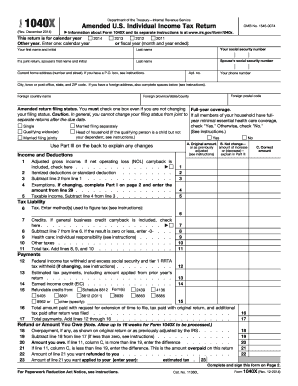

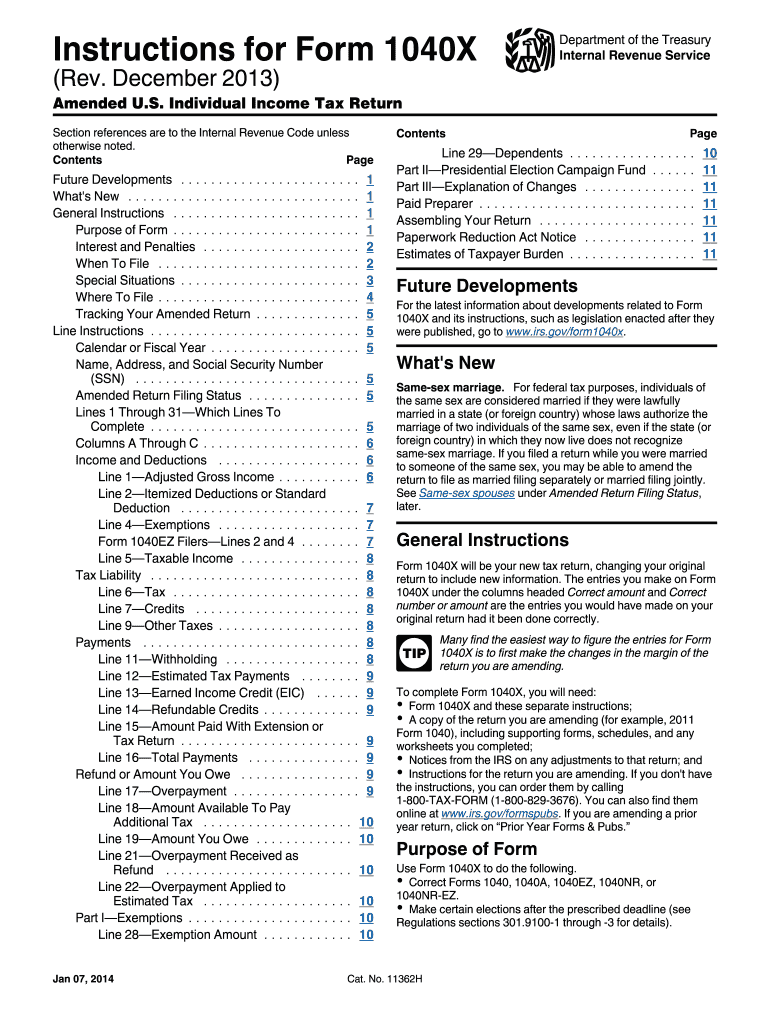

IRS Instructions 1040X 2013 free printable template

Instructions and Help about IRS Instructions 1040X

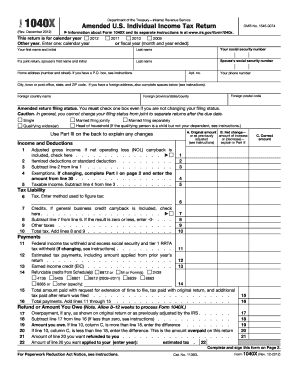

How to edit IRS Instructions 1040X

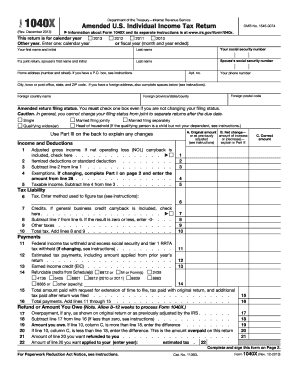

How to fill out IRS Instructions 1040X

About IRS Instructions 1040X 2013 previous version

What is IRS Instructions 1040X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS Instructions 1040X

What should I do if my IRS Instructions 1040X shows up as rejected after e-filing?

If your IRS Instructions 1040X is rejected after e-filing, carefully review the rejection codes provided. Common reasons include inconsistencies in personal information or issues with your SSN. Once you've identified the error, make the necessary corrections and resubmit your amended return promptly to avoid further issues.

How can I confirm that my IRS Instructions 1040X has been received by the IRS?

To verify the receipt of your IRS Instructions 1040X, you can use the IRS 'Where’s My Amended Return?' tool. This online resource allows you to track the status of your amendment and provides updates about the processing stages, including when it has been accepted or is undergoing review.

What are the consequences of not filing the IRS Instructions 1040X correctly?

Failing to file your IRS Instructions 1040X correctly can lead to delays in processing your amended return and possible penalties. It may also result in unresolved tax discrepancies, which could impact your tax filings in future years. To minimize risks, ensure all information is accurate before submission.

Can a third party file my IRS Instructions 1040X on my behalf?

Yes, a designated third party can file your IRS Instructions 1040X on your behalf if you provide them with a valid Power of Attorney (POA). This ensures they have the authority to handle your tax matters, while you also need to stay informed about your filing status and any potential implications.

What are some common errors to be aware of when submitting the IRS Instructions 1040X?

When submitting your IRS Instructions 1040X, common errors include incorrect personal information, missing signatures, and failing to include all required schedules or documents. To avoid these mistakes, double-check all entries and ensure that you include any necessary supporting documentation.