HI DoT P-64B 2013 free printable template

Show details

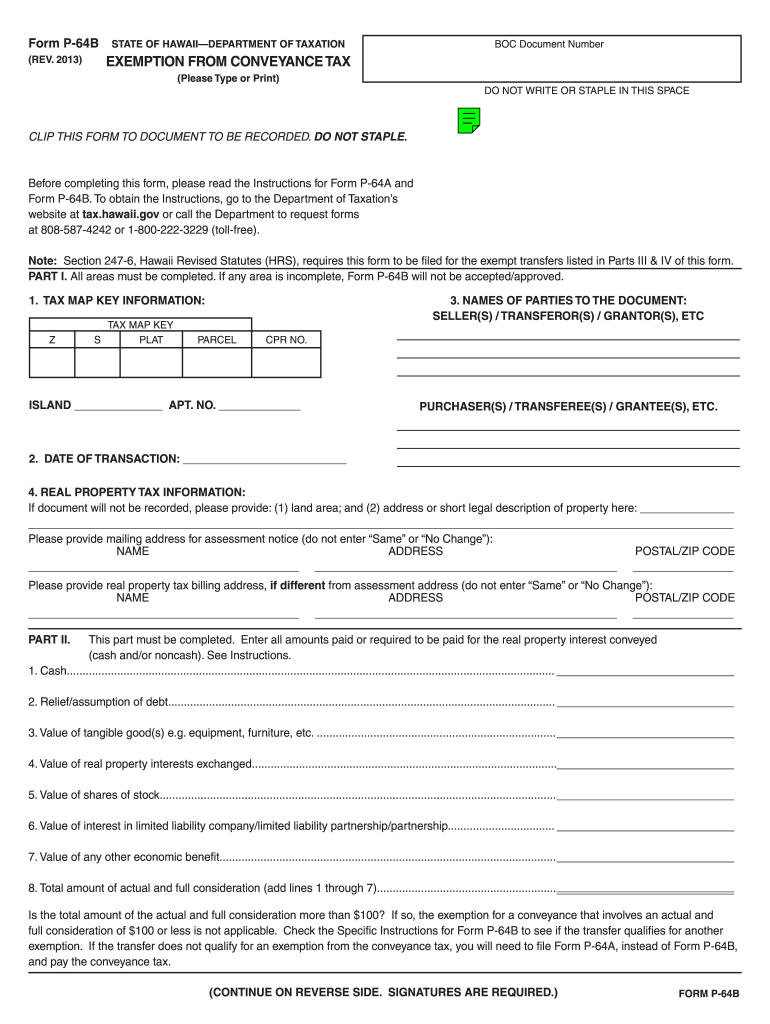

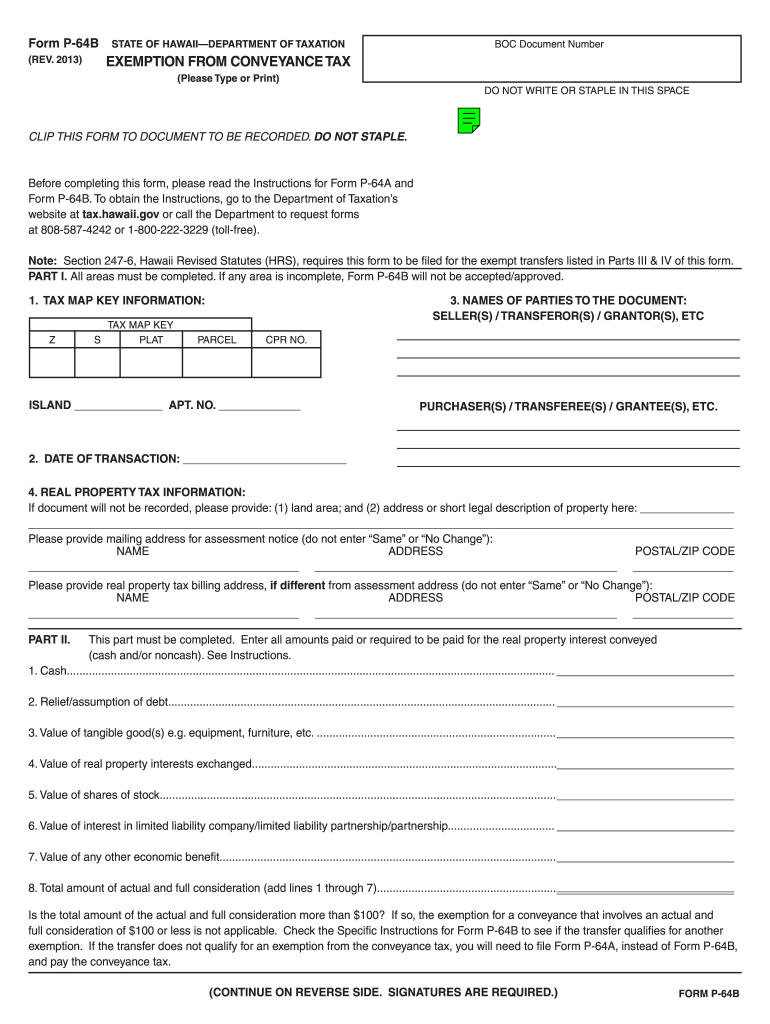

Form P-64B STATE OF HAWAII DEPARTMENT OF TAXATION BOC Document Number EXEMPTION FROM CONVEYANCE TAX REV. List a claim for an exemption from tax for any other transfer involving a trust in Part III. LIBER PAGE OR AS DOCUMENT NO. FOR WHICH A STATE CONVEYANCE TAX WAS PAID. List the Liber and Page Land Court Document Number or Document Number. Check the Specific Instructions for Form P-64B to see if the transfer qualifies for another exemption. If the transfer does not qualify for an exemption...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT P-64B

Edit your HI DoT P-64B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT P-64B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI DoT P-64B online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit HI DoT P-64B. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT P-64B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT P-64B

How to fill out HI DoT P-64B

01

Gather all necessary documentation required for the form.

02

Start by filling out your personal information at the top of the form.

03

Provide details about the purpose of your request in the designated section.

04

Complete the specific sections that apply to your situation, ensuring all information is accurate.

05

Review the form for any missing information or errors.

06

Sign and date the form at the bottom.

07

Submit the completed form according to the instructions provided, whether by mail, fax, or in person.

Who needs HI DoT P-64B?

01

Individuals or businesses seeking to obtain a specific permit or exemption related to transportation in Hawaii.

02

Companies that need to demonstrate compliance with state regulations regarding transportation activities.

03

Anyone involved in transporting goods or services in Hawaii that may require official documentation.

Instructions and Help about HI DoT P-64B

Fill

form

: Try Risk Free

People Also Ask about

What is the conveyance tax on real property in Hawaii?

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater . The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

What is exempt from conveyance tax in Hawaii?

A transfer from a grantor to a grantor's own revocable living trust, or from a grantor's revocable living trust to the grantor who is the primary beneficiary of the trust, is exempt from conveyance taxes.

How do I get property tax exemption in Hawaii?

You file a claim for home exemption online or fill out Form (BFS-RPA-E-8-10.3) with the Real Property Assessment Division on or before September 30 preceding the tax year for which you claim the exemption.

What is the real property tax exemption in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What are real property tax exemptions in Honolulu?

The City and County of Honolulu offers a real property tax credit to property owners who meet certain eligibility requirements. If you qualify, you are entitled to a tax credit equal to the amount of taxes owed for the 2022 – 2023 tax year that exceed 3% of the titleholders' combined total gross income.

Who pays conveyance tax in Hawaii?

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit HI DoT P-64B from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your HI DoT P-64B into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send HI DoT P-64B for eSignature?

When you're ready to share your HI DoT P-64B, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the HI DoT P-64B in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your HI DoT P-64B and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is HI DoT P-64B?

HI DoT P-64B is a form used in Hawaii for the reporting of business activities and tax information, specifically related to the Department of Taxation.

Who is required to file HI DoT P-64B?

Businesses and entities operating in Hawaii that are required to report their tax information to the Department of Taxation must file HI DoT P-64B.

How to fill out HI DoT P-64B?

To fill out HI DoT P-64B, follow the instructions provided on the form, ensuring that all required fields are completed accurately, and submit it to the Department of Taxation by the specified deadline.

What is the purpose of HI DoT P-64B?

The purpose of HI DoT P-64B is to collect necessary tax information and business activity details from entities operating in Hawaii for compliance and tax assessment purposes.

What information must be reported on HI DoT P-64B?

Information that must be reported on HI DoT P-64B includes business identification, types of income, expenses, and any other relevant details required by the Department of Taxation.

Fill out your HI DoT P-64B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT P-64b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.