NM TRD RPD-41227 2012 free printable template

Show details

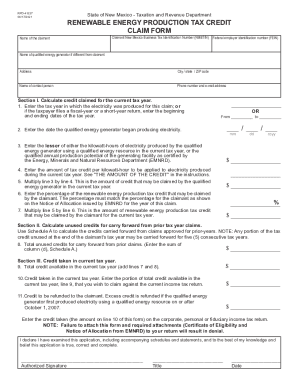

RPD-41227 Rev. 10/11/2012 State of New Mexico Taxation and Revenue Department RENEWABLE ENERGY PRODUCTION TAX CREDIT CLAIM FORM Name of the claimant CRS identification number Federal employer identification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41227

Edit your NM TRD RPD-41227 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41227 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41227 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NM TRD RPD-41227. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41227 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41227

How to fill out NM TRD RPD-41227

01

Obtain the NM TRD RPD-41227 form from the New Mexico Taxation and Revenue Department website or office.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Specify the applicable tax period for which you are filing.

04

Indicate the type of tax or transaction being reported on the form.

05

Provide details as requested in the form, including any relevant financial figures or calculations.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate department by the specified deadline.

Who needs NM TRD RPD-41227?

01

Individuals or businesses in New Mexico who are filing a specific tax return or claim related to the state's taxation requirements.

02

Taxpayers seeking to report certain transactions or tax liabilities as defined by the New Mexico Revenue and Taxation Department.

Fill

form

: Try Risk Free

People Also Ask about

Can you claim the solar tax credit more than once?

You can only claim the federal solar tax credit once. If the taxes you owe are less than the value of the credit, the remainder will roll over for a maximum of five years. For example, if you a solar energy system worth $19,000, you'll owe 30% ($5,700) less on your federal tax return.

Are solar panels refundable tax credits?

Instead, you pay for the system (or finance it with a solar loan) and then it is your responsibility to claim the tax credit when you file your taxes. One thing to note about the IRS solar tax credit is that it is a non-refundable tax credit.

Is the New Mexico solar tax credit refundable?

That portion of a new solar market development income tax credit that exceeds a taxpayer's tax liability in the taxable year in which the credit is claimed [may be carried forward for a maximum of five consecutive taxable years] shall be refunded to the taxpayer.

How does solar tax credit work in New Mexico?

Solar Installation Sales Tax Exemption When you buy a new solar power system in New Mexico, you won't pay sales tax on the system. The exemption is for 100% of the sales tax of a solar installation used to provide space heat, hot water, or electricity to your home. This can save you 5.125% right off the bat.

How to claim New Mexico solar tax credit?

A taxpayer may claim the renewable energy production tax credit by submitting to TRD, a completed Form RPD-41227, New Mexico Renewable Energy Production Tax Credit Claim Form, the certificate of eligibility issued by EMNRD, the notice of allocation approved by EMNRD, if applicable, and documentation of the amount of

What is a TRD 41406 form?

Form TRD-41406, New Solar Market Development Tax Credit Claim Form, is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy, Minerals and Natural Resources Department (EMNRD) and wishes to claim the credit against personal or fiduciary income tax liability (Section 7-2-

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NM TRD RPD-41227?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NM TRD RPD-41227 and other forms. Find the template you need and change it using powerful tools.

How do I edit NM TRD RPD-41227 online?

The editing procedure is simple with pdfFiller. Open your NM TRD RPD-41227 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit NM TRD RPD-41227 in Chrome?

Install the pdfFiller Google Chrome Extension to edit NM TRD RPD-41227 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is NM TRD RPD-41227?

NM TRD RPD-41227 is a form used in New Mexico for reporting specific tax information to the New Mexico Taxation and Revenue Department.

Who is required to file NM TRD RPD-41227?

Individuals or entities that have certain tax obligations in New Mexico, typically based on income or business operations, are required to file NM TRD RPD-41227.

How to fill out NM TRD RPD-41227?

To fill out NM TRD RPD-41227, follow the instructions provided on the form, ensuring all required fields are completed accurately, and provide any necessary supporting documentation.

What is the purpose of NM TRD RPD-41227?

The purpose of NM TRD RPD-41227 is to collect tax information that helps the New Mexico Taxation and Revenue Department assess tax liabilities and ensure compliance.

What information must be reported on NM TRD RPD-41227?

NM TRD RPD-41227 requires reporting information such as taxpayer identification, income details, deductions, and any applicable tax credits.

Fill out your NM TRD RPD-41227 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41227 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.