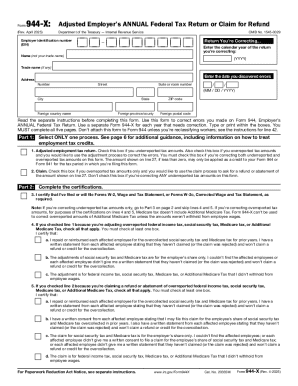

IRS 944-X 2014 free printable template

Instructions and Help about IRS 944-X

How to edit IRS 944-X

How to fill out IRS 944-X

About IRS 944-X 2014 previous version

What is IRS 944-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 944-X

What steps should I follow if I need to submit a corrected instructions for form 945-x?

To correct any mistakes on your submitted instructions for form 945-x, use the appropriate amendment form. Ensure to clearly indicate the corrections and reference the original submission to avoid confusion. It's also advisable to track the progress of your amendment to ensure it has been processed appropriately.

How can I check the status of my submitted instructions for form 945-x?

You can verify the status of your submitted instructions for form 945-x by contacting the relevant tax authority or using their online tracking tools. If you submitted electronically, keep an eye on common e-file rejection codes, as early identification of issues can save time and effort.

What privacy measures are in place for submitting the instructions for form 945-x electronically?

When filing instructions for form 945-x electronically, significant privacy measures, such as encryption and data security protocols, are typically in place. Ensure you are using a secure site and disconnecting from public networks during submission to protect personal information.

Are there any common errors to watch out for when filing instructions for form 945-x?

Common errors when filing instructions for form 945-x include incorrect Payee identification numbers and wrong payment amounts; these mistakes can lead to processing delays. Double-check all entries for accuracy and ensure that all required fields are complete before submission.

What should I do if I receive an audit notice after submitting my instructions for form 945-x?

If you receive an audit notice post-filing instructions for form 945-x, carefully read the notice and prepare the necessary documentation to support your filing. It’s beneficial to consult with a tax professional to ensure you respond appropriately and meet deadlines for providing requested information.