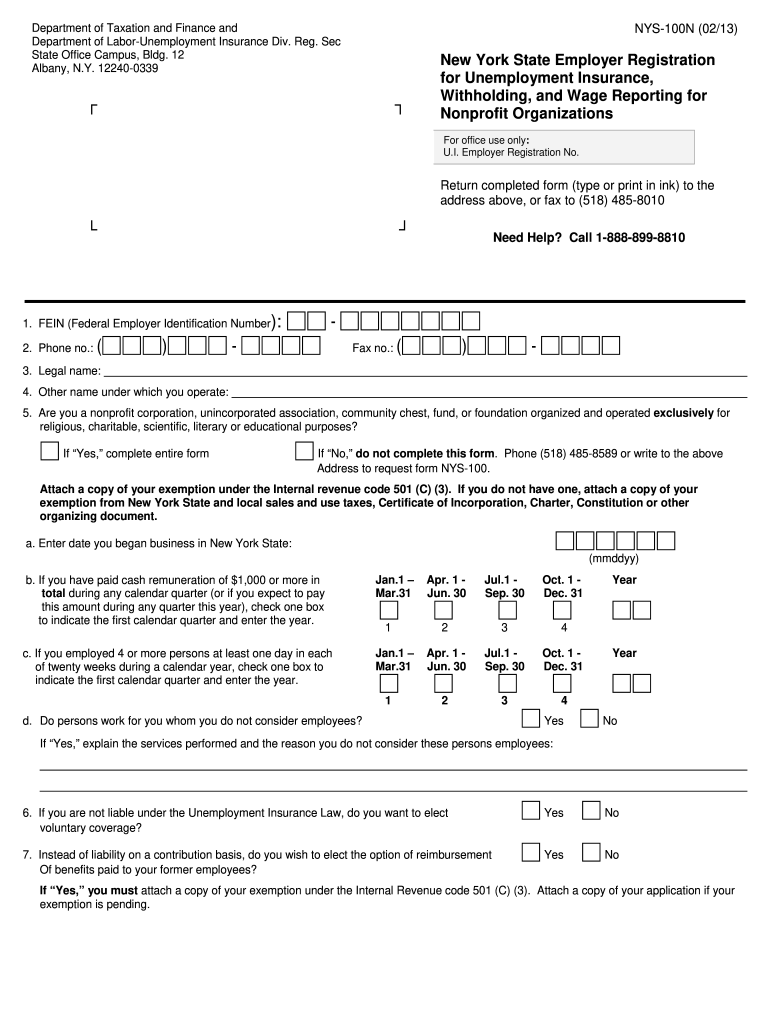

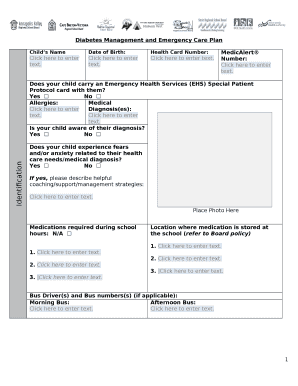

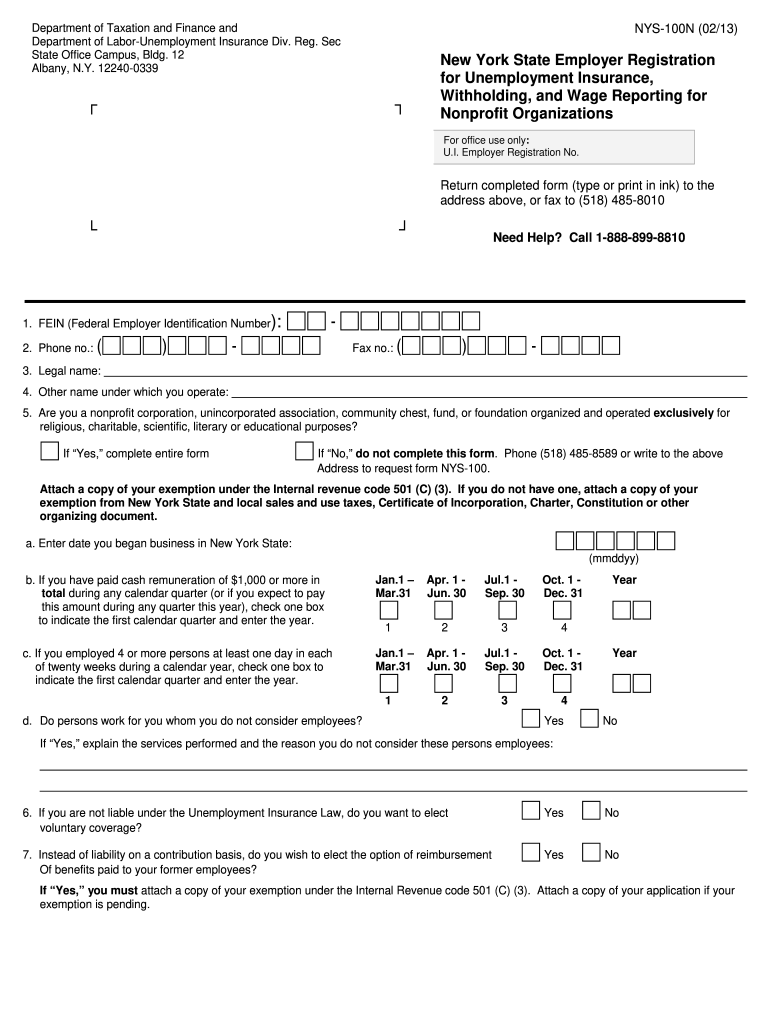

NY NYS-100N 2013 free printable template

Get, Create, Make and Sign NY NYS-100N

How to edit NY NYS-100N online

Uncompromising security for your PDF editing and eSignature needs

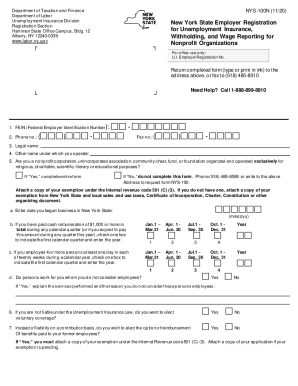

NY NYS-100N Form Versions

How to fill out NY NYS-100N

How to fill out NY NYS-100N

Who needs NY NYS-100N?

Instructions and Help about NY NYS-100N

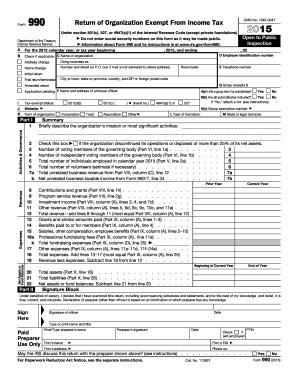

Hey thanks for joining me guys my name is will Lopez I'm founder of advisor Phi comm today this video is going to cover why the escort status and how to complete form 2553 which is the IRS form to elect S corporation status federally, so I get asked this question a lot by a lot of small business owners all across the country I do a lot of consulting in this area and I do a lot of guidance in this area so the common question I get is how do I save money in taxes and then how do I properly format my corporation or structure my corporation where it's beneficial to save money in taxes, and it all basically comes down to this S corp status that this term always gets kicked around so what I want to try to do is explain what the S Corp status is why I believe you should elect it if it quite a few qualify for it and then basically how to elect it which is basically formed 2553 and how to complete that so what is the S corp status so the S corp status is a federal tax status that needs to be elected that the IRS allows you to elect federally, so you basically fill out form 2553 the corporate the IRS processes that form and basically sends a letter to you saying that your corporation or your LLC has been qualified for S corp status LLC's King's can elect it so what people don't know is that LLC's default to a certain tax position and so to inks default to a certain tax position in that tax position is not S corp status for inks generally oils for inks its is corpse for LLC's generally sole proprietorship if one person owns it not the default tax status for LLC's and lynx S corp status is a status that needs to be elected so the IRS by default puts you in the as far as I'm concerned the worst tax position possible, and it's your job to elect otherwise and the S Club status is a way to save a bunch of money for all of us default tax status is for LLC's well if one person or one entity owns an LLC or starts an LLC in the state in your state if it's an individual as a sole proprietorship if it's another corporate raisin that formed the LLC and owns wholly owns that LLC is a disregarded entity if two or more people own an LLC it's considered a partnership of two or more corporations or other entities own an LLC it's a partnership, so proprietors disregarded entities partnerships in general are subject to self-employment tax which is Social Security tax and Medicare tax and subject to the full realm of Social Security self-employment tax which is the employees portion and the employers portion which is fifteen point three percent total altogether so on $100,000 bottom line if you're an LLC being taxed as a sole proprietorship after all expenses then your tax bill at least will be fifteen thousand three hundred dollars which is what Social Security is and does and that does not take into account federal income tax state income tax if you're subject to that, so you know it's a huge way to save money electing S corp status so default tax sentences for in...

People Also Ask about

What is the employer registration number?

How do I get a NY withholding identification number?

Where do I find my NYS employer registration number?

What is an example of an employer ID number?

What is a NYS 100 form?

Is FEIN the same as employer registration number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY NYS-100N for eSignature?

How do I fill out NY NYS-100N using my mobile device?

How do I edit NY NYS-100N on an iOS device?

What is NY NYS-100N?

Who is required to file NY NYS-100N?

How to fill out NY NYS-100N?

What is the purpose of NY NYS-100N?

What information must be reported on NY NYS-100N?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.