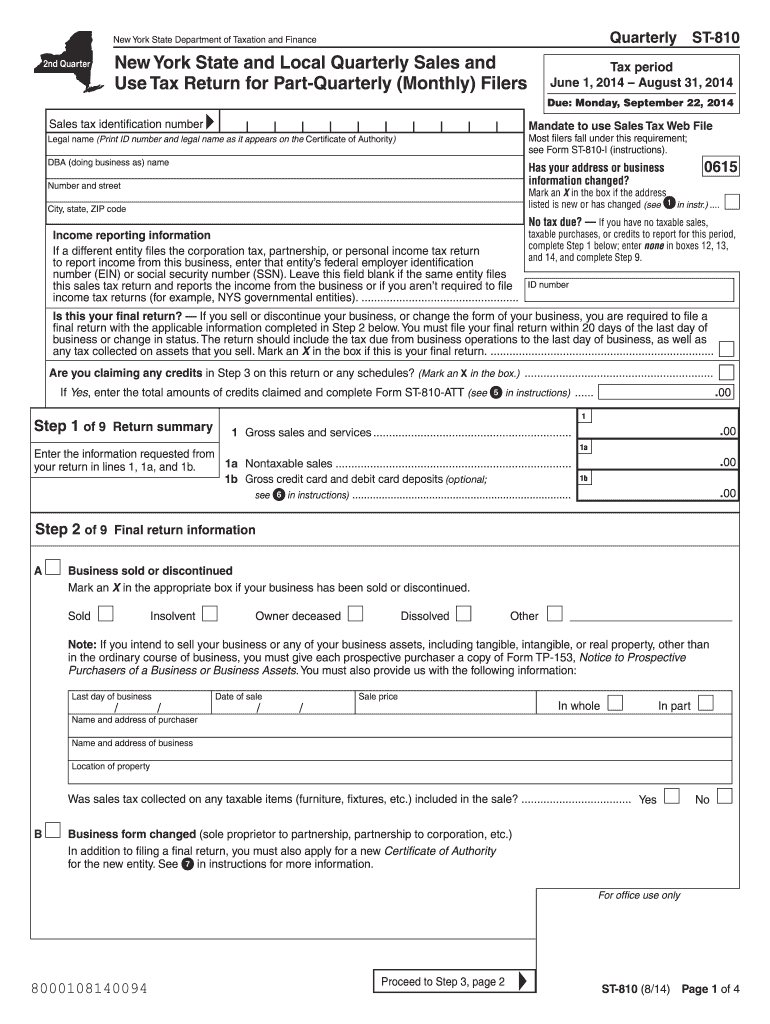

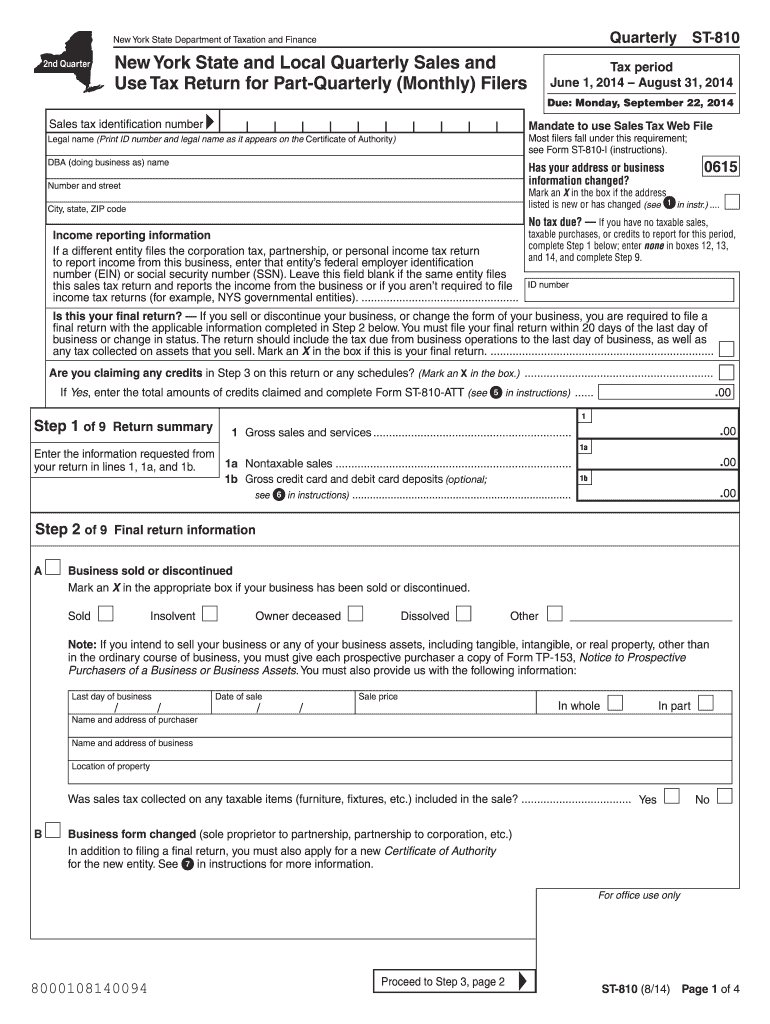

NY DTF ST-810 2014 free printable template

Get, Create, Make and Sign NY DTF ST-810

Editing NY DTF ST-810 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-810 Form Versions

How to fill out NY DTF ST-810

How to fill out NY DTF ST-810

Who needs NY DTF ST-810?

Instructions and Help about NY DTF ST-810

Hello everybody as you can see I have zero makeup on and that is because I wanted to do my makeup on camera with you so you can see what I was doing I haven't done an everyday makeup look I'm not going to say tutorial because as we all know all I do is put my makeup on a ramble away to camera not necessarily the way that you're supposed to do it, but this is the way I like to do it and you guys really like these videos, so I wanted to do another one I haven't done an updated everyday makeup look for a really long time, so I felt it was about time I did that, and I'm really enjoying a lot of the makeup that I'm using at the moment, so I really wanted to film this video so the first thing I'm going to be doing is popping on my foundations the foundation I have been using and absolutely loving at the moment is the Rimmed lasting finish this promises to last for 25 hours now I can't say I've actually worn it for 25 hours because I put my makeup on in the morning and I take off at night um, so I can't say that that works because I've not tested that, but I absolutely love it I love the coverage I love how it feels on the skin, and it is a full coverage foundation so avoid if you don't like that, but I am loving this at the moment also the brush I am using is the Sigma round kabuki I really like using kabuki brushes just because I like to kind of buff it into the skin rather than like stroke it on and this is my kabuki of choice as you can see my skin is already looking a lot more even, but I do still want to put on some concealer so on my blemishes I'm going to put the Urban Decay Naked skin and under my eyes I'm going to go for the collection lasting perfection concealer get a sneeze s you q Oh bless you now to wake myself up a little and pop some concealer under my eyes I kind of bring it down from the kind of inside my eye down towards the top of my cheekbone and then up my cheekbones I just find that kind of works, and then I just blend it in again just using the same thing kabuki now that I look far more awake I have absolutely no dimensions to my face whatsoever I am going to powder the powder I've been really liking at the moment is this one it's five bits by Terry, and it's the hyaluronic hydra powder it's really, really fine, so I find that it goes on my skin really nicely oh gosh dropped it all over my jeans I'm just going to use this brush which is the Sigma blush f9 to do a little of dab in a little of that I am going to very lightly sweep this in any areas where I find that my makeup goes a little patchy first, or I can sometimes get a little oily throughout the day which is generally my t-zone I also like to do a little sweep under the eyes just to set my concealer and then I kind of find that it lasts a lot better throughout the day next up is bronzer it's January everyone's skin looks a little invisible a little pale, so I think I probably do overdo the bronzer slightly and just in January in December but yes I am going to use CARS...

People Also Ask about

How many allowances should I claim 2104?

Is it better to claim 1 or 0 allowances?

What is a NY 2104 form?

What is the difference between it-2104 and it 2104e?

Should I fill out it-2104?

What is it-2104.1 form used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF ST-810 for eSignature?

How do I complete NY DTF ST-810 online?

Can I sign the NY DTF ST-810 electronically in Chrome?

What is NY DTF ST-810?

Who is required to file NY DTF ST-810?

How to fill out NY DTF ST-810?

What is the purpose of NY DTF ST-810?

What information must be reported on NY DTF ST-810?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.