NM TRD RPD-41227 2014 free printable template

Show details

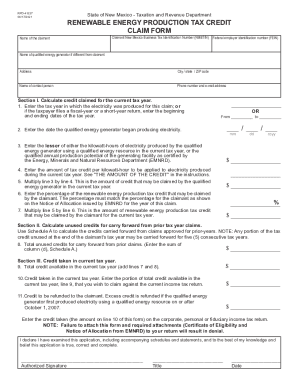

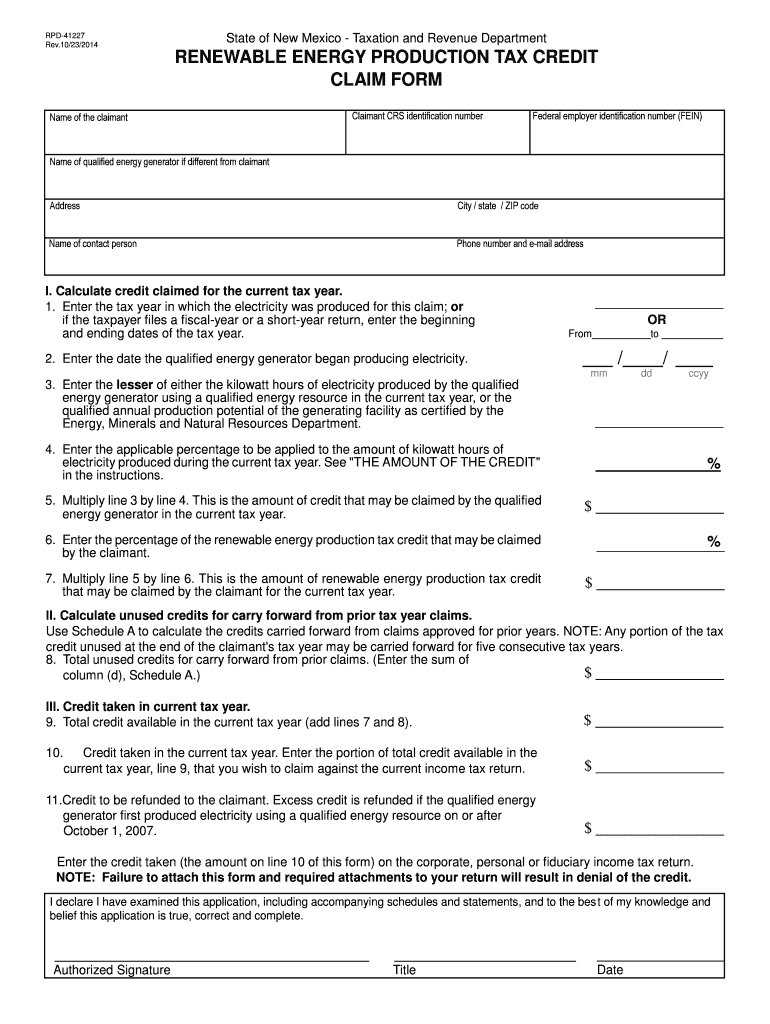

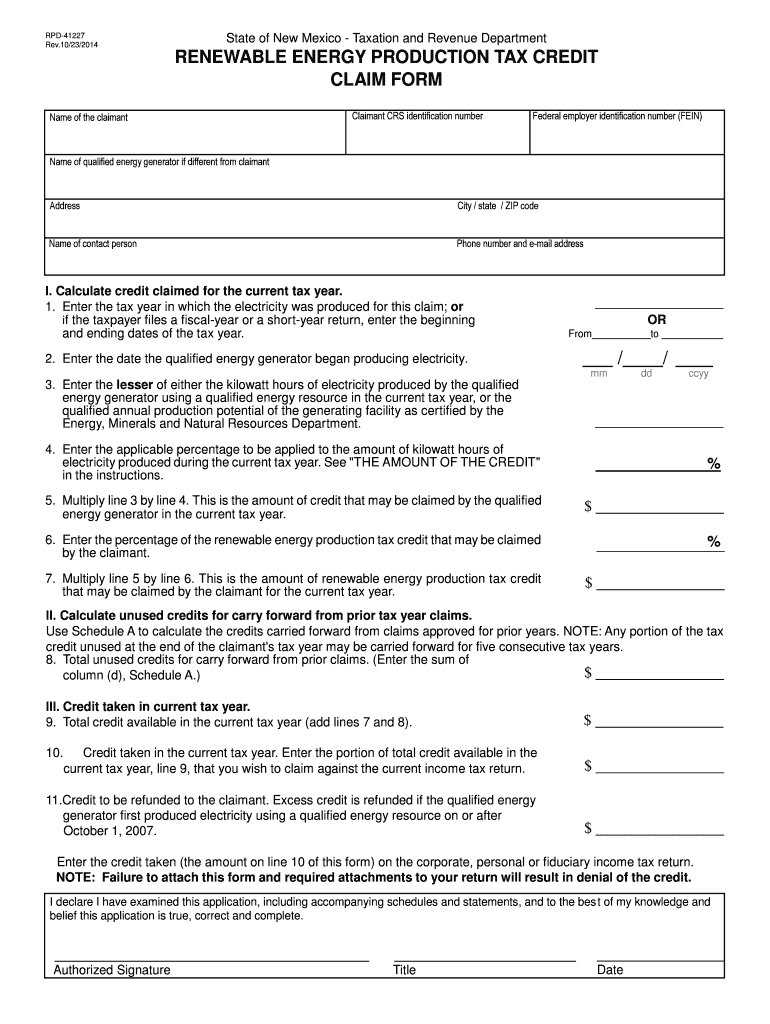

Authorized Signature Title Date Rev. 10/11/2012 Schedule A To complete Section II of the claim Form RPD-41227 Renewable Energy Production Tax Credit Claim Form attach a completed Schedule A to compute unused credits for carry forward from prior tax year claims. Line 8 of Form RPD-41227. You must apply credit approved to be claimed in the tax year first. If the credit amount approved to be claimed in a tax year is less than the personal or corporate income tax liability for that year you may...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD RPD-41227

Edit your NM TRD RPD-41227 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD RPD-41227 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD RPD-41227 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD RPD-41227. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD RPD-41227 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD RPD-41227

How to fill out NM TRD RPD-41227

01

Obtain NM TRD RPD-41227 form from the New Mexico Taxation and Revenue Department website or office.

02

Fill in your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Copy the section or description of the tax or credit you are applying for from the guidance provided by the RPD.

04

Provide detailed information regarding the tax calculations and credits claimed in the appropriate sections of the form.

05

Review the form for accuracy and completeness, ensuring all required fields are filled out.

06

Sign and date the form at the bottom to certify that the information is correct.

07

Submit the completed form via mail or electronically according to the submission guidelines provided.

Who needs NM TRD RPD-41227?

01

Individuals or businesses that are applying for specific tax credits or deductions in New Mexico.

02

Tax preparers or accountants handling tax filings for clients in New Mexico.

03

Anyone who needs official documentation related to tax matters with the New Mexico Taxation and Revenue Department.

Fill

form

: Try Risk Free

People Also Ask about

How do I file my personal income tax?

There are three main ways to file taxes: fill out IRS Form 1040 or Form 1040-SR by hand and mail it (not recommended), use tax software and file taxes online, or hire a human tax preparer to do the work of tax filing.

What is the solar tax credit and how does it work?

What Is the Solar Tax Credit? If you solar energy equipment in your residence any time this year through the end of 2032, you are entitled to a nonrefundable credit off your federal income taxes, equal to 30 percent of eligible expenses.

What is the solar tax credit form?

More In Forms and Instructions Use Form 5695 to figure and take your residential energy credits. The residential energy credits are: The nonbusiness energy property credit, and. The residential energy efficient property credit.

Who fills out Form 5695?

You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit.

What is a TRD 41406 form?

Form TRD-41406, New Solar Market Development Tax Credit Claim Form, is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy, Minerals and Natural Resources Department (EMNRD) and wishes to claim the credit against personal or fiduciary income tax liability (Section 7-2-

How does the solar tax credit work?

What Is the Solar Tax Credit? If you solar energy equipment in your residence any time this year through the end of 2032, you are entitled to a nonrefundable credit off your federal income taxes, equal to 30 percent of eligible expenses.

Do you get money back from solar tax credit?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. 15 However, you can carry over any unused amount of tax credit to the next tax year.

Why can't I claim my solar tax credit?

ing to the U.S. Department of Energy, to qualify for the solar federal tax credit, you must meet all of the following requirements: You must own your home (renters are excluded, unfortunately). The solar panel system must be new or is being used for the first time. You must own your solar panels.

How do I claim the solar tax credit in New Mexico?

A taxpayer may claim the renewable energy production tax credit by submitting to TRD, a completed Form RPD-41227, New Mexico Renewable Energy Production Tax Credit Claim Form, the certificate of eligibility issued by EMNRD, the notice of allocation approved by EMNRD, if applicable, and documentation of the amount of

What is a form pit 1?

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Is there a New Mexico state tax form?

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return.

How do I file a pit?

PIT Fill up the PIT Registration Form carefully. Mandatory fields are marked with asterisks(*); Choose the place of registration (RRCO) depending upon your convenience; You are ALLOWED to choose ONLY one RRCO for your registration purpose and the same RRCO should be used to file your Tax Return;

How to claim New Mexico solar tax credit?

A taxpayer may claim the renewable energy production tax credit by submitting to TRD, a completed Form RPD-41227, New Mexico Renewable Energy Production Tax Credit Claim Form, the certificate of eligibility issued by EMNRD, the notice of allocation approved by EMNRD, if applicable, and documentation of the amount of

How do I claim my solar tax credit?

To claim the credit, you must file IRS Form 5695 as part of your tax return. You'll calculate the credit on Part I of the form, and then enter the result on your 1040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NM TRD RPD-41227 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NM TRD RPD-41227 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit NM TRD RPD-41227 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing NM TRD RPD-41227 right away.

How do I edit NM TRD RPD-41227 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NM TRD RPD-41227 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is NM TRD RPD-41227?

NM TRD RPD-41227 is a form used by taxpayers in New Mexico to report certain types of transactions and activities for tax purposes.

Who is required to file NM TRD RPD-41227?

Taxpayers who engage in specified transactions, such as those involving gross receipts or compensating taxes, are required to file NM TRD RPD-41227.

How to fill out NM TRD RPD-41227?

To fill out NM TRD RPD-41227, taxpayers should provide accurate information regarding their transactions, including figures for gross receipts, deductions, and other relevant data as instructed on the form.

What is the purpose of NM TRD RPD-41227?

The purpose of NM TRD RPD-41227 is to gather information for the assessment and collection of state tax obligations from individuals and businesses engaging in taxable transactions.

What information must be reported on NM TRD RPD-41227?

The information that must be reported on NM TRD RPD-41227 includes taxpayer identification details, types of transactions, gross receipts amounts, any deductions, and other pertinent financial data.

Fill out your NM TRD RPD-41227 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD RPD-41227 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.