropriate office as outlined in the filing instructions.

Who needs NY DTF DTF-17-I?

01

Individuals or businesses that are required to report income or claim tax credits in New York State.

02

Taxpayers seeking to reconcile their tax liabilities or gain clarification regarding instructions from the New York State Department of Taxation and Finance.

03

Those who have received the form as a part of their tax filing process or as a notice from tax authorities.

Instructions and Help about NY DTF DTF-17-I

Fill

form

: Try Risk Free

People Also Ask about

What's a TF number?

Toll free numbers are telephone numbers with distinct three-digit codes that can be dialed from landlines with no charge to the person placing the call. Such numbers allow callers to reach businesses and individuals out of the area without being charged a long-distance fee for the call.

What is a DTF 17 form?

Application to Register for a Sales Tax Certificate of Authority. DTF-17-I. (11/18) General information. Complete this application to obtain your sales tax Certificate of Authority, which allows you to collect tax, make taxable sales in New York State (NYS), and issue or accept most sales tax exemption certificates.

What is DTF tax?

October 2021. Introduction. The Department of Taxation and Finance (DTF) is the state agency charged with administering the Tax Law and, in conjunction with local governments, with administering the Real Property Tax Law.

How long does it take to get a NYS Certificate of Authority?

Processing time is approximately five days, and if your application is approved, your Certificate of Authority will be mailed to you.

How do I find my NYS tax ID number?

To locate your New York Employer Registration Number: Find this on any previously filed quarterly tax return (Form NYS-45). Call the NY Department of Labor at 888-899-8810.

How do I get a copy of my NYS resale certificate?

If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

What is NYS DTF payment?

New York State Department of Tax & Finance. If you're seeing it as an ACH withdrawal from your checking, it's a tax payment. Possibly your NYS Sales Tax, but it could be some other tax that NYS is grabbing. 1.

What is the New York State Department of Taxation and Finance?

The New York State Department of Taxation and Finance (NYSDTF) is the department of the New York state government responsible for taxation and revenue, including handling all tax forms and publications, and dispersing tax revenue to other agencies and counties within New York State.

How long does it take to get a certificate of Authority in NY?

Processing time is approximately five days, and if your application is approved, your Certificate of Authority will be mailed to you.

What is NYS DTF sales tax?

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

Is the NY sales tax ID same as EIN?

Is an EIN the same as a NYS vendor ID number? An employer identification number (EIN) or federal tax identification number is different than a NYS vendor ID number. An EIN is issued by the IRS and is used to identify a business entity and federal business tax returns.

Is Certificate of Authority same as tax ID?

In New York, a Certificate of Authority is issued by the New York Tax Department and contains your sales tax ID. With the certificate, your business is granted the right to collect sales tax and issue and accept most New York State sales tax exemption certificates.

Do I need a NYS tax ID number?

Your New York state tax ID number is a requirement if you're going to hire employees in the state of New York. You'll also need one if you're selling taxable goods and services in the state, or if you're going to owe excise taxes on regulated goods like alcohol or tobacco.

Why would I get a certified letter from NYS tax?

Typically, we send this letter if we need to verify: your amounts of wages and withholding, your residency, your eligibility for refundable tax credits, or.

How much is a certificate of Authority in New York?

The completed Application for Authority and statutory filing fee of $225, made payable to the New York Department of State, should be forwarded to the New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

How do I get a copy of my NYS certificate of Authority?

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

What is the NYS sales tax rate for 2022?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Why would I get a letter from New York State Department of Taxation and Finance?

Common reasons we send RFI letters include: We need to verify you reported the correct amount of wages and withholding for New York State, New York City, and Yonkers (see Checklist for acceptable proof of wages and withholding). We need to verify you lived or worked in New York State, New York City, or Yonkers.

What is a NYS TF number?

A TF number is a temporary ID number issued by the New York State Tax Department. EINs (employer identification numbers) are issued by the IRS, and are federally regulated. Most companies are required to have an EIN. Once your company has one, you will have to update your records with the NYS Tax Department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY DTF DTF-17-I directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NY DTF DTF-17-I and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify NY DTF DTF-17-I without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your NY DTF DTF-17-I into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit NY DTF DTF-17-I straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NY DTF DTF-17-I right away.

What is NY DTF DTF-17-I?

NY DTF DTF-17-I is a form used by taxpayers in New York State to report certain information related to their personal income tax liability.

Who is required to file NY DTF DTF-17-I?

Individuals and businesses that need to report specific income adjustments or tax credits as required by New York State tax regulations must file NY DTF DTF-17-I.

How to fill out NY DTF DTF-17-I?

To fill out NY DTF DTF-17-I, taxpayers should follow the instructions provided on the form, ensuring they enter all required personal information, income details, and any applicable adjustments or credits.

What is the purpose of NY DTF DTF-17-I?

The purpose of NY DTF DTF-17-I is to provide the New York State Department of Taxation and Finance with necessary information to accurately assess and record tax liabilities.

What information must be reported on NY DTF DTF-17-I?

The information that must be reported on NY DTF DTF-17-I includes taxpayer identification details, sources of income, any deductions or credits being claimed, and other relevant tax-related information.

Fill out your NY DTF DTF-17-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF DTF-17-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.