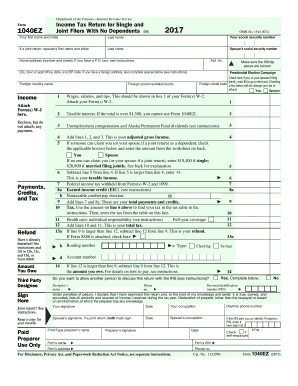

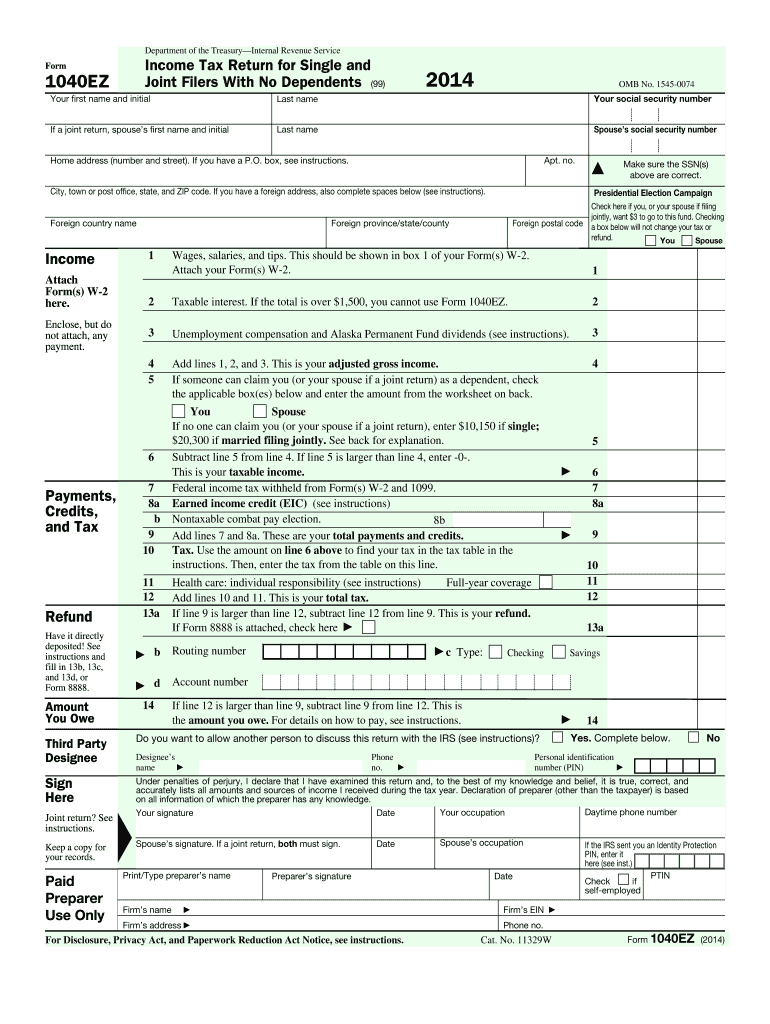

IRS 1040-EZ 2014 free printable template

Instructions and Help about IRS 1040-EZ

How to edit IRS 1040-EZ

How to fill out IRS 1040-EZ

About IRS 1040-EZ 2014 previous version

What is IRS 1040-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-EZ

What should I do if I realize I've made a mistake on my IRS 1040-EZ after filing?

If you discover an error on your IRS 1040-EZ after submission, you should file an amended return using Form 1040-X. Ensure that you accurately explain the reason for the amendment. Remember to keep copies of all documentation related to the correction for your records.

How can I check the status of my IRS 1040-EZ after I've filed it?

To check the status of your IRS 1040-EZ, you can use the IRS 'Where's My Refund?' tool available on their website. This tool provides updates on the processing status of your return and any associated refunds or issues.

Are e-signatures accepted for IRS 1040-EZ filings, and what should I know about their legality?

Yes, e-signatures are accepted for IRS 1040-EZ filings, provided that you use an IRS-approved e-filing service. These services ensure the security and authenticity of your signature, which is legally binding for tax documentation.

What common errors should I be aware of when preparing my IRS 1040-EZ?

Common errors with the IRS 1040-EZ include incorrect Social Security numbers, miscalculations in income or tax liability, and failing to sign the return. Utilizing tax software can help minimize these errors by performing automatic checks.

If my IRS 1040-EZ submission is rejected, what steps can I take to resolve the issue?

If your IRS 1040-EZ is rejected, review the rejection notice for specific reasons. Common issues may relate to incorrect information provided. After correcting the errors, you can resubmit your return directly through the e-filing platform or by mail.

See what our users say