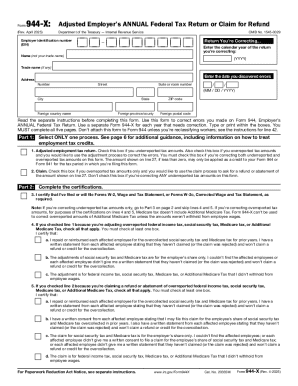

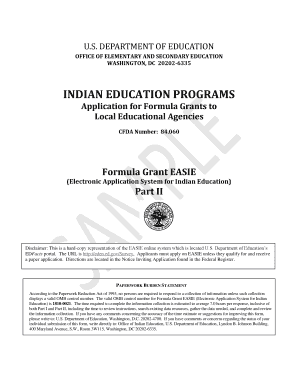

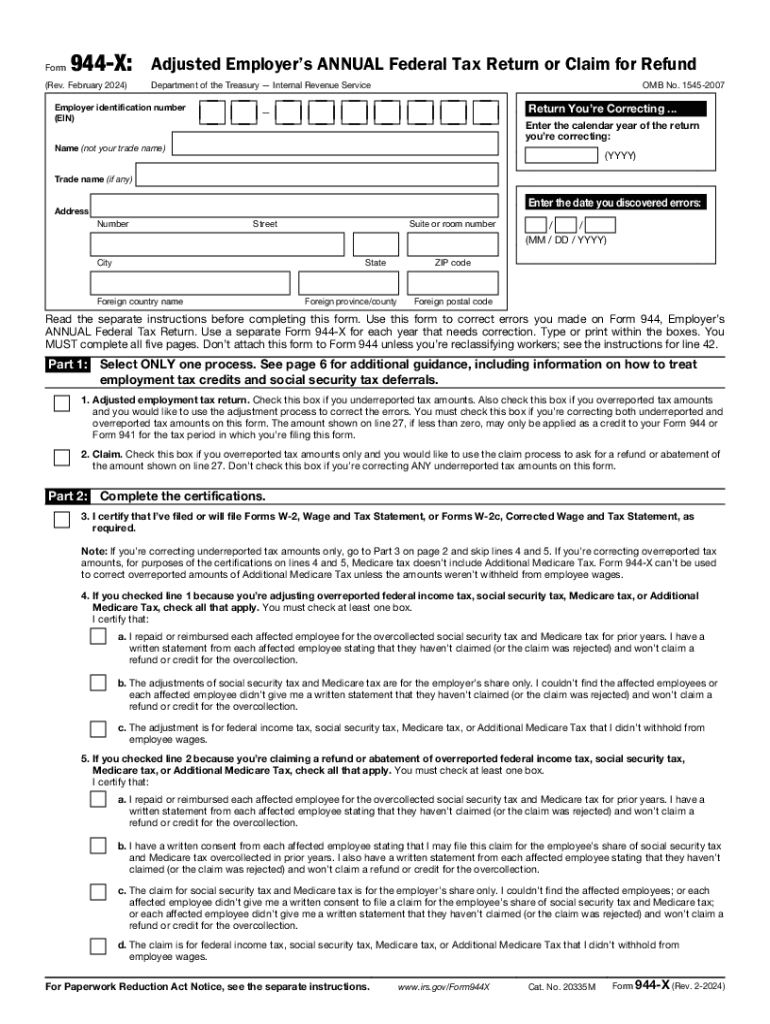

IRS 944-X 2024 free printable template

Instructions and Help about 944 x form

How to edit 944 x form

How to fill out 944 x form

Latest updates to 944 x form

All You Need to Know About 944 x form

What is 944 x form?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 944-X

What should I do if I make a mistake on my submitted 944 x form?

If you need to correct mistakes on your submitted 944 x form, you can file an amended form. It's essential to clearly mark the form as 'Amended' and provide an explanation of the changes. This ensures that the IRS processes your revisions accurately and maintains an updated record.

How can I verify the status of my 944 x form submission?

To verify the status of your 944 x form submission, you can use the IRS's e-file status tool. Keep your confirmation numbers handy, as they will help you track the processing of your form. If there are any issues or common rejection codes, the IRS will provide you with specific guidance on how to resolve those.

What should I consider regarding the privacy and security of my 944 x form data?

When filing your 944 x form, it's important to consider data privacy and security. Make sure that you use a secure method for e-filing, such as trusted software or authorized e-file providers. Retain records of your submission for the appropriate duration while ensuring that any personal information is stored and shared securely.

Are there fees associated with e-filing the 944 x form?

Yes, there can be service fees for e-filing the 944 x form, which may vary depending on the e-file provider you choose. Additionally, if your submission is rejected and needs to be resubmitted, you may be subject to additional fees from the service provider.

What should I do if I receive an audit notice related to my 944 x form?

If you receive an audit notice concerning your 944 x form, it’s crucial to carefully review the request and gather the necessary documentation to support your filing. Respond promptly with the required information, and consider consulting a tax professional to navigate the audit process effectively.