NY NYS-100N 2002 free printable template

Show details

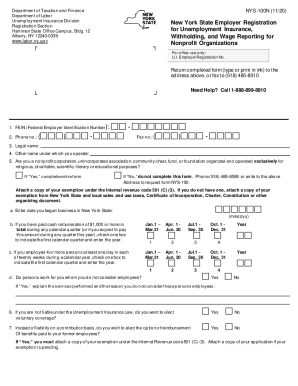

Department of Taxation and Finance and State Office Campus Bldg. 12 Albany N.Y. 12240-0339 NYS-100N 02/13 New York State Employer Registration for Unemployment Insurance Withholding and Wage Reporting for Nonprofit Organizations For office use only U. You acquired their good will. Privacy Notification Personal information including Social Security Account number requested on Form NYS-100N New York State Employer Registration for Insurance Division of the Department of Labor and the Department...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYS-100N

Edit your NY NYS-100N form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYS-100N form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYS-100N online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY NYS-100N. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYS-100N Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYS-100N

How to fill out NY NYS-100N

01

Download the NYS-100N form from the New York State Board of Elections website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information in the appropriate sections, including your name, address, and contact details.

04

Indicate your voting district and party affiliation as required.

05

Provide details about your qualifications and any previous political experience if applicable.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form to certify the information provided.

08

Submit the form to the appropriate election official by mail or in-person before the deadline.

Who needs NY NYS-100N?

01

Individuals seeking to enroll in a political party in New York.

02

Candidates running for office in New York.

03

Voters who need to update their party affiliation or personal information.

Fill

form

: Try Risk Free

People Also Ask about

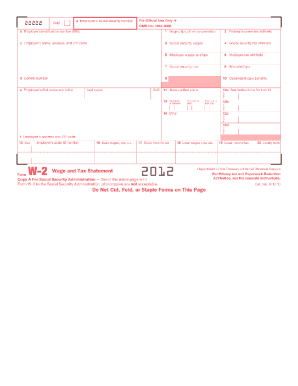

What is my New York State employee identification number?

Where can I find my Employee ID Number? On your paystub. Look for the area on your paystub identified as "NYS EMPLID" located next to the “Department ID” and under the “Pay Start Date/Pay End Date” section. You can find this online at New York State Payroll Online.

What is a NYS 100 form?

Unemployment Insurance, Withholding and Wage Reporting form. Use the NYS 100 form to register for Unemployment Insurance, withholding and wage reporting if you are a: • Business Employer, or • Household Employer of domestic services.

What is NY tax ID number?

A NY tax ID is issued by the New York State Tax Department to businesses selling taxable tangible personal property or services in the state.

What is NY reemployment tax?

Employers pay . 075% of their quarterly wages subject to contribution to this fund. It goes on their Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return (NYS-45).

How do I find my employer registration number for unemployment NY?

Can't Locate Your New York Payroll Account Numbers? To locate your New York Employer Registration Number: Find this on any previously filed quarterly tax return (Form NYS-45). Call the NY Department of Labor at 888-899-8810.

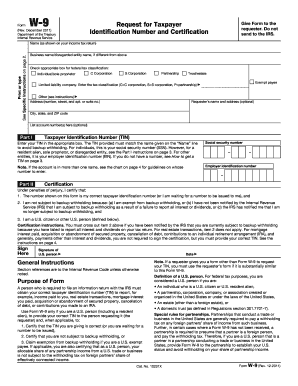

How do I get a NY withholding identification number?

You can register by: applying online through New York Business Express (see Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Business Employer (NYS 100), or. calling the Department of Labor at 1 888 899-8810 or (518) 457-4179.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY NYS-100N online?

pdfFiller has made filling out and eSigning NY NYS-100N easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit NY NYS-100N straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NY NYS-100N right away.

How do I edit NY NYS-100N on an Android device?

You can make any changes to PDF files, like NY NYS-100N, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY NYS-100N?

NY NYS-100N is a form used for reporting New York State withholding tax for New York non-residents who have purchased or received income from New York sources.

Who is required to file NY NYS-100N?

Individuals or entities that have received income from New York sources and are not residents of New York State are required to file NY NYS-100N.

How to fill out NY NYS-100N?

To fill out NY NYS-100N, taxpayers must provide their identifying information, report their total income earned from New York sources, and calculate the corresponding withholding tax based on the applicable rates.

What is the purpose of NY NYS-100N?

The purpose of NY NYS-100N is to ensure non-residents report their New York income and pay the appropriate withholding tax to the state.

What information must be reported on NY NYS-100N?

NY NYS-100N requires reporting of the taxpayer's name, address, social security number or ITIN, type and amount of income earned in New York, and the amount of state tax withheld.

Fill out your NY NYS-100N online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYS-100n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.