DoL 5500 - Schedule H 2012 free printable template

Instructions and Help about DoL 5500 - Schedule H

How to edit DoL 5500 - Schedule H

How to fill out DoL 5500 - Schedule H

About DoL 5500 - Schedule H 2012 previous version

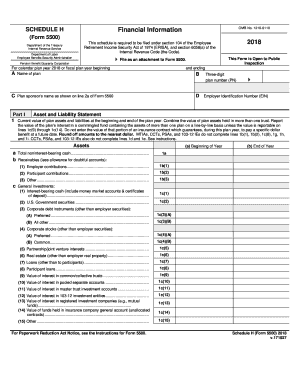

What is DoL 5500 - Schedule H?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about DoL 5500 - Schedule H

What should I do if I realize I made a mistake on my filed DoL 5500 - Schedule H?

If you recognize an error after filing your DoL 5500 - Schedule H, you need to submit an amended return. Ensure that any corrections are clearly indicated, and follow the necessary procedures for amendments. Keep a record of all corrections for your documentation.

How can I verify if my DoL 5500 - Schedule H has been received and is being processed?

To verify the receipt and processing status of your DoL 5500 - Schedule H, you can use the online tracking tools provided by the filing platform or contact the relevant agency. Check for confirmation emails or notifications that may indicate the filing status.

Are e-signatures accepted when filing the DoL 5500 - Schedule H?

Yes, e-signatures are accepted for the DoL 5500 - Schedule H as long as the signature complies with regulatory standards. Make sure to follow any guidelines provided for electronic signatures to ensure your filing is valid.

What should I do if my e-filed DoL 5500 - Schedule H is rejected?

If your e-filed DoL 5500 - Schedule H is rejected, review the rejection codes provided and address the specific issues noted. After making the necessary corrections, resubmit the form promptly to meet any deadlines and prevent penalties.

What are some common mistakes to avoid when filing the DoL 5500 - Schedule H?

Common mistakes when filing the DoL 5500 - Schedule H include incorrect entity information, miscalculating financial figures, and failing to sign the form. Double-check all entries and consult guidelines specific to your filing to ensure accuracy.

See what our users say