HI DoT P-64B 2009 free printable template

Show details

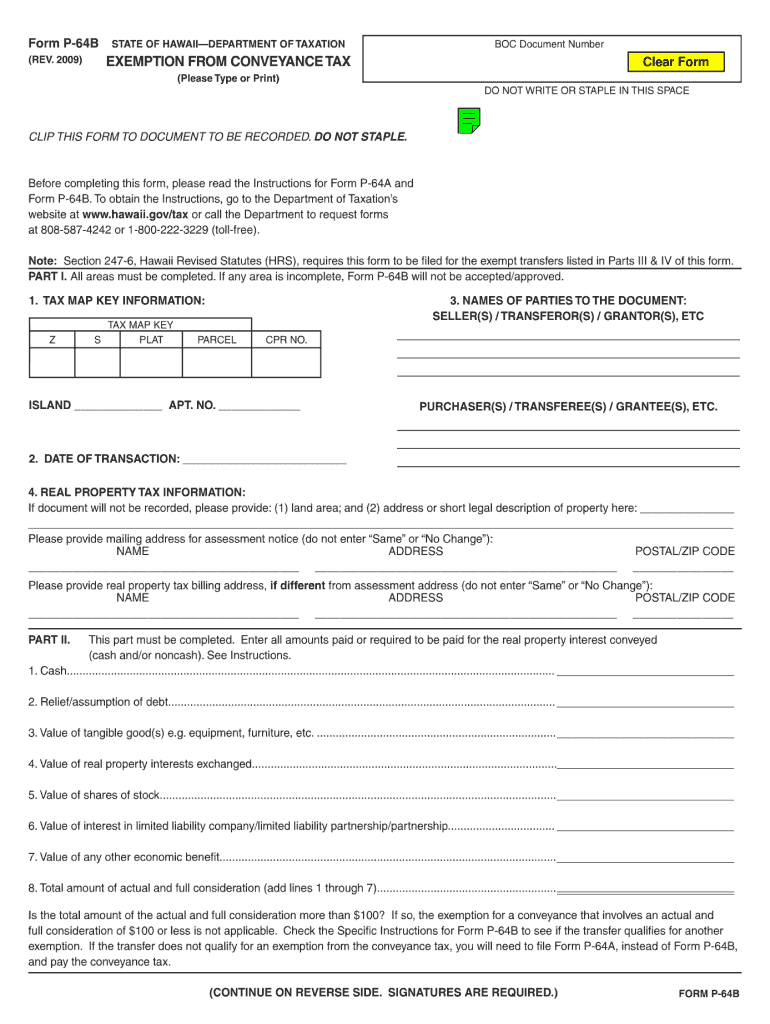

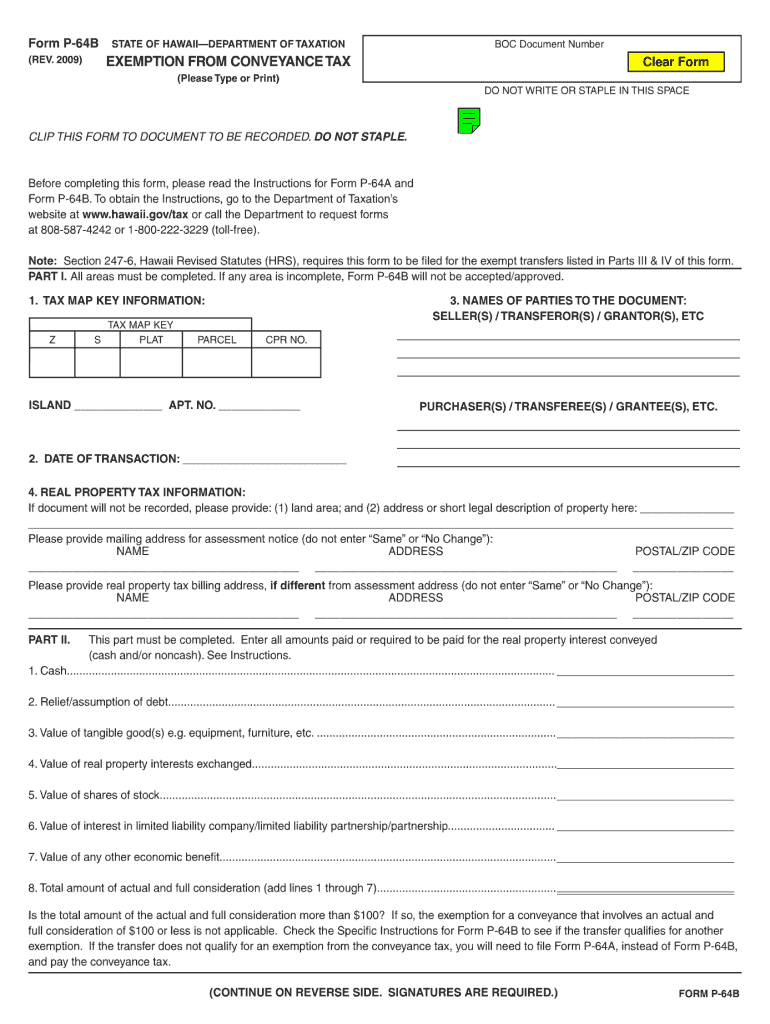

Form P-64B (REV. 2009) STATE OF HAWAII--DEPARTMENT OF TAXATION BOC Document Number EXEMPTION FROM CONVEYANCE TAX (Please Type or Print) Clear Form DO NOT WRITE OR STAPLE IN THIS SPACE CLIP THIS FORM

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT P-64B

Edit your HI DoT P-64B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT P-64B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT P-64B online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit HI DoT P-64B. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT P-64B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT P-64B

How to fill out HI DoT P-64B

01

Begin by gathering all necessary information about the transportation of hazardous materials.

02

Enter the shipper's name, address, and contact information in the designated fields.

03

Fill out the consignee's name, address, and contact information.

04

Provide a detailed description of the hazardous materials being transported, including proper shipping names and UN numbers.

05

Indicate the quantity of each type of hazardous material being shipped.

06

Specify the packaging type and any special handling requirements.

07

Include the emergency contact information for the shipment.

08

Review the form for completeness and accuracy.

09

Sign and date the form as required.

10

Submit the form to the appropriate authorities or retain it for your records.

Who needs HI DoT P-64B?

01

Hazardous material shippers.

02

Transport companies handling hazardous materials.

03

Regulatory compliance professionals.

04

Environmental health and safety officers.

05

Anyone involved in the shipping or transportation of hazardous materials.

Instructions and Help about HI DoT P-64B

Fill

form

: Try Risk Free

People Also Ask about

What is conveyance tax in Hawaii?

• One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

What is the conveyance tax on real property in Hawaii?

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater . The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

What is the real property tax exemption in Hawaii?

The basic home exemption for homeowners under the age of 60 is $40,000. The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000.

What is exempt from conveyance tax in Hawaii?

A transfer from a grantor to a grantor's own revocable living trust, or from a grantor's revocable living trust to the grantor who is the primary beneficiary of the trust, is exempt from conveyance taxes.

Who pays conveyance tax in Hawaii?

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

Who pays Hawaii conveyance tax?

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get HI DoT P-64B?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific HI DoT P-64B and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the HI DoT P-64B electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your HI DoT P-64B in seconds.

Can I create an electronic signature for signing my HI DoT P-64B in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your HI DoT P-64B directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is HI DoT P-64B?

HI DoT P-64B is a form used in Hawaii for reporting certain information related to the handling of hazardous substances.

Who is required to file HI DoT P-64B?

Individuals or businesses that handle hazardous substances in Hawaii are required to file HI DoT P-64B.

How to fill out HI DoT P-64B?

To fill out HI DoT P-64B, provide accurate details regarding the hazardous substances handled, including quantities and locations, and submit the form to the appropriate authorities.

What is the purpose of HI DoT P-64B?

The purpose of HI DoT P-64B is to ensure compliance with state regulations regarding hazardous substances and to promote public safety and environmental protection.

What information must be reported on HI DoT P-64B?

The information that must be reported on HI DoT P-64B includes the types and amounts of hazardous substances handled, the locations of handling activities, and contact information of the entities involved.

Fill out your HI DoT P-64B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT P-64b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.