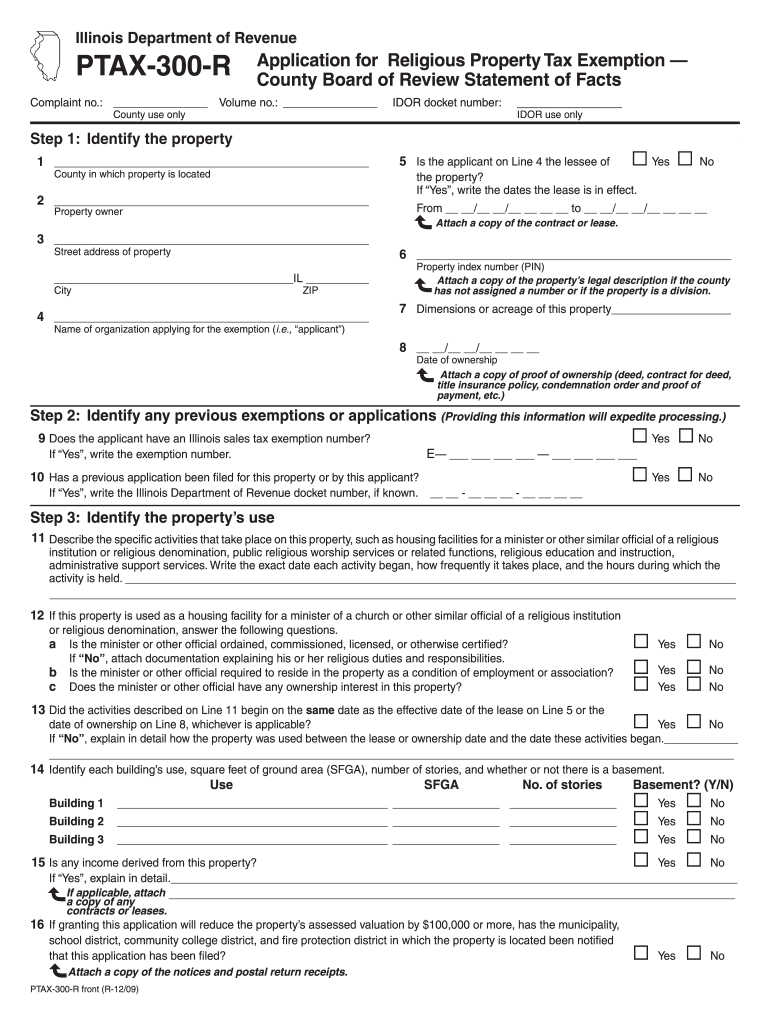

Who needs a PTAX-300-R form?

Form PTAX-300-R, or the Application for Religious Property Tax Exemption — County Board of Review Statement of Facts, must be filed for non-homestead exemption in the State of Illinois. Pay attention: Federal/state agency exemptions or religious exemptions are requested with other versions of PTAX-300 forms.

What is the PTAX-300-R form for?

Information on this form concerns real property deeds of the organization. This form is required when:

- Multiple parcels are acquired by the same deed;

- Multiple parcels are acquired by separate deeds;

- A single parcel was acquired by multiple deeds.

Is it accompanied by other forms?

There is a list of documents to attach to the PTAX-300-R form include:

- Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of statement);

- Picture of the property;

- Notarized affidavit of use;

- Copies of any contracts or leases of the property.

There is also a list of optional addenda, such as audited financial statements for the most recent year or a Copy of Illinois Department of Revenue Exemption Certificate. You have to check in the box next to a title of a document in the list on page 2 or write down a title of the document you attach, if it’s not on the list.

When is form PTAX-300-R due?

The county board of review will assign a deadline for your application. It may hold a hearing to consider this form, so it will take a while to determine if the exemption should be granted.

How do I fill out a PTAX-300-R form?

Provide all necessary details about the subject of your deal. Identify the property, write down its location, the owner’s name and contacts, property index number and date of ownership. Determine how exactly your organization uses the property. Don’t forget to give the contacts of a person responsible for this application in your company and capable of answering any questions that the county board may have.

Where do I send it?

Send it to the closest county board of review.